Posts Tagged ‘Credit report’

How Will A Consumer Proposal or Bankruptcy Affect My Credit Rating?

The proposal stays on your credit file for 3 years from the date of completion. A first bankruptcy will stay on your credit report for a period of 6-7 years (depending on which Province you live in) from the date of discharge. A second bankruptcy will be reflected on the debtor’s credit report for a period of 14 years from the date of discharge.

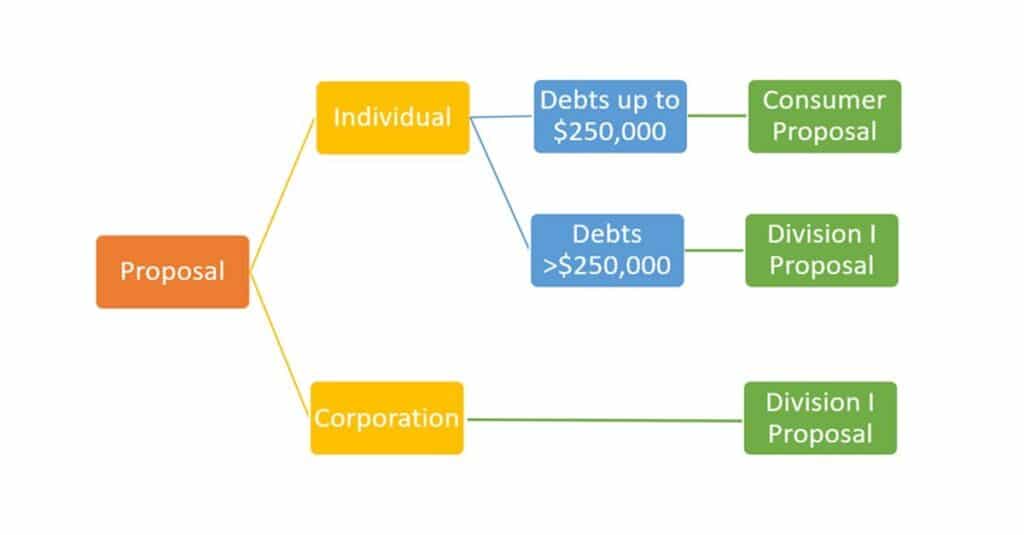

Read MoreDealing With Debt – Understanding the Two Types of Proposals

Division 1 Proposal Is when a consumer debtor owes more than $250,000 in debts, excluding the mortgage on their principal residence. If creditors don’t accept this proposal there is a deemed personal bankruptcy.

A consumer proposal is when a consumer debtor owes less than $250,000 in debts, excluding the mortgage on their principal residence. There is no deemed personal bankruptcy if the creditors reject the consumer proposal.

Read MoreUnderstanding Consumer Proposals

A consumer proposal is a settlement arrangement with your unsecured creditors to pay a portion of your debt in monthly payment over a period of up to 5 years. These payments are the full and final settlement of your debts with these creditors.

Read MoreCan I Apply For Credit While Bankrupt?

Filing for personal bankruptcy does not prevent you from applying for credit however as a bankrupt person you have a duty not to engage in any business transactions, or obtain credit of more than $1,000, without disclosing to the lender that you are an undischarged bankrupt.

Read MoreCan Creditors Collect Debts After Bankruptcy?

When you receive a discharge after completing your bankruptcy, it releases you from the debts you owed before your date of bankruptcy. Once you file personal bankruptcy, your creditors cannot legally collect on those debts.

Read MoreCan I Claim Bankruptcy a Second Time?

Yes, you can declare personal bankruptcy a second time, as long as you have been discharged from your first bankruptcy. If you don’t have surplus income, comply with your duties and cooperate with your trustee on other estate matters. You are eligible to be discharged from your second bankruptcy, after 24 months.

Read MoreDealing With Debts in Collection

Besides all of the harassing phone calls and intimidating letters, these collection accounts have a negative impact on your credit score and your ability to access credit or to own a home.

Read MoreHow to Correct Errors on Your Credit Report

Maintaining a good credit score is vital, as it directly impacts your ability to borrow money or finance purchases. It also affects things such as the cost of insurance and specific employment opportunities. For these and many other reasons, it is essential to identify and correct any errors on your credit report as soon as possible.

Read MoreWill My Personal Bankruptcy Affect My Spouse?

When you file a personal bankruptcy it does not directly affect your spouse or reflect on their credit report. Your personal bankruptcy is between you and your creditors. Your spouse is not liable for your debts simply because he/she is your spouse. However, your personal bankruptcy can have an impact on the other person in certain ways.

Read MoreWhat to Know Before Co-signing A Loan?

When you sign for a student loan, line of credit or any type of loan for another person you are legally responsible if that person fails to meet the terms of that credit agreement. If the other person misses payments the creditor will expect you to make the payments and demand that you pay the debt in full.

Read More