consumer proposal pei

2020 Surplus Income Standards

The Government of Canada has set net monthly income thresholds for a person or family to maintain a minimal standard of living in Canada. Every dollar that a bankrupt family makes above this level is subject to a surplus income payment of 50% while a person remains bankrupt.

Read More2019 Surplus Income Standards

The Government of Canada has set net monthly income thresholds for a person or family to maintain a minimal standard of living in Canada. Every dollar that a bankrupt family makes above this level is subject to a surplus income payment of 50% while a person remains bankrupt.

Read More2017 Surplus Income Standards

The Government of Canada has set net monthly income thresholds for a person or family to maintain a minimal standard of living in Canada. Every dollar that a bankrupt family makes above this level is subject to a surplus income payment of 50% while a person remains bankrupt.

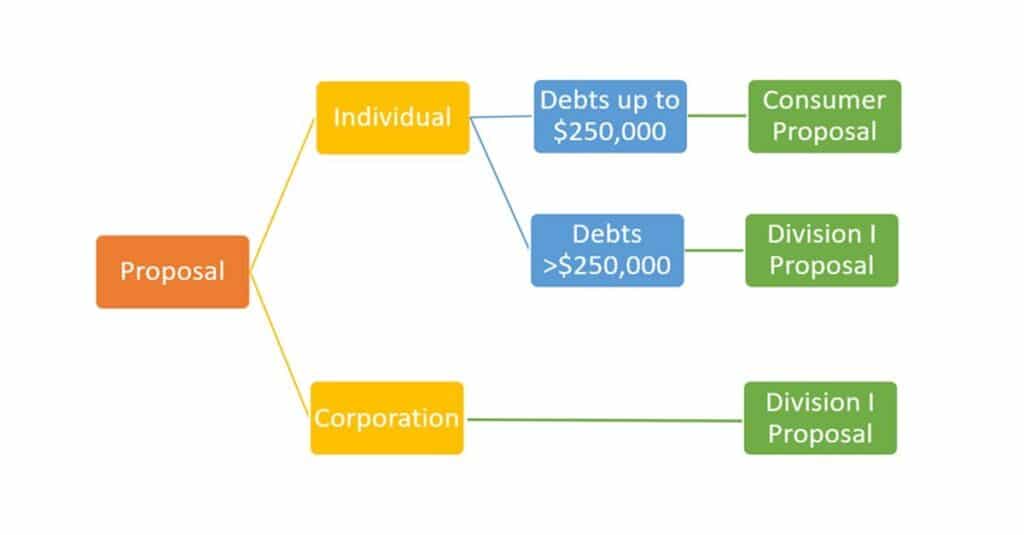

Read MoreDealing With Debt – Understanding the Two Types of Proposals

Division 1 Proposal Is when a consumer debtor owes more than $250,000 in debts, excluding the mortgage on their principal residence. If creditors don’t accept this proposal there is a deemed personal bankruptcy.

A consumer proposal is when a consumer debtor owes less than $250,000 in debts, excluding the mortgage on their principal residence. There is no deemed personal bankruptcy if the creditors reject the consumer proposal.

Read MoreUnderstanding Consumer Proposals

A consumer proposal is a settlement arrangement with your unsecured creditors to pay a portion of your debt in monthly payment over a period of up to 5 years. These payments are the full and final settlement of your debts with these creditors.

Read MoreUsing RRSPs to Pay Down Debt

If you are unable to keep up with your debt payments you should consult a Licensed Insolvency Trustee to discuss your options before cashing-in any of your investments. Your investment savings may be exempt from seizure so you may be able to keep them if you file for personal bankruptcy or settle your debts through a consumer proposal.

Read More