Posts Tagged ‘creditors’

What Happens if I Default on My Consumer Proposal

If a debtor is 3 months in arrears of monthly consumer proposal payments the consumer proposal is deemed annulled, which means that creditors can resume collection actions. There is no automatic bankruptcy if a debtor defaults on a consumer proposal.

that fails to make more than 2 payments cumulative during the Proposal will have their Proposal annulled and creditors can resume collecting their balances plus interest less any payments made. While a default on a Consumer Proposal will not automatically result in a Bankruptcy, however, the debtor cannot file another Proposal.

Read MorePersonal Bankruptcy in 12 Steps

Recognize the Problem, often the most challenging step as it requires that you admit that you are having financial troubles beyond your control and need help. Contact a Licensed Insolvency Trustee, the Trustee will provide a free confidential consultation and review your financial situation and discuss your options.

Read MoreDealing With Debt – Understanding the Two Types of Proposals

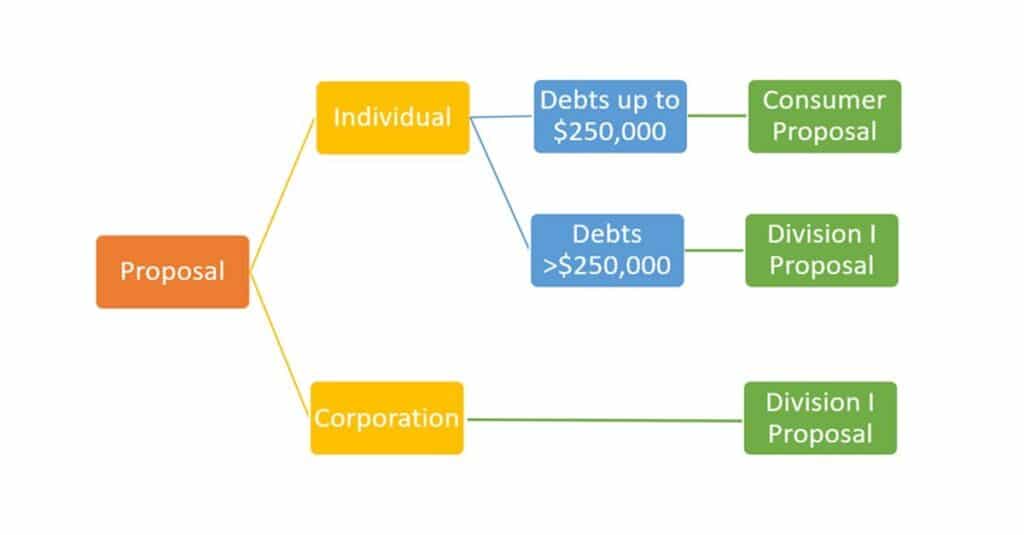

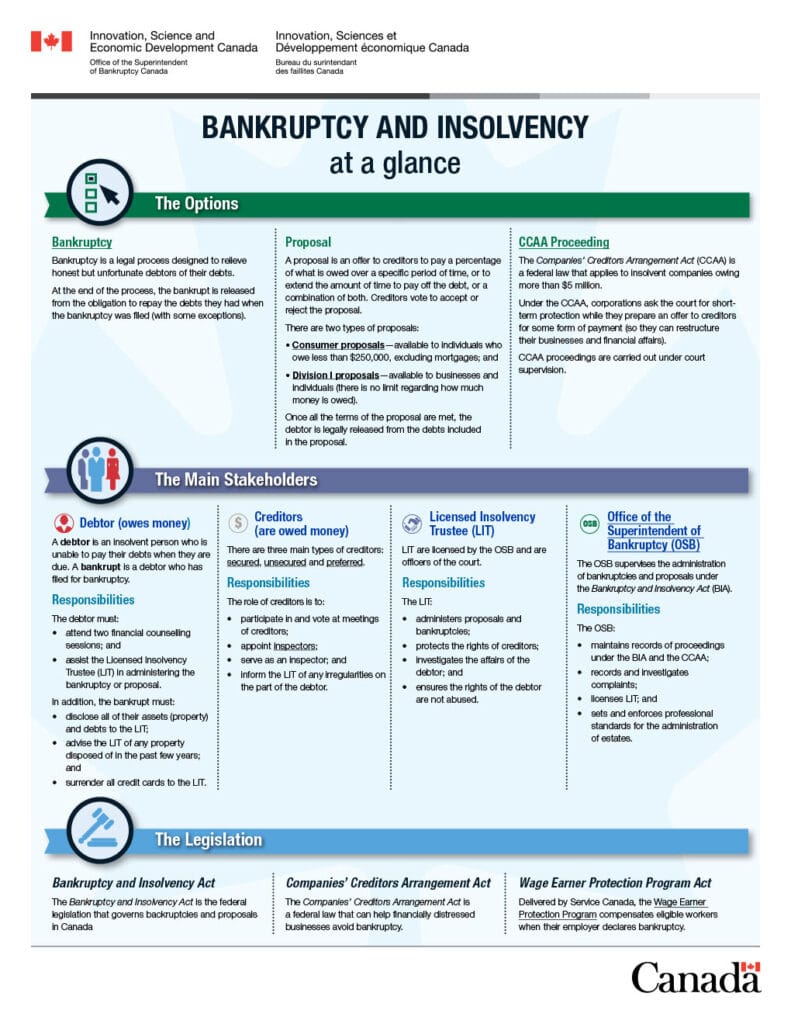

Division 1 Proposal Is when a consumer debtor owes more than $250,000 in debts, excluding the mortgage on their principal residence. If creditors don’t accept this proposal there is a deemed personal bankruptcy.

A consumer proposal is when a consumer debtor owes less than $250,000 in debts, excluding the mortgage on their principal residence. There is no deemed personal bankruptcy if the creditors reject the consumer proposal.

Read MoreFiling Your Income Tax Return After Bankruptcy

As part of the bankruptcy process, your Licensed Insolvency Trustee is required to file your income tax return for the year of bankruptcy and any returns that came due during the calendar year prior to bankruptcy. Any tax refunds for either of these periods will come directly to your bankruptcy estate for the benefit of the unsecured creditors.

Read MoreDealing With Increasing Insolvency Rates

There are lots of factors but, I think the greatest single contributor is the proliferation of easy credit combined with low levels of financial literacy. High debt levels limit financial flexibility and the ability to weather and recover from financial setbacks resulting from job loss, reduced income, illness, separation/divorce, and other life events.

Read MoreThe Real Cost of Vehicle Ownership

Think about the cost of ownership before you buy and then think about the cost of use and think ahead to consolidate trips, skip the trip, or car pool with friends and co-workers. The cost of vehicle ownership also needs to be considered when you choose where you live. While the cost of housing may be cheaper here in rural New Brunswick, the cost of the travel can offset the housing cost savings.

Read MoreStruggling With Debt Tackle Your Finances Head On

Hiding from the reality of your financial situation will do nothing to improve it. People have a pre-disposition to hide from the truth, particularly when the truth is ugly. Unfortunately, we see this every day.

Read MoreAnnouncement – New Designation for Insolvency Professionals

The Office of the Superintendent of Bankruptcy Canada released Directive 33, Trustee Designation and Advertising, updating the designation to be used by Licensed Trustees with regards to the advertisement, promotion, and communications related to their services. All trustees will now adopt the professional designation “Licensed Insolvency Trustee”.

Read MoreWhat Is the Bankruptcy and Insolvency Act (“BIA)

What Happens If I Win The Lottery While Bankrupt?

If you win the lottery during your personal bankruptcy, before you are discharged, the lottery winnings are considered “after-acquired property” and forms part of your bankruptcy. After-acquired property can be seized by your Trustee in Bankruptcy for the benefit of your unsecured creditors.

Read More