Bankruptcy NS

What Is A Stay of Proceedings?

A stay of proceedings basically means that creditors must cease all collection or legal proceedings against the debtor, including wage garnishments. The purpose of the stay is to protect the assets of the bankrupt so the Trustee or Proposal Administrator can deal with them in an orderly fashion.

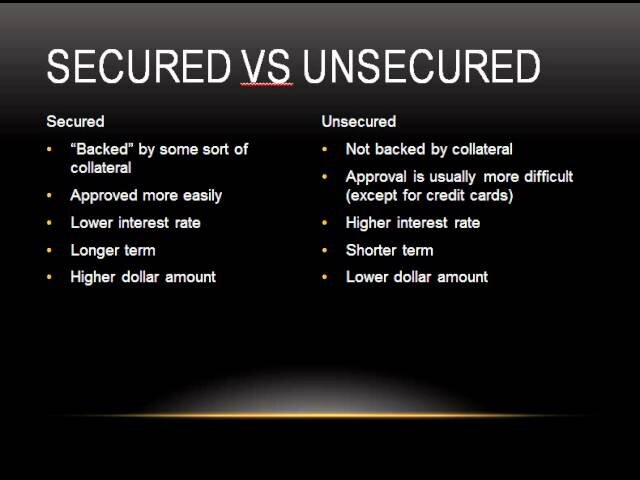

Read MoreSecured vs Unsecured Loan, Debt, Credit Cards & Line of Credit

Secured debts include mortgages, vehicle or investment loans. The borrower gives the lender a lien or mortgage against assets such as property, vehicles or investments in exchange for the loan. Unsecured debts typically include personal loans, lines of credit, credit cards, overdraft on bank accounts, and personal income taxes.

Read MoreMy Spouse filed bankruptcy, do I need too?

No, if one spouse files personal bankruptcy or a consumer proposal, it may not be necessary for the other spouse to file. This depends on several facts which a Licensed Insolvency Trustee will assist the couple to review. The couple can then make an informed decision as to which option best meets their needs and allows them to achieve their financial goals.

Read MoreBankruptcy And Sponsoring a Relative’s Application For Immigration

According to Immigration Canada, you can sponsor a relative’s immigration application as long as you are a citizen or permanent resident of Canada and are 18 years of age or older. There are however some restrictions, one of which states that you can not be an undischarged bankrupt.

Read MoreHow Are Secured Debts Treated In Personal Bankruptcy or a Consumer Proposal?

When an individual files personal bankruptcy or a consumer proposal these loans are not always impacted and the assets can usually be kept as long as the loan payments are current and continue to be made in accordance with the credit agreement.

Read MoreBanking Fees – Are You Paying Too Much?

It’s important to find the best type of account and monthly plan to fit your lifestyle so you can start by reviewing your monthly bank statements to see the fees and service charges you have incurred in the past. This will provide the information you need to compare the types of accounts and plans that best suited to your usage.

Having the wrong plan or too many bank accounts can be costly, and you might be paying for unnecessary bank expenses than a plan that is tailored to your individual or family needs.

Read MoreCan Creditors Collect Debts After Bankruptcy?

When you receive a discharge after completing your bankruptcy, it releases you from the debts you owed before your date of bankruptcy. Once you file personal bankruptcy, your creditors cannot legally collect on those debts.

Read More