bankruptcy pei

How Many Times Can You Declare Bankruptcy In Canada

Have you been curious as to how bankruptcy works in Canada? More specifically, how many times you can file bankruptcy? In theory, you can declare bankruptcy as many times as you like in Canada. Practically speaking, however, every time you file the consequences and the difficulty in receiving a discharge from your bankruptcy increases. The…

Read MoreThe New Debtor Prison

We have found that a new form of debtor prison exists and this is due to excessive phone calls, emails, text messages and mail from creditors and collection agencies. These tactics can leave a person feeling afraid to answer their own phone and for some, it can cause undue stress and anxiety which can negatively affect their everyday life and ability to function at work.

Read MoreWhat is a Deemed Trust?

In a bankruptcy, amounts owing for GST/HST and the employer portion of CPP and EI, and penalties and interest on these amounts are unsecured claims, ranking the same as all other general creditors of a debtor. However, before bankruptcy occurs, CRA may obtain a lien or charge (be filing a memorial judgment) against the real or personal property of a debtor, CRA will be a secured creditor.

Read MoreWhat Is The New Brunswick Personal Property Security Act (PPSA)?

PPSA legislation provides a central registry for filing notices of security interests in personal property, allows both individuals and institutions to record their financial interest in personal property (cars, boats, appliances, etc.). Bankruptcy eliminates all of your unsecured debt such as credit cards, bank loans, tax debts, unpaid bills and payday loans. However, secured debts such as vehicle loans, mortgages and home equity lines of credit are typically not included in a bankruptcy.

Read More2016 Surplus Income Standards

When an individual files for personal bankruptcy the trustee will calculate whether or not he will be required to make surplus income payments based on his net household income.

Read MoreWhat Is A Stay of Proceedings?

A stay of proceedings basically means that creditors must cease all collection or legal proceedings against the debtor, including wage garnishments. The purpose of the stay is to protect the assets of the bankrupt so the Trustee or Proposal Administrator can deal with them in an orderly fashion.

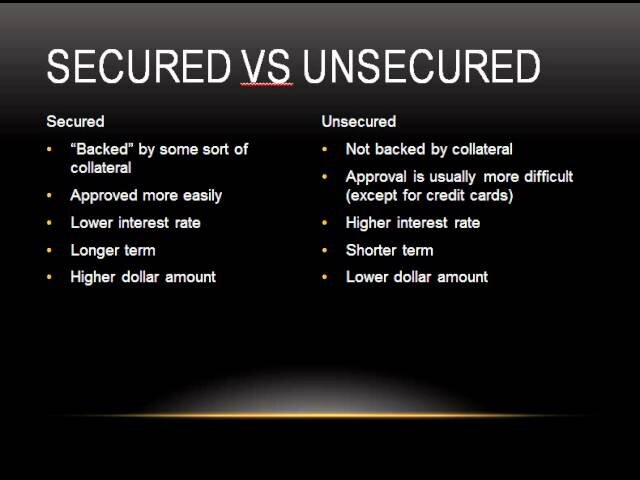

Read MoreSecured vs Unsecured Loan, Debt, Credit Cards & Line of Credit

Secured debts include mortgages, vehicle or investment loans. The borrower gives the lender a lien or mortgage against assets such as property, vehicles or investments in exchange for the loan. Unsecured debts typically include personal loans, lines of credit, credit cards, overdraft on bank accounts, and personal income taxes.

Read MoreMy Spouse filed bankruptcy, do I need too?

No, if one spouse files personal bankruptcy or a consumer proposal, it may not be necessary for the other spouse to file. This depends on several facts which a Licensed Insolvency Trustee will assist the couple to review. The couple can then make an informed decision as to which option best meets their needs and allows them to achieve their financial goals.

Read MoreBankruptcy And Sponsoring a Relative’s Application For Immigration

According to Immigration Canada, you can sponsor a relative’s immigration application as long as you are a citizen or permanent resident of Canada and are 18 years of age or older. There are however some restrictions, one of which states that you can not be an undischarged bankrupt.

Read MoreDo I Have To Continue Paying Student Loans During My Bankruptcy or Consumer Proposal?

Even though your student loan debt may not be discharged as part of your personal bankruptcy or consumer proposal, the creditor is still prohibited from normal collection activities during your personal bankruptcy or consumer proposal. We recommend paying the interest portion of the payment during your personal bankruptcy or consumer proposal.

Read More