Posts Tagged ‘Bankruptcy and Insolvency Act’

How will COVID-19 affect my consumer proposal?

These are stressful times but no one should feel alone with these challenges.

Read MoreCan I Go Bankrupt If My Debts Are The Result of Gambling?

For individuals who are problem gamblers we strongly recommend other counselling to help address the addiction. Personal bankruptcy may provide short-term financial relief but cannot resolve the issue of gambling unless it is combined with other treatment.

Read MoreWill I Lose My Canada Child Benefit (CCB) If I File For Bankruptcy?

The short answer is no, you will not lose your Canada Child Benefit (CCB) if you decide to file personal bankruptcy. While your CCB will not be affected by bankruptcy, you are required to report your CCB when calculating and reporting your household income. These monthly reports will determine whether or not you have “surplus income”, which in turn will impact how long you are in bankruptcy and how much you will be required to pay.

Read MoreDealing With Increasing Insolvency Rates

There are lots of factors but, I think the greatest single contributor is the proliferation of easy credit combined with low levels of financial literacy. High debt levels limit financial flexibility and the ability to weather and recover from financial setbacks resulting from job loss, reduced income, illness, separation/divorce, and other life events.

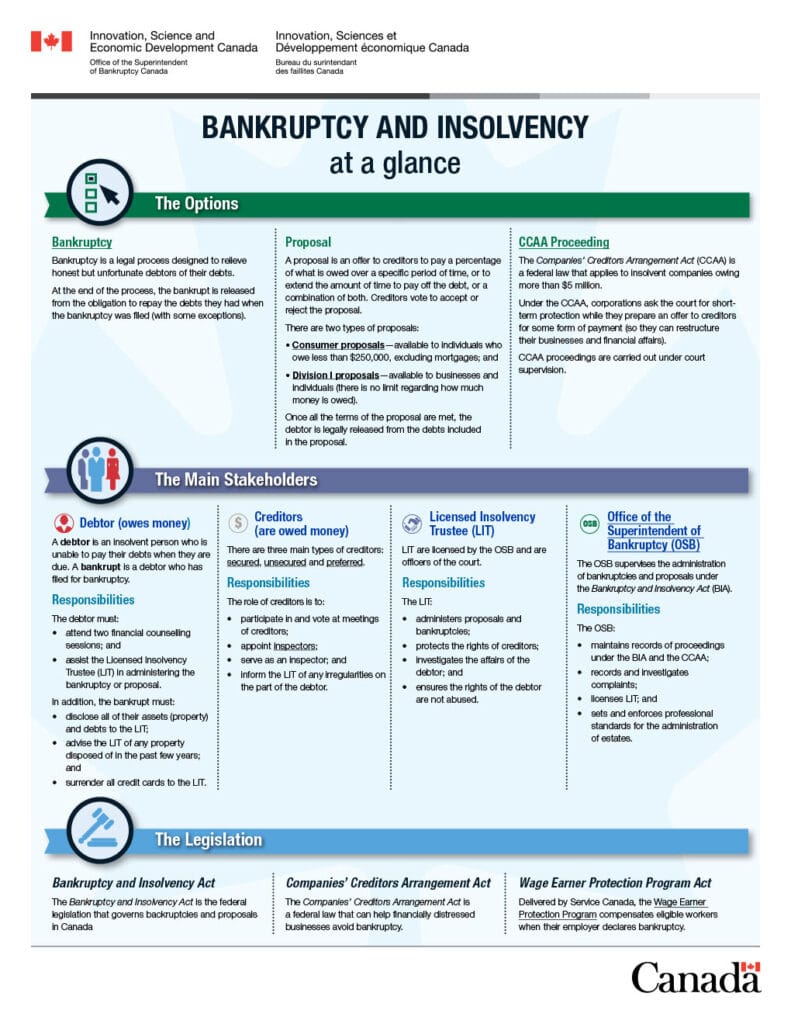

Read MoreWhat Is the Bankruptcy and Insolvency Act (“BIA)

What Are My Duties In Bankruptcy?

There are several duties that an individual must complete as part of a personal bankruptcy to be eligible to be discharged from bankruptcy. These duties include, but are not limited to; completing two counselling sessions, report your monthly income to the Trustee, assist the Trustee with file your income tax return for the year of bankruptcy.

Read MoreDoes My Trustee Work For Me or My Creditors?

Your Trustee’s job is to administer your bankruptcy or consumer proposal following the Bankruptcy and Insolvency Act.

Read More