Posts Tagged ‘creditors’

Director Obligations and How To Prevent Corporate Debts From Becoming Personal

Company debts can become personal debts. It is important to understand the links between the Company and directors (including guarantors of Company debts). These links need to be considered and managed when dealing with a Company insolvency. We have the experience to help.

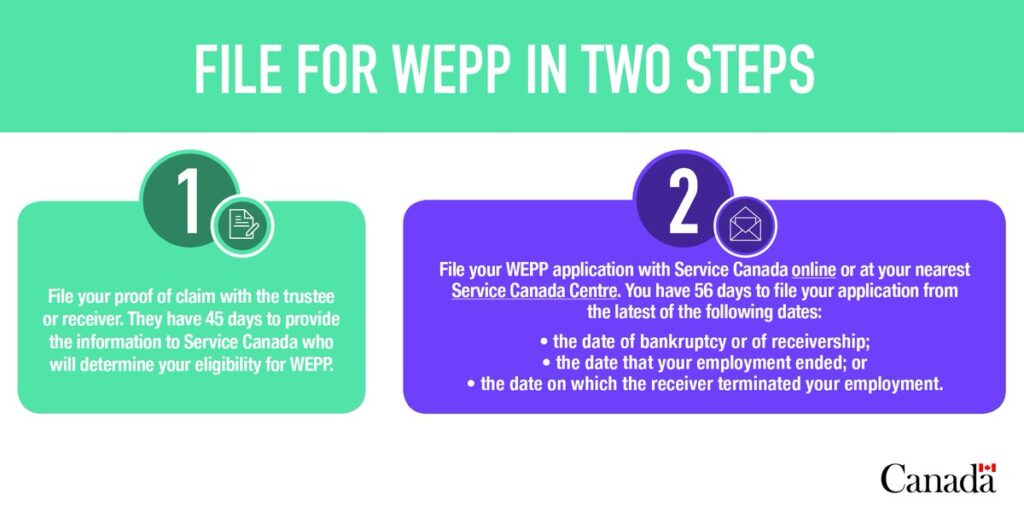

Read MoreWhat Is the Canadian Wage Earner Protection Program (WEPP)

Workers of companies that have gone bankrupt or under receivership may qualify to receive unpaid wages, vacation pay, and termination/severance pay. WEPP is a program that was established by the Federal Government in July 2008. WEPP provides employees of bankrupt employers, or employers subject to a receivership, with the ability to recover up to approximately…

Read MoreWhat is Receivership and How Can It Be Delayed?

Receivership is usually focused on creditors enforcing their rights through the appointment of a receiver to seize and sell assets. A business can seek protection to delay receivership while trying to negotiate a restructuring. These matters are very time sensitive. Don’t wait…we can help! Receivership happens when a Receiver is appointed by creditors or the…

Read MoreWhat Does It Mean to Voluntarily File for Corporate Bankruptcy?

If your debt problems seem insurmountable – we can help. We service the Maritime Provinces. A company can face Corporate Bankruptcy either voluntarily or involuntarily. In order to become bankrupt voluntarily, the board of directors passes a resolution authorizing the company to file for Bankruptcy. Any company that owes at least $1,000 and is unable…

Read MoreWhat Does It Mean to ‘Restructure’ or File a Corporate Proposal?

When their is a viable business with too much debt to handle, a Corporate Proposal can be used to restructure the Company so it can continue in business. We can help guide the business through a restructuring. A corporate proposal is filed with the intent of restructuring the debt of a company and allowing the…

Read MoreThe Up-Sell

You can’t make it through a drive-through without “do you want to upsize that?”, “can we add a muffin?”, “do you want to make a donation to….”; no, thank you, I just want the coffee I ordered!

Read MoreThe New Debtor Prison

We have found that a new form of debtor prison exists and this is due to excessive phone calls, emails, text messages and mail from creditors and collection agencies. These tactics can leave a person feeling afraid to answer their own phone and for some, it can cause undue stress and anxiety which can negatively affect their everyday life and ability to function at work.

Read MoreIncome Tax Deadlines

For Canadians, April 30 is the official deadline to file your personal income tax return with the Canada Revenue Agency. If you file your return past the deadline you will be assessed a late filing penalty. The deadline, if you or your spouse or common-law partner carried on a business in 2016, is June 15.

Read More2017 Surplus Income Standards

The Government of Canada has set net monthly income thresholds for a person or family to maintain a minimal standard of living in Canada. Every dollar that a bankrupt family makes above this level is subject to a surplus income payment of 50% while a person remains bankrupt.

Read MoreBudgeting 101 – Part 5 of 5

Catastrophic expenses are those expenses that you have no reasonable expectation of knowing that they are coming and they have a material and negative impact on your finances to the extent that you cannot recover from the impact and, in fact, may not even be able to deal with the expense in the first place..

Read More