Posts Tagged ‘credit counselling’

Credit Rebuilding Basics, Part 1 — What is Your Credit Score and Why is it so Important?

Your credit score—only three digits long, but those three digits have a significant impact on how the rest of the world looks at you. They can dictate your eligibility for loans and other credit, the accommodations you can rent, and it can even affect your employment opportunities.

Read MorePersonal Bankruptcy in 12 Steps

Recognize the Problem, often the most challenging step as it requires that you admit that you are having financial troubles beyond your control and need help. Contact a Licensed Insolvency Trustee, the Trustee will provide a free confidential consultation and review your financial situation and discuss your options.

Read MoreAnnouncement – New Designation for Insolvency Professionals

The Office of the Superintendent of Bankruptcy Canada released Directive 33, Trustee Designation and Advertising, updating the designation to be used by Licensed Trustees with regards to the advertisement, promotion, and communications related to their services. All trustees will now adopt the professional designation “Licensed Insolvency Trustee”.

Read MoreConsumer Proposal vs. Credit Counselling?

With all of the choices facing financially distressed consumers, it’s important to compare your options. The most common options are a Consumer Proposal only available through a Licensed Insolvency Trustee or a Debt Management/Repayment Plan offered by credit counselling agencies.

Read MoreDoes My Trustee Work For Me or My Creditors?

Your Trustee’s job is to administer your bankruptcy or consumer proposal following the Bankruptcy and Insolvency Act.

Read MoreWill Bankruptcy Ruin My Credit?

People often try to avoid bankruptcy at all costs because they are worried about ruining their credit rating. They pride themselves on paying their bills on time, have always maintained a strong credit score and they thought of doing anything to jeopardize that is unthinkable.

Read MoreUnderstanding Your Credit Score in Canada

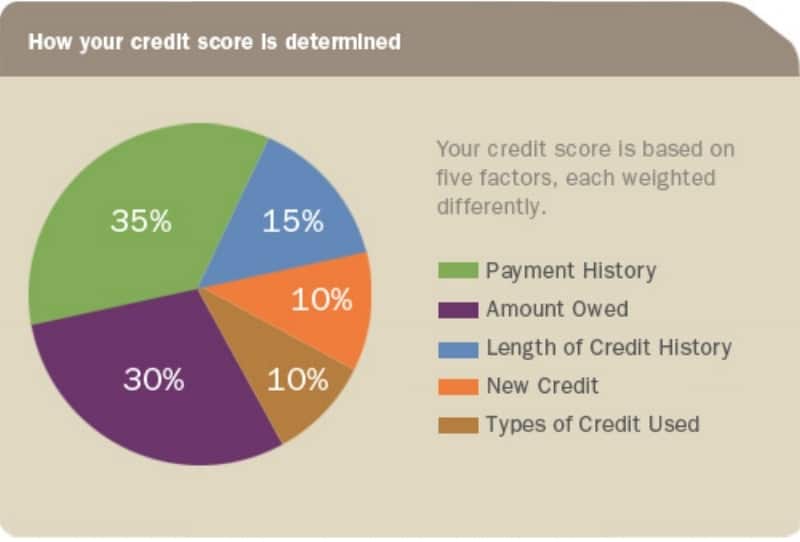

A credit score is a number, attached to your credit report, that represents your credit-worthiness and indicates how likely or unlikely you are to pay your debts. Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to you. The higher the score the more likely you are to be approved for credit; a lower score decreases your chances of obtaining credit.

Read MoreBeware of Debt Settlement Offers

The debt settlement and credit counselling companies would have you believe that they can easily have your credit balances reduced and save you hundreds if not thousands of dollars. The problem is they cannot guarantee any results. They will require that you pay them monthly administration fees and/or a percentage of the settlement amount as payment for their services. But you need to read their documents very closely to find out what happens to all of those fees that you have paid if they are unable to reach agreements with some or all of your creditors.

Read MoreWhich Debt Solution is Right for Me?

With consumer debt at an all-time high, the number of companies offering credit counselling or debt settlement services, are multiplying at an alarming rate. Many of these companies have large advertising budgets and slick websites designed to play on the fears of stressed out consumers who are in need of debt relief.

Read MoreWhy Choose a Licensed Insolvency Trustee For Advice?

A Licensed Insolvency Trustee will treat you in a dignified manner and review the facts of your situation and review the options to deal with your financial situation, including explaining how personal bankruptcy or a consumer proposal would work for you so that you can make an informed decision and choose the solution that is best for you.

Read More