Posts Tagged ‘assets’

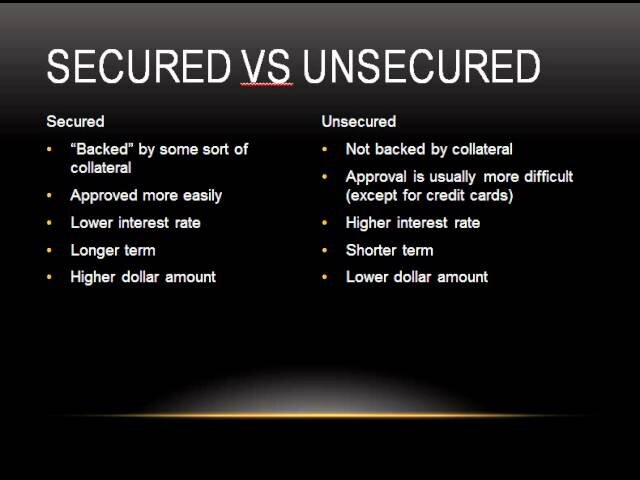

Secured vs Unsecured Loan, Debt, Credit Cards & Line of Credit

Secured debts include mortgages, vehicle or investment loans. The borrower gives the lender a lien or mortgage against assets such as property, vehicles or investments in exchange for the loan. Unsecured debts typically include personal loans, lines of credit, credit cards, overdraft on bank accounts, and personal income taxes.

Read MoreMy Spouse filed bankruptcy, do I need too?

No, if one spouse files personal bankruptcy or a consumer proposal, it may not be necessary for the other spouse to file. This depends on several facts which a Licensed Insolvency Trustee will assist the couple to review. The couple can then make an informed decision as to which option best meets their needs and allows them to achieve their financial goals.

Read MoreUnderstanding Consumer Proposals

A consumer proposal is a settlement arrangement with your unsecured creditors to pay a portion of your debt in monthly payment over a period of up to 5 years. These payments are the full and final settlement of your debts with these creditors.

Read MoreWhat Assets Can PEI Residents Keep In Bankruptcy?

What asset can I keep? A Licensed Insolvency Trustee can help you identify which assets you can keep. There is a specific list of assets that you are allowed to keep when you file personal bankruptcy or consumer proposal. This list of assets is specific to the province in which you live.

Read MoreWhat Assets Can Nova Scotia Residents Keep In Bankruptcy?

What asset can I keep? A Licensed Insolvency Trustee can help you identify which assets you can keep. There is a specific list of assets that you are allowed to keep when you file personal bankruptcy or consumer proposal. This list of assets is specific to the province in which you live.

Read MoreWhat Assets Can New Brunswick Residents Keep In Bankruptcy?

What asset can I keep? A Licensed Insolvency Trustee can help you identify which assets you can keep. There is a specific list of assets that you are allowed to keep when you file personal bankruptcy or consumer proposal. This list of assets is specific to the province in which you live.

Read MoreHow Are Secured Debts Treated In Personal Bankruptcy or a Consumer Proposal?

When an individual files personal bankruptcy or a consumer proposal these loans are not always impacted and the assets can usually be kept as long as the loan payments are current and continue to be made in accordance with the credit agreement.

Read MoreReceiving a Windfall While Bankrupt

Any assets or property that you receive or become entitled to receive, before your discharge from bankruptcy, can be seized by the trustee and distributed to your creditors. As a bankrupt, you must report any windfalls to your trustee and failure to do so could cause difficulties in obtaining your discharge from bankruptcy or even after you have received your discharge.

Read MoreCan Creditors Collect Debts After Bankruptcy?

When you receive a discharge after completing your bankruptcy, it releases you from the debts you owed before your date of bankruptcy. Once you file personal bankruptcy, your creditors cannot legally collect on those debts.

Read MoreWhat happens If My Ex-Spouse Goes Bankrupt?

If both parties have agreed to assume responsibility for certain debts, it does not absolve them, if one of them defaults on a debt, that was granted to both parties jointly. Bankruptcy laws and family laws do not deal with assets and liabilities in the same way; there can be conflicts and unintended consequences when the two interact.

Read More