Posts Tagged ‘Consumer Proposals’

Understanding Consumer Proposals

A consumer proposal is a settlement arrangement with your unsecured creditors to pay a portion of your debt in monthly payment over a period of up to 5 years. These payments are the full and final settlement of your debts with these creditors.

Read MoreBankruptcy And Sponsoring a Relative’s Application For Immigration

According to Immigration Canada, you can sponsor a relative’s immigration application as long as you are a citizen or permanent resident of Canada and are 18 years of age or older. There are however some restrictions, one of which states that you can not be an undischarged bankrupt.

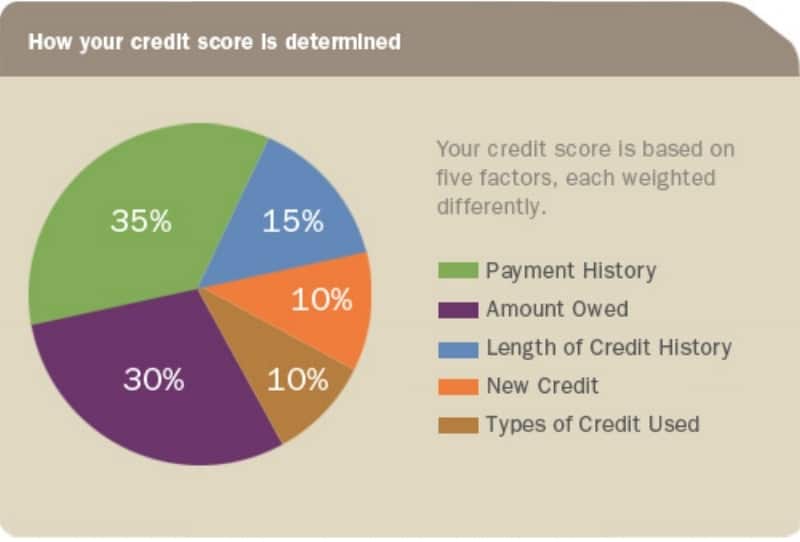

Read MoreUnderstanding Your Credit Score in Canada

A credit score is a number, attached to your credit report, that represents your credit-worthiness and indicates how likely or unlikely you are to pay your debts. Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to you. The higher the score the more likely you are to be approved for credit; a lower score decreases your chances of obtaining credit.

Read MoreWhich Debt Solution is Right for Me?

With consumer debt at an all-time high, the number of companies offering credit counselling or debt settlement services, are multiplying at an alarming rate. Many of these companies have large advertising budgets and slick websites designed to play on the fears of stressed out consumers who are in need of debt relief.

Read More