Posts Tagged ‘financial stress’

Caught in the Pay Day Loan Cycle?

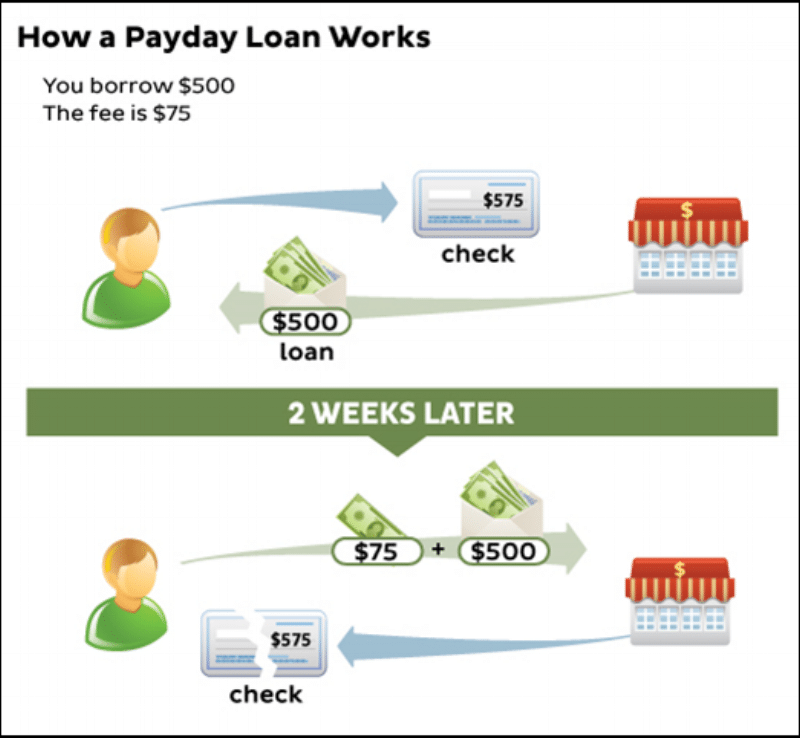

The problem with this type of borrowing is that it is very expensive and can often leave the borrower, who is already in a tight financial position, unable to repay the loan. So they end up re-borrowing or getting a “roll-over” loan by paying off the current loan and immediately getting another one from the payday lender.

Read MoreCan I Claim Bankruptcy a Second Time?

Yes, you can declare personal bankruptcy a second time, as long as you have been discharged from your first bankruptcy. If you don’t have surplus income, comply with your duties and cooperate with your trustee on other estate matters. You are eligible to be discharged from your second bankruptcy, after 24 months.

Read MoreDealing With Debts in Collection

Besides all of the harassing phone calls and intimidating letters, these collection accounts have a negative impact on your credit score and your ability to access credit or to own a home.

Read MoreHow Long Will I be Bankrupt?

If you are a first-time bankrupt, you are eligible for an automatic discharge from bankruptcy after 9 months if you have no obligation to make Surplus Income payments and after 21 months if you have to make Surplus Income payments.

Read MoreTips for Saving Money on Groceries

For most Canadian families groceries are there second highest monthly expense outside of their housing cost so it’s important to get the most bang for your buck. Here are a few tips and suggestions that may help you reduce your grocery expenses.

Read MoreDo I Qualify For Bankruptcy?

Basically, if you owe at least $1,000, are unable to keep up with your monthly debt payments and do not have assets such as vehicles, house, or investments that you can sell to pay your debts in full, then you can choose to file personal bankruptcy. It is your choice whether or not to voluntarily put yourself into bankruptcy and no one can stop you.

Read MoreThe Difference Between Prepaid and Secured Credit Cards

Two credit card products that often get confused are secured and prepaid credit cards. Let’s take a closer look at the characteristics of each one and some of the things you should be aware of before choosing either of these products. Choosing the product that is best for you will depend on your circumstances. Either way, we encourage you to do your research and to read the cardholder agreement or terms and conditions prior to opening one of these products.

Read MoreBeware of Debt Settlement Offers

The debt settlement and credit counselling companies would have you believe that they can easily have your credit balances reduced and save you hundreds if not thousands of dollars. The problem is they cannot guarantee any results. They will require that you pay them monthly administration fees and/or a percentage of the settlement amount as payment for their services. But you need to read their documents very closely to find out what happens to all of those fees that you have paid if they are unable to reach agreements with some or all of your creditors.

Read More20 Ways to Save Money on Insurance

There are many ways to save on your insurance costs so here are a few that we think you should be aware of…

Read MoreThe Cost of Credit Card Debt

If you are struggling to keep up with credit card debt and don’t see your balances decreasing this is a sign to seek professional help. A Licensed Insolvency Trustee can review your financial situation and help you find the best strategy to deal with your credit card debt.

Read More