Posts Tagged ‘income taxes’

Income Tax Deadlines Are Coming Soon But Why Do They Matter?

Even if you cannot pay your full balance owing on or before April 30, 2018, you can avoid the late-filing penalty by filing your return on time, by April 30, 2018.

Read MoreDirector Obligations and How To Prevent Corporate Debts From Becoming Personal

Company debts can become personal debts. It is important to understand the links between the Company and directors (including guarantors of Company debts). These links need to be considered and managed when dealing with a Company insolvency. We have the experience to help.

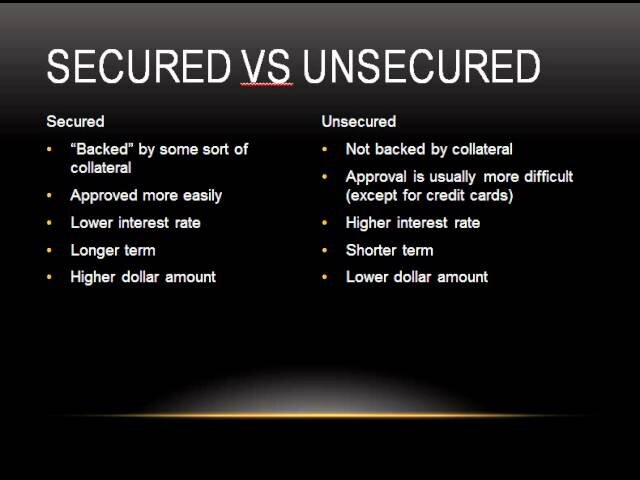

Read MoreSecured vs Unsecured Loan, Debt, Credit Cards & Line of Credit

Secured debts include mortgages, vehicle or investment loans. The borrower gives the lender a lien or mortgage against assets such as property, vehicles or investments in exchange for the loan. Unsecured debts typically include personal loans, lines of credit, credit cards, overdraft on bank accounts, and personal income taxes.

Read MoreUsing RRSPs to Pay Down Debt

If you are unable to keep up with your debt payments you should consult a Licensed Insolvency Trustee to discuss your options before cashing-in any of your investments. Your investment savings may be exempt from seizure so you may be able to keep them if you file for personal bankruptcy or settle your debts through a consumer proposal.

Read MoreAm I Responsible For the Debt of My Business?

If your business is incorporated, you may still have personal obligations for certain debts; debt that you personally guaranteed, director liabilities, unpaid wages. If you operate your business as a sole proprietor, you are personally responsible for all the debts of that business. If you are a partner in a partnership, you and your business partner are jointly liable for all the debts of the partnership, not just your own portion.

Read More