Posts Tagged ‘assets’

What Are the Different Types of Bankruptcy Administrations?

Summary administration bankruptcy, there is no notice in the newspaper and no automatic meeting of creditors. Ordinary administration bankruptcy, there is a mandatory meeting of creditors and there is also a requirement for the Trustee to publish a notice of the bankruptcy in the newspaper.

Read MoreDebts Owing to the Canada Revenue Agency

Many people believe that debts owing to CRA will never go away. That is not necessarily the case, particularly when an individual goes bankrupt or files a proposal under the provisions of the Bankruptcy and Insolvency Act (“BIA”). However, prior to file personal bankruptcy or a consumer proposal, CRA has some significant legislated powers to collect debts.; including garnishing paycheques, seizing bank accounts.

Read MoreWhat Is The New Brunswick Personal Property Security Act (PPSA)?

PPSA legislation provides a central registry for filing notices of security interests in personal property, allows both individuals and institutions to record their financial interest in personal property (cars, boats, appliances, etc.). Bankruptcy eliminates all of your unsecured debt such as credit cards, bank loans, tax debts, unpaid bills and payday loans. However, secured debts such as vehicle loans, mortgages and home equity lines of credit are typically not included in a bankruptcy.

Read MoreAdvantages of Filing a Consumer Proposal vs. a Bankruptcy

A consumer proposal can be creative and involve the sale, over time, of assets and payment of all or a portion of the equity in those assets to your creditors. This would allow you to settle your debts through a lump-sum payment instead of having to make monthly payments.

Read MorePersonal Bankruptcy in 12 Steps

Recognize the Problem, often the most challenging step as it requires that you admit that you are having financial troubles beyond your control and need help. Contact a Licensed Insolvency Trustee, the Trustee will provide a free confidential consultation and review your financial situation and discuss your options.

Read MoreDealing With Increasing Insolvency Rates

There are lots of factors but, I think the greatest single contributor is the proliferation of easy credit combined with low levels of financial literacy. High debt levels limit financial flexibility and the ability to weather and recover from financial setbacks resulting from job loss, reduced income, illness, separation/divorce, and other life events.

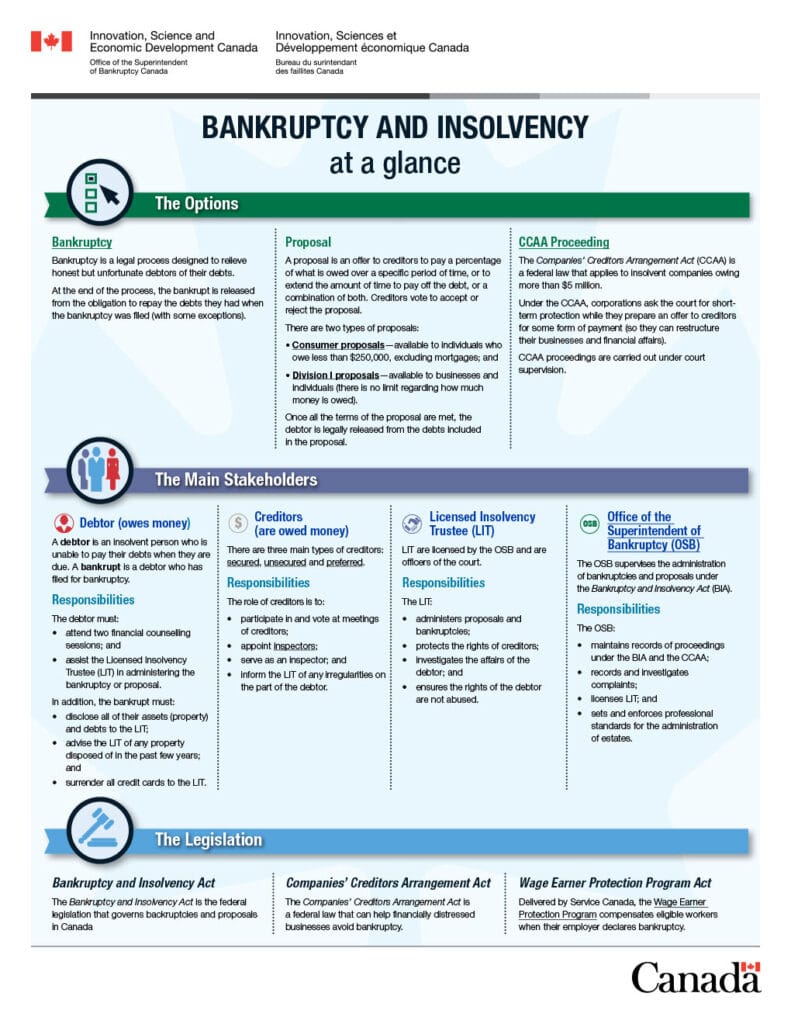

Read MoreWhat Is the Bankruptcy and Insolvency Act (“BIA)

What Are My Duties In Bankruptcy?

There are several duties that an individual must complete as part of a personal bankruptcy to be eligible to be discharged from bankruptcy. These duties include, but are not limited to; completing two counselling sessions, report your monthly income to the Trustee, assist the Trustee with file your income tax return for the year of bankruptcy.

Read MoreWhat Is A Stay of Proceedings?

A stay of proceedings basically means that creditors must cease all collection or legal proceedings against the debtor, including wage garnishments. The purpose of the stay is to protect the assets of the bankrupt so the Trustee or Proposal Administrator can deal with them in an orderly fashion.

Read MoreCan A Person Have Savings During Bankruptcy?

Yes, you can accumulate savings during a personal bankruptcy or consumer proposal. During a personal bankruptcy provided you are paying your required surplus income payment, if applicable. You can save as much as your budget allows.

Read More