Posts Tagged ‘Consumer Proposal’

Will My Friends and Family Know I Went Bankrupt?

Personal bankruptcy and consumer proposal filings are a matter of public record and are kept on file with the Government of Canada through the Office of the Superintendent of Bankruptcy. These records are accessible for a fee but how many people, other than Licensed Insolvency Trustee (bankruptcy trustee), would incur the expense or even think or know where to look?

Read MoreTips for Saving Money on Groceries

For most Canadian families groceries are there second highest monthly expense outside of their housing cost so it’s important to get the most bang for your buck. Here are a few tips and suggestions that may help you reduce your grocery expenses.

Read MoreDo I Qualify For Bankruptcy?

Basically, if you owe at least $1,000, are unable to keep up with your monthly debt payments and do not have assets such as vehicles, house, or investments that you can sell to pay your debts in full, then you can choose to file personal bankruptcy. It is your choice whether or not to voluntarily put yourself into bankruptcy and no one can stop you.

Read MoreUnderstanding Your Credit Score in Canada

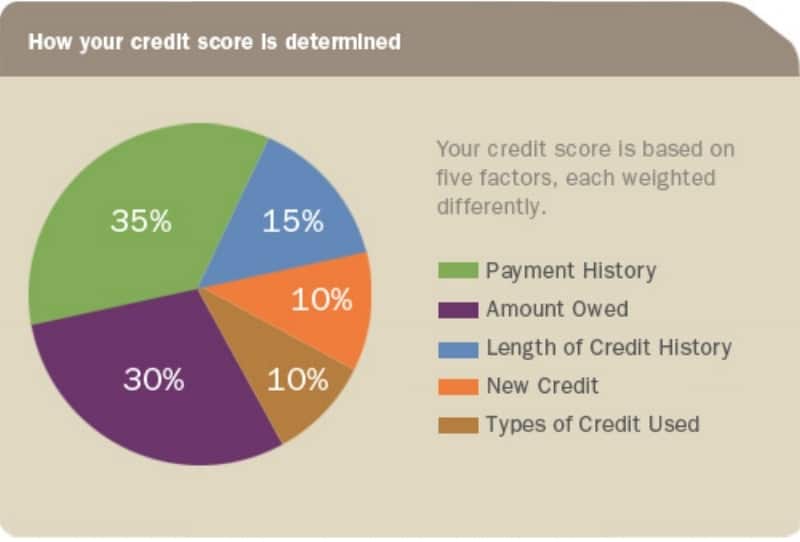

A credit score is a number, attached to your credit report, that represents your credit-worthiness and indicates how likely or unlikely you are to pay your debts. Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to you. The higher the score the more likely you are to be approved for credit; a lower score decreases your chances of obtaining credit.

Read MoreWill My Personal Bankruptcy Affect My Spouse?

When you file a personal bankruptcy it does not directly affect your spouse or reflect on their credit report. Your personal bankruptcy is between you and your creditors. Your spouse is not liable for your debts simply because he/she is your spouse. However, your personal bankruptcy can have an impact on the other person in certain ways.

Read MorePersonal Bankruptcy and Income Taxes – What You Need to Know

When filing a personal bankruptcy income tax debts are discharged the same as any other unsecured debt, such as credit cards and personal loans. If you are struggling with income tax debt or have had your wages garnished then you should seek the assistance of a professional.

Read MoreAnnual Consumer Insolvency Rates – Canada vs. Maritime Provinces

Annual Consumer Insolvency Rates – Canada vs. Maritime Provinces On September 30, 2014, the Office of the Superintendent of Bankruptcy released its most recent statistics on annual insolvency rates for Canada and the Provinces. These figures include both consumer bankruptcy and consumer proposal filings for the years 1987 through 2013 and show the significant trend…

Read MoreGood Debt vs. Bad Debt

Good debt is for purchases that appreciate in value or significantly improve your quality of life. Bad debts on the other hand typically do not provide you with any long-term benefit. If you carry a heavy amount of bad debt and are only able to make minimum payments then it’s time to look for help.

Read More10 Steps To Rebuild Your Credit Rating After Bankruptcy

Once you have been discharged from your personal bankruptcy or consumer proposal there are some steps you can follow to put you on the path to a healthy credit rating.

Read MoreThe Difference Between Prepaid and Secured Credit Cards

Two credit card products that often get confused are secured and prepaid credit cards. Let’s take a closer look at the characteristics of each one and some of the things you should be aware of before choosing either of these products. Choosing the product that is best for you will depend on your circumstances. Either way, we encourage you to do your research and to read the cardholder agreement or terms and conditions prior to opening one of these products.

Read More