Posts Tagged ‘Financial trouble’

When Small Business Owners Run Into Financial Trouble, What They Need is Help

We believe that entrepreneurs should be encouraged and supported, particularly when they run into financial difficulty.

Read MoreCan I Go Bankrupt If My Debts Are The Result of Gambling?

For individuals who are problem gamblers we strongly recommend other counselling to help address the addiction. Personal bankruptcy may provide short-term financial relief but cannot resolve the issue of gambling unless it is combined with other treatment.

Read MoreBanking Fees – Are You Paying Too Much?

It’s important to find the best type of account and monthly plan to fit your lifestyle so you can start by reviewing your monthly bank statements to see the fees and service charges you have incurred in the past. This will provide the information you need to compare the types of accounts and plans that best suited to your usage.

Having the wrong plan or too many bank accounts can be costly, and you might be paying for unnecessary bank expenses than a plan that is tailored to your individual or family needs.

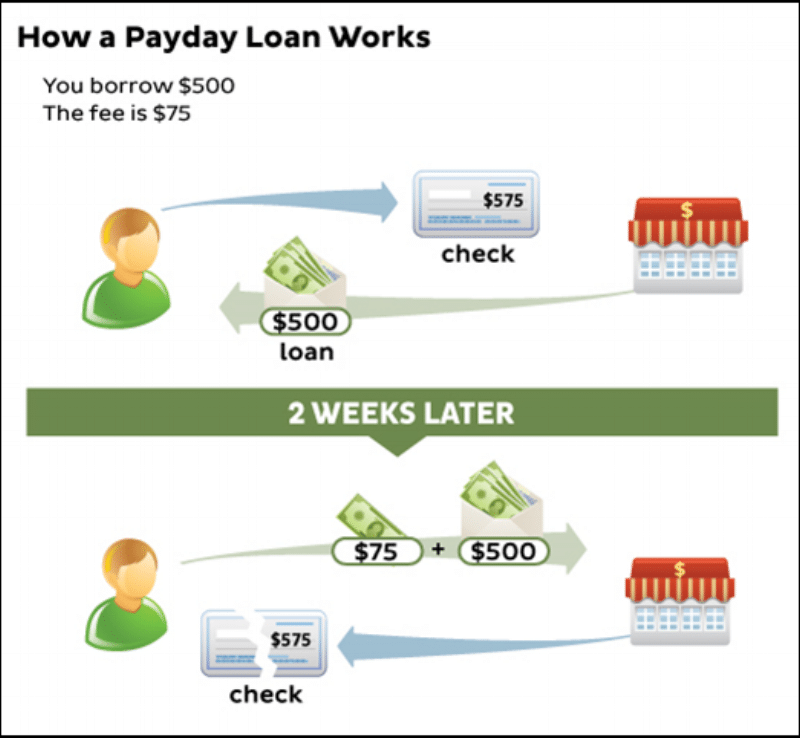

Read MoreCaught in the Pay Day Loan Cycle?

The problem with this type of borrowing is that it is very expensive and can often leave the borrower, who is already in a tight financial position, unable to repay the loan. So they end up re-borrowing or getting a “roll-over” loan by paying off the current loan and immediately getting another one from the payday lender.

Read MoreFinancial Warning Signs

Most of us can sense impending financial trouble but we tend to shy away from seeking professional help out of embarrassment or fear of being judged. Licenced Insolvency Trustees and debt counsellors are there to help and should be able to provide you with financial counselling in a non-judgmental and professional manner. The information they provide should help you better understand your financial situation and the options and resources that are in place to assist you. This will allow you to make the best possible decision to resolve your financial concerns.

Read More