Posts Tagged ‘personal bankruptcy’

Banking Fees – Are You Paying Too Much?

It’s important to find the best type of account and monthly plan to fit your lifestyle so you can start by reviewing your monthly bank statements to see the fees and service charges you have incurred in the past. This will provide the information you need to compare the types of accounts and plans that best suited to your usage.

Having the wrong plan or too many bank accounts can be costly, and you might be paying for unnecessary bank expenses than a plan that is tailored to your individual or family needs.

Read MoreCan Creditors Collect Debts After Bankruptcy?

When you receive a discharge after completing your bankruptcy, it releases you from the debts you owed before your date of bankruptcy. Once you file personal bankruptcy, your creditors cannot legally collect on those debts.

Read MoreMy Bank Account Is Always In Overdraft

Banks charge interest on overdraft account as high as 20%; this can be a costly form of credit. If you find that you are carrying an overdraft balance and running out of money between pay periods, this can be an early warning sign of future financial difficulties.

Read MoreCaught in the Pay Day Loan Cycle?

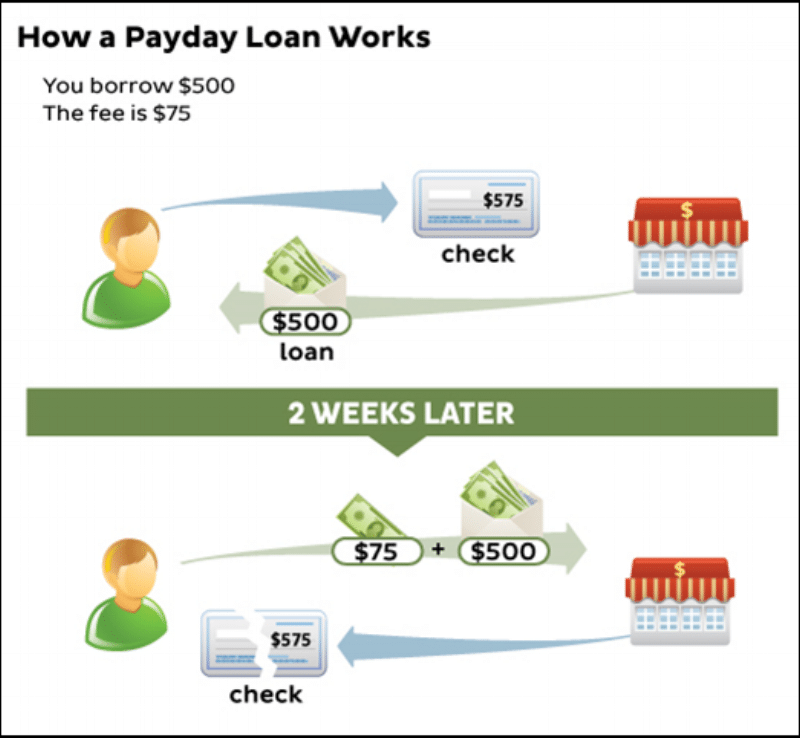

The problem with this type of borrowing is that it is very expensive and can often leave the borrower, who is already in a tight financial position, unable to repay the loan. So they end up re-borrowing or getting a “roll-over” loan by paying off the current loan and immediately getting another one from the payday lender.

Read MoreWhat happens If My Ex-Spouse Goes Bankrupt?

If both parties have agreed to assume responsibility for certain debts, it does not absolve them, if one of them defaults on a debt, that was granted to both parties jointly. Bankruptcy laws and family laws do not deal with assets and liabilities in the same way; there can be conflicts and unintended consequences when the two interact.

Read MoreFinancial Literacy – Understanding Collateral Mortgages

The mortgage process is changing and many banks have are now using collateral mortgages when you purchase or refinance your home. A collateral mortgage typically designed to secure all obligations that you owe to the bank and there is no dollar limit on the mortgage.

Read MoreIs Bankruptcy My Only Option?

Bankruptcy is not the only debt solution option available to resolve overwhelming debt. Your Trustee (Licensed Insolvency Trustee) can also put together a consumer proposal to your creditors. Where you pay a portion of the debt, you owe your creditors, and the creditors write off the remaining balance of the debt.

Read MoreI Received a Mortgage Sale Notice – What Can I do?

When you fall behind on mortgage payments your bank has the right to take control of your house and sell it. The mortgage company or bank must follow a formal legal process called a mortgage sale or foreclosure.

Read MoreAm I Responsible For the Debt of My Business?

If your business is incorporated, you may still have personal obligations for certain debts; debt that you personally guaranteed, director liabilities, unpaid wages. If you operate your business as a sole proprietor, you are personally responsible for all the debts of that business. If you are a partner in a partnership, you and your business partner are jointly liable for all the debts of the partnership, not just your own portion.

Read MoreCan I Claim Bankruptcy a Second Time?

Yes, you can declare personal bankruptcy a second time, as long as you have been discharged from your first bankruptcy. If you don’t have surplus income, comply with your duties and cooperate with your trustee on other estate matters. You are eligible to be discharged from your second bankruptcy, after 24 months.

Read More