Posts Tagged ‘PPR’

Dealing With Debt – Understanding the Two Types of Proposals

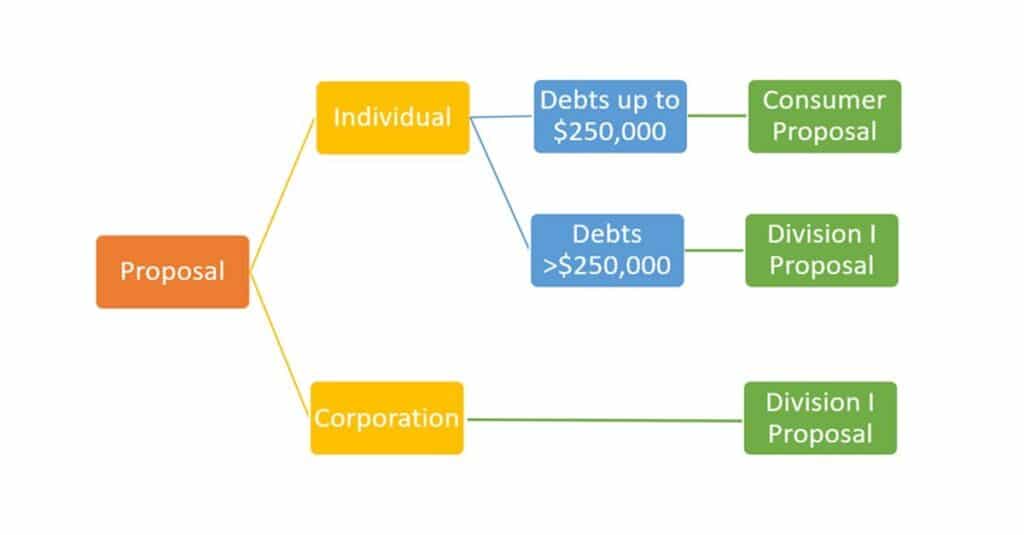

Division 1 Proposal Is when a consumer debtor owes more than $250,000 in debts, excluding the mortgage on their principal residence. If creditors don’t accept this proposal there is a deemed personal bankruptcy.

A consumer proposal is when a consumer debtor owes less than $250,000 in debts, excluding the mortgage on their principal residence. There is no deemed personal bankruptcy if the creditors reject the consumer proposal.

Read MoreThe Real Cost of Vehicle Ownership

Think about the cost of ownership before you buy and then think about the cost of use and think ahead to consolidate trips, skip the trip, or car pool with friends and co-workers. The cost of vehicle ownership also needs to be considered when you choose where you live. While the cost of housing may be cheaper here in rural New Brunswick, the cost of the travel can offset the housing cost savings.

Read MoreCan Creditors Collect Debts After Bankruptcy?

When you receive a discharge after completing your bankruptcy, it releases you from the debts you owed before your date of bankruptcy. Once you file personal bankruptcy, your creditors cannot legally collect on those debts.

Read MoreI Received a Mortgage Sale Notice – What Can I do?

When you fall behind on mortgage payments your bank has the right to take control of your house and sell it. The mortgage company or bank must follow a formal legal process called a mortgage sale or foreclosure.

Read MoreHow to Correct Errors on Your Credit Report

Maintaining a good credit score is vital, as it directly impacts your ability to borrow money or finance purchases. It also affects things such as the cost of insurance and specific employment opportunities. For these and many other reasons, it is essential to identify and correct any errors on your credit report as soon as possible.

Read MoreGood Debt vs. Bad Debt

Good debt is for purchases that appreciate in value or significantly improve your quality of life. Bad debts on the other hand typically do not provide you with any long-term benefit. If you carry a heavy amount of bad debt and are only able to make minimum payments then it’s time to look for help.

Read More