bankruptcy pei

Can I Declare Bankruptcy If I Live Outside of The Country?

Generally speaking, under the Bankruptcy & Insolvency Act, if you reside outside of the country you can still declare bankruptcy as long as you meet certain criteria. If you are a previous Canadian resident and are have debt issues you should contact Powell Associates Ltd. to determine if you meet the criteria to file personal bankruptcy or a consumer proposal in Canada.

Read MoreWill Bankruptcy Take Care of Judgments?

Yes, judgments from creditors do get released when you file a personal bankruptcy or complete a consumer proposal. However, judgments registered against your assets by Canada Revenue Agency do not get released when you file a personal bankruptcy or complete a consumer proposal.

Read MoreUsing RRSPs to Pay Down Debt

If you are unable to keep up with your debt payments you should consult a Licensed Insolvency Trustee to discuss your options before cashing-in any of your investments. Your investment savings may be exempt from seizure so you may be able to keep them if you file for personal bankruptcy or settle your debts through a consumer proposal.

Read MoreCan Creditors Collect Debts After Bankruptcy?

When you receive a discharge after completing your bankruptcy, it releases you from the debts you owed before your date of bankruptcy. Once you file personal bankruptcy, your creditors cannot legally collect on those debts.

Read MoreMy Bank Account Is Always In Overdraft

Banks charge interest on overdraft account as high as 20%; this can be a costly form of credit. If you find that you are carrying an overdraft balance and running out of money between pay periods, this can be an early warning sign of future financial difficulties.

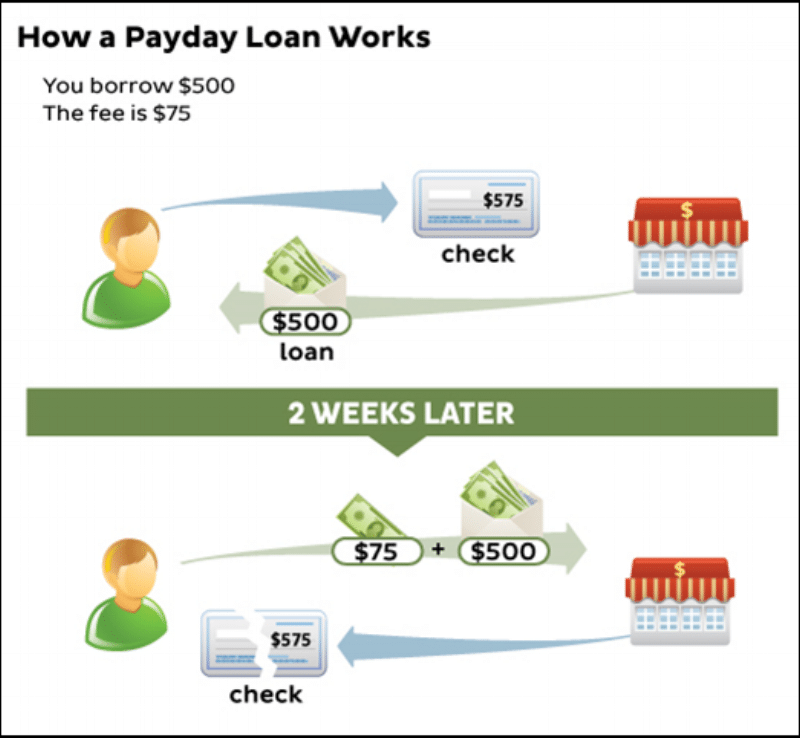

Read MoreCaught in the Pay Day Loan Cycle?

The problem with this type of borrowing is that it is very expensive and can often leave the borrower, who is already in a tight financial position, unable to repay the loan. So they end up re-borrowing or getting a “roll-over” loan by paying off the current loan and immediately getting another one from the payday lender.

Read MoreWhat happens If My Ex-Spouse Goes Bankrupt?

If both parties have agreed to assume responsibility for certain debts, it does not absolve them, if one of them defaults on a debt, that was granted to both parties jointly. Bankruptcy laws and family laws do not deal with assets and liabilities in the same way; there can be conflicts and unintended consequences when the two interact.

Read MoreWill My Personal Bankruptcy Affect My Spouse?

When you file a personal bankruptcy it does not directly affect your spouse or reflect on their credit report. Your personal bankruptcy is between you and your creditors. Your spouse is not liable for your debts simply because he/she is your spouse. However, your personal bankruptcy can have an impact on the other person in certain ways.

Read MorePersonal Bankruptcy and Income Taxes – What You Need to Know

When filing a personal bankruptcy income tax debts are discharged the same as any other unsecured debt, such as credit cards and personal loans. If you are struggling with income tax debt or have had your wages garnished then you should seek the assistance of a professional.

Read MoreGood Debt vs. Bad Debt

Good debt is for purchases that appreciate in value or significantly improve your quality of life. Bad debts on the other hand typically do not provide you with any long-term benefit. If you carry a heavy amount of bad debt and are only able to make minimum payments then it’s time to look for help.

Read More