consumer proposal nb

2020 Surplus Income Standards

The Government of Canada has set net monthly income thresholds for a person or family to maintain a minimal standard of living in Canada. Every dollar that a bankrupt family makes above this level is subject to a surplus income payment of 50% while a person remains bankrupt.

Read More2019 Surplus Income Standards

The Government of Canada has set net monthly income thresholds for a person or family to maintain a minimal standard of living in Canada. Every dollar that a bankrupt family makes above this level is subject to a surplus income payment of 50% while a person remains bankrupt.

Read More2017 Surplus Income Standards

The Government of Canada has set net monthly income thresholds for a person or family to maintain a minimal standard of living in Canada. Every dollar that a bankrupt family makes above this level is subject to a surplus income payment of 50% while a person remains bankrupt.

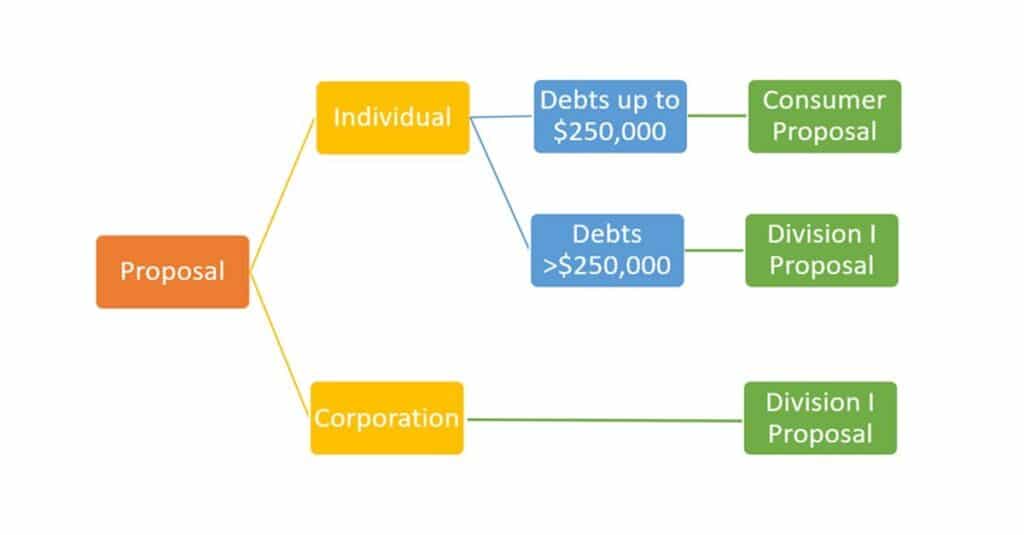

Read MoreDealing With Debt – Understanding the Two Types of Proposals

Division 1 Proposal Is when a consumer debtor owes more than $250,000 in debts, excluding the mortgage on their principal residence. If creditors don’t accept this proposal there is a deemed personal bankruptcy.

A consumer proposal is when a consumer debtor owes less than $250,000 in debts, excluding the mortgage on their principal residence. There is no deemed personal bankruptcy if the creditors reject the consumer proposal.

Read MoreWhat Assets Can New Brunswick Residents Keep In Bankruptcy?

What asset can I keep? A Licensed Insolvency Trustee can help you identify which assets you can keep. There is a specific list of assets that you are allowed to keep when you file personal bankruptcy or consumer proposal. This list of assets is specific to the province in which you live.

Read MoreUsing RRSPs to Pay Down Debt

If you are unable to keep up with your debt payments you should consult a Licensed Insolvency Trustee to discuss your options before cashing-in any of your investments. Your investment savings may be exempt from seizure so you may be able to keep them if you file for personal bankruptcy or settle your debts through a consumer proposal.

Read MoreWhat happens If My Ex-Spouse Goes Bankrupt?

If both parties have agreed to assume responsibility for certain debts, it does not absolve them, if one of them defaults on a debt, that was granted to both parties jointly. Bankruptcy laws and family laws do not deal with assets and liabilities in the same way; there can be conflicts and unintended consequences when the two interact.

Read More