consumer proposal canada

Top 20 Consumer Proposal FAQs for Canadian Debt Relief

If you’re searching for debt relief in Canada, you may have come across the term “consumer proposal”. What exactly is a consumer proposal, though, and how can it help you? In this “Consumer Proposal FAQs” blog, we’ll answer the 20 most frequently asked questions about this Canadian debt relief option and whether or not it’s…

Read MoreDealing With Debt – Understanding the Two Types of Proposals

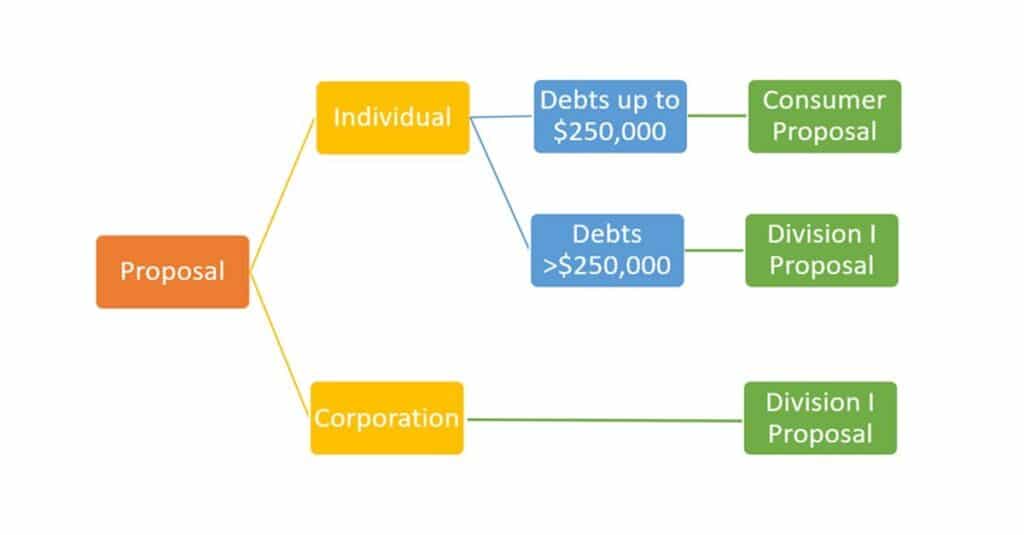

Division 1 Proposal Is when a consumer debtor owes more than $250,000 in debts, excluding the mortgage on their principal residence. If creditors don’t accept this proposal there is a deemed personal bankruptcy.

A consumer proposal is when a consumer debtor owes less than $250,000 in debts, excluding the mortgage on their principal residence. There is no deemed personal bankruptcy if the creditors reject the consumer proposal.

Read MoreUnderstanding Consumer Proposals

A consumer proposal is a settlement arrangement with your unsecured creditors to pay a portion of your debt in monthly payment over a period of up to 5 years. These payments are the full and final settlement of your debts with these creditors.

Read MoreCan I Declare Bankruptcy If I Live Outside of The Country?

Generally speaking, under the Bankruptcy & Insolvency Act, if you reside outside of the country you can still declare bankruptcy as long as you meet certain criteria. If you are a previous Canadian resident and are have debt issues you should contact Powell Associates Ltd. to determine if you meet the criteria to file personal bankruptcy or a consumer proposal in Canada.

Read More