bankruptcy canada

Struggling With Debt Tackle Your Finances Head On

Hiding from the reality of your financial situation will do nothing to improve it. People have a pre-disposition to hide from the truth, particularly when the truth is ugly. Unfortunately, we see this every day.

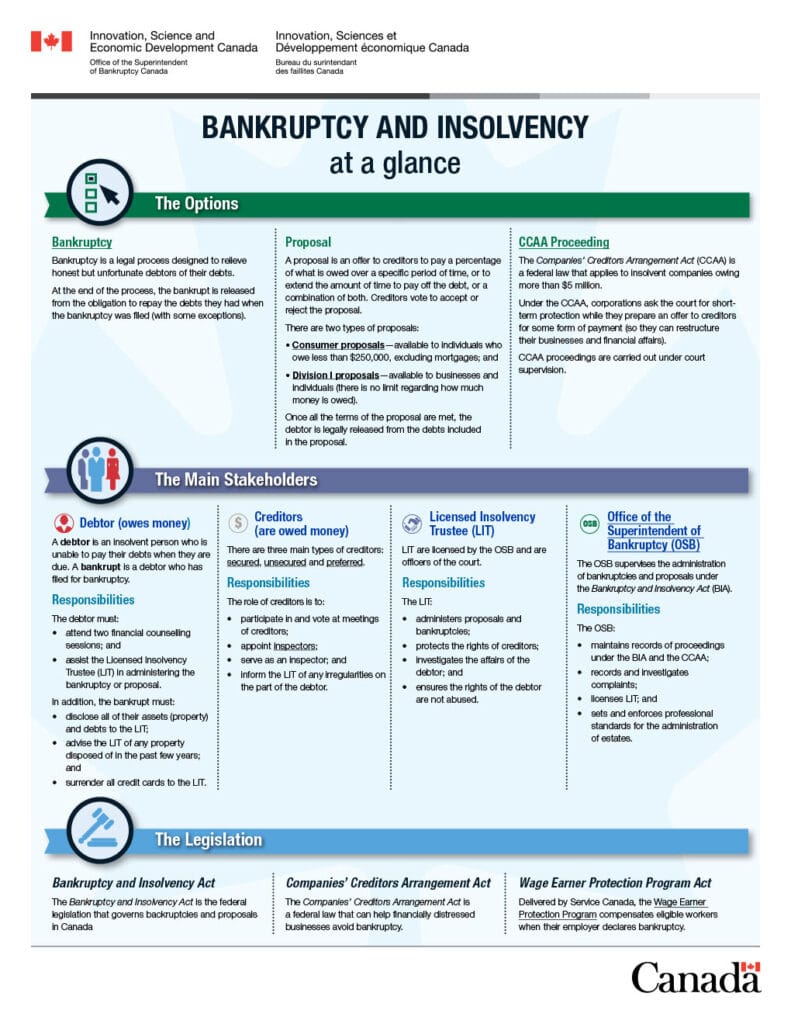

Read MoreWhat Is the Bankruptcy and Insolvency Act (“BIA)

What Happens If I Win The Lottery While Bankrupt?

If you win the lottery during your personal bankruptcy, before you are discharged, the lottery winnings are considered “after-acquired property” and forms part of your bankruptcy. After-acquired property can be seized by your Trustee in Bankruptcy for the benefit of your unsecured creditors.

Read More2016 Surplus Income Standards

When an individual files for personal bankruptcy the trustee will calculate whether or not he will be required to make surplus income payments based on his net household income.

Read MoreWhat Are My Duties In Bankruptcy?

There are several duties that an individual must complete as part of a personal bankruptcy to be eligible to be discharged from bankruptcy. These duties include, but are not limited to; completing two counselling sessions, report your monthly income to the Trustee, assist the Trustee with file your income tax return for the year of bankruptcy.

Read MoreWhat Is A Stay of Proceedings?

A stay of proceedings basically means that creditors must cease all collection or legal proceedings against the debtor, including wage garnishments. The purpose of the stay is to protect the assets of the bankrupt so the Trustee or Proposal Administrator can deal with them in an orderly fashion.

Read MoreCan A Person Have Savings During Bankruptcy?

Yes, you can accumulate savings during a personal bankruptcy or consumer proposal. During a personal bankruptcy provided you are paying your required surplus income payment, if applicable. You can save as much as your budget allows.

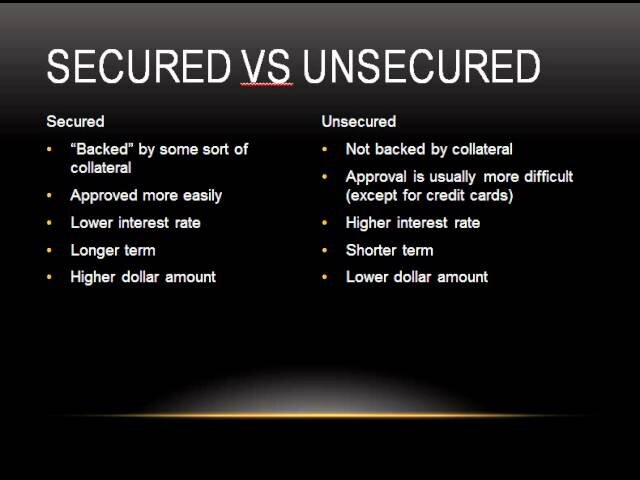

Read MoreSecured vs Unsecured Loan, Debt, Credit Cards & Line of Credit

Secured debts include mortgages, vehicle or investment loans. The borrower gives the lender a lien or mortgage against assets such as property, vehicles or investments in exchange for the loan. Unsecured debts typically include personal loans, lines of credit, credit cards, overdraft on bank accounts, and personal income taxes.

Read MoreMy Spouse filed bankruptcy, do I need too?

No, if one spouse files personal bankruptcy or a consumer proposal, it may not be necessary for the other spouse to file. This depends on several facts which a Licensed Insolvency Trustee will assist the couple to review. The couple can then make an informed decision as to which option best meets their needs and allows them to achieve their financial goals.

Read MoreBankruptcy And Sponsoring a Relative’s Application For Immigration

According to Immigration Canada, you can sponsor a relative’s immigration application as long as you are a citizen or permanent resident of Canada and are 18 years of age or older. There are however some restrictions, one of which states that you can not be an undischarged bankrupt.

Read More