Posts Tagged ‘personal bankruptcy’

Dealing With Debts in Collection

Besides all of the harassing phone calls and intimidating letters, these collection accounts have a negative impact on your credit score and your ability to access credit or to own a home.

Read MoreHow to Correct Errors on Your Credit Report

Maintaining a good credit score is vital, as it directly impacts your ability to borrow money or finance purchases. It also affects things such as the cost of insurance and specific employment opportunities. For these and many other reasons, it is essential to identify and correct any errors on your credit report as soon as possible.

Read MoreDoes My Trustee Work For Me or My Creditors?

Your Trustee’s job is to administer your bankruptcy or consumer proposal following the Bankruptcy and Insolvency Act.

Read MoreHow to Create a Budget in 5 Steps

We all know the importance of living within our means but according to recent statistics, less than 50% of Canadians use a monthly budget to plan their spending. When putting together a budget plan the key is not to make it complicated or difficult to follow.

Read MoreHow Long Will I be Bankrupt?

If you are a first-time bankrupt, you are eligible for an automatic discharge from bankruptcy after 9 months if you have no obligation to make Surplus Income payments and after 21 months if you have to make Surplus Income payments.

Read MoreWill Bankruptcy Ruin My Credit?

People often try to avoid bankruptcy at all costs because they are worried about ruining their credit rating. They pride themselves on paying their bills on time, have always maintained a strong credit score and they thought of doing anything to jeopardize that is unthinkable.

Read MoreWill My Friends and Family Know I Went Bankrupt?

Personal bankruptcy and consumer proposal filings are a matter of public record and are kept on file with the Government of Canada through the Office of the Superintendent of Bankruptcy. These records are accessible for a fee but how many people, other than Licensed Insolvency Trustee (bankruptcy trustee), would incur the expense or even think or know where to look?

Read MoreTips for Saving Money on Groceries

For most Canadian families groceries are there second highest monthly expense outside of their housing cost so it’s important to get the most bang for your buck. Here are a few tips and suggestions that may help you reduce your grocery expenses.

Read MoreDo I Qualify For Bankruptcy?

Basically, if you owe at least $1,000, are unable to keep up with your monthly debt payments and do not have assets such as vehicles, house, or investments that you can sell to pay your debts in full, then you can choose to file personal bankruptcy. It is your choice whether or not to voluntarily put yourself into bankruptcy and no one can stop you.

Read MoreUnderstanding Your Credit Score in Canada

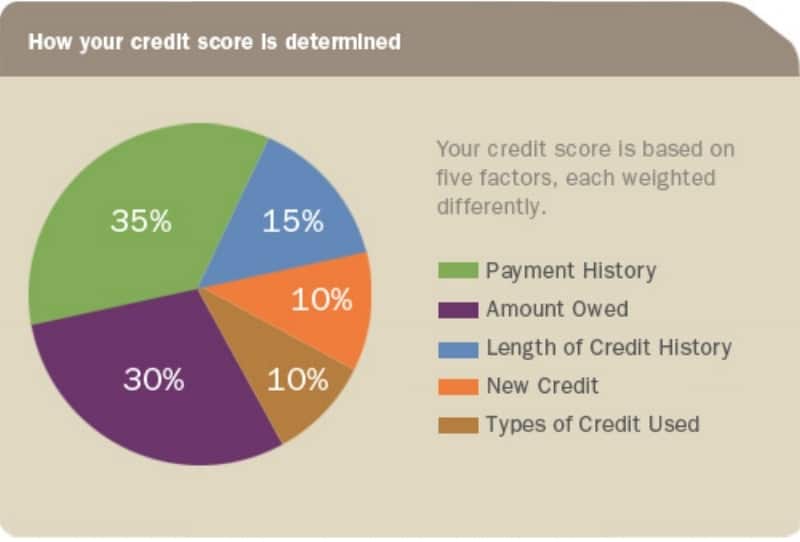

A credit score is a number, attached to your credit report, that represents your credit-worthiness and indicates how likely or unlikely you are to pay your debts. Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to you. The higher the score the more likely you are to be approved for credit; a lower score decreases your chances of obtaining credit.

Read More