Posts Tagged ‘assets’

Is Bankruptcy My Only Option?

Bankruptcy is not the only debt solution option available to resolve overwhelming debt. Your Trustee (Licensed Insolvency Trustee) can also put together a consumer proposal to your creditors. Where you pay a portion of the debt, you owe your creditors, and the creditors write off the remaining balance of the debt.

Read MoreCan I Claim Bankruptcy a Second Time?

Yes, you can declare personal bankruptcy a second time, as long as you have been discharged from your first bankruptcy. If you don’t have surplus income, comply with your duties and cooperate with your trustee on other estate matters. You are eligible to be discharged from your second bankruptcy, after 24 months.

Read MoreWill My Friends and Family Know I Went Bankrupt?

Personal bankruptcy and consumer proposal filings are a matter of public record and are kept on file with the Government of Canada through the Office of the Superintendent of Bankruptcy. These records are accessible for a fee but how many people, other than Licensed Insolvency Trustee (bankruptcy trustee), would incur the expense or even think or know where to look?

Read MoreDo I Qualify For Bankruptcy?

Basically, if you owe at least $1,000, are unable to keep up with your monthly debt payments and do not have assets such as vehicles, house, or investments that you can sell to pay your debts in full, then you can choose to file personal bankruptcy. It is your choice whether or not to voluntarily put yourself into bankruptcy and no one can stop you.

Read MoreUnderstanding Your Credit Score in Canada

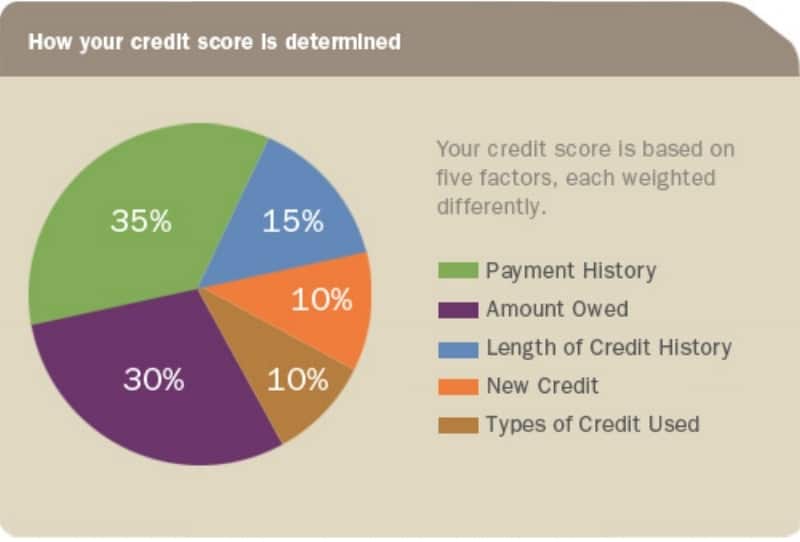

A credit score is a number, attached to your credit report, that represents your credit-worthiness and indicates how likely or unlikely you are to pay your debts. Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to you. The higher the score the more likely you are to be approved for credit; a lower score decreases your chances of obtaining credit.

Read MoreWill My Personal Bankruptcy Affect My Spouse?

When you file a personal bankruptcy it does not directly affect your spouse or reflect on their credit report. Your personal bankruptcy is between you and your creditors. Your spouse is not liable for your debts simply because he/she is your spouse. However, your personal bankruptcy can have an impact on the other person in certain ways.

Read More5 Myths About Bankruptcy

Filing for personal bankruptcy can be a very stressful event due to the stigma and misinformation that surrounds this topic. Bankruptcy is often thought of as something that happens to irresponsible people or those who cannot properly manage their financial affairs. In many instances, this couldn’t be further from the truth. Most bankruptcies are triggered by life events such as marital breakdown, loss of job, illness or decreased income.

Read More