Posts Tagged ‘licensed insolvency trustee’

Dealing With Increasing Insolvency Rates

There are lots of factors but, I think the greatest single contributor is the proliferation of easy credit combined with low levels of financial literacy. High debt levels limit financial flexibility and the ability to weather and recover from financial setbacks resulting from job loss, reduced income, illness, separation/divorce, and other life events.

Read MoreThe Real Cost of Vehicle Ownership

Think about the cost of ownership before you buy and then think about the cost of use and think ahead to consolidate trips, skip the trip, or car pool with friends and co-workers. The cost of vehicle ownership also needs to be considered when you choose where you live. While the cost of housing may be cheaper here in rural New Brunswick, the cost of the travel can offset the housing cost savings.

Read MoreAnnouncement – New Designation for Insolvency Professionals

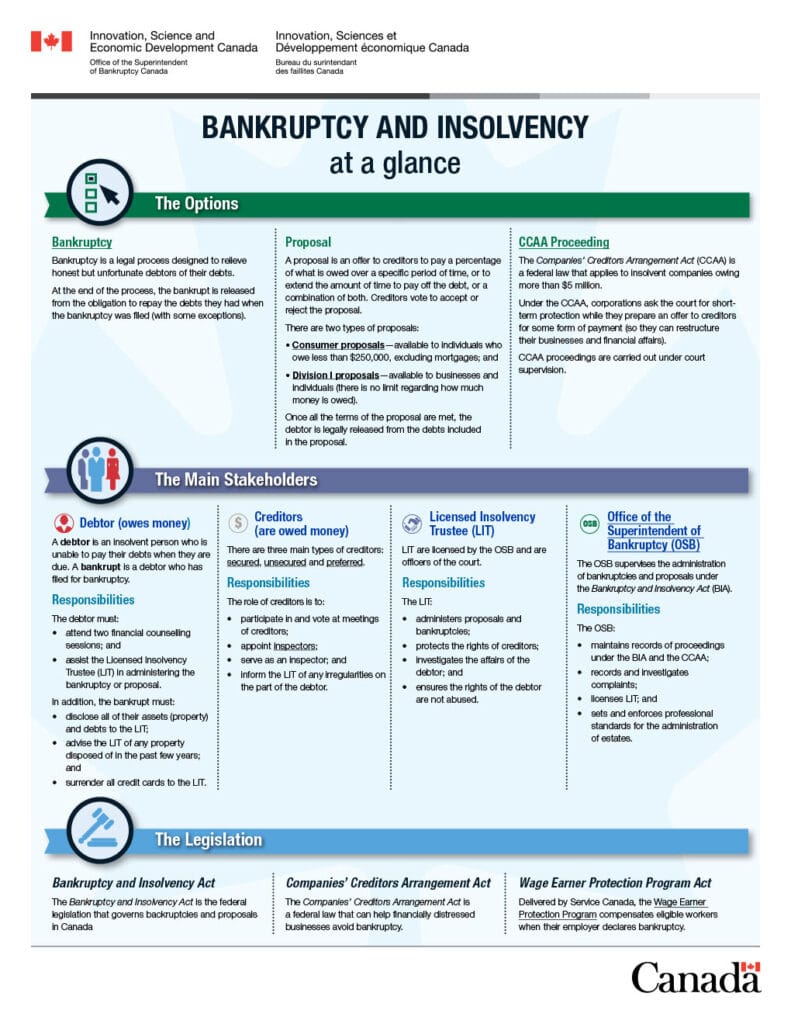

The Office of the Superintendent of Bankruptcy Canada released Directive 33, Trustee Designation and Advertising, updating the designation to be used by Licensed Trustees with regards to the advertisement, promotion, and communications related to their services. All trustees will now adopt the professional designation “Licensed Insolvency Trustee”.

Read MoreWhat Is the Bankruptcy and Insolvency Act (“BIA)

What Happens If I Win The Lottery While Bankrupt?

If you win the lottery during your personal bankruptcy, before you are discharged, the lottery winnings are considered “after-acquired property” and forms part of your bankruptcy. After-acquired property can be seized by your Trustee in Bankruptcy for the benefit of your unsecured creditors.

Read More2016 Surplus Income Standards

When an individual files for personal bankruptcy the trustee will calculate whether or not he will be required to make surplus income payments based on his net household income.

Read MoreWhat Are My Duties In Bankruptcy?

There are several duties that an individual must complete as part of a personal bankruptcy to be eligible to be discharged from bankruptcy. These duties include, but are not limited to; completing two counselling sessions, report your monthly income to the Trustee, assist the Trustee with file your income tax return for the year of bankruptcy.

Read MoreWhat Is A Stay of Proceedings?

A stay of proceedings basically means that creditors must cease all collection or legal proceedings against the debtor, including wage garnishments. The purpose of the stay is to protect the assets of the bankrupt so the Trustee or Proposal Administrator can deal with them in an orderly fashion.

Read MoreCan A Person Have Savings During Bankruptcy?

Yes, you can accumulate savings during a personal bankruptcy or consumer proposal. During a personal bankruptcy provided you are paying your required surplus income payment, if applicable. You can save as much as your budget allows.

Read MoreMy Spouse filed bankruptcy, do I need too?

No, if one spouse files personal bankruptcy or a consumer proposal, it may not be necessary for the other spouse to file. This depends on several facts which a Licensed Insolvency Trustee will assist the couple to review. The couple can then make an informed decision as to which option best meets their needs and allows them to achieve their financial goals.

Read More