Posts Tagged ‘savings’

Week 2: How To Live In Debt To No One

Calvin Coolidge once said, “There is no dignity quite so impressive, and no independence quite so important, as living within your means.” I like to think what he meant by this is that when you live within your means, you can hold your head high because you are beholden to no one.

Read MoreBudgeting 101 – Part 5 of 5

Catastrophic expenses are those expenses that you have no reasonable expectation of knowing that they are coming and they have a material and negative impact on your finances to the extent that you cannot recover from the impact and, in fact, may not even be able to deal with the expense in the first place..

Read MoreThe Real Cost of Vehicle Ownership

Think about the cost of ownership before you buy and then think about the cost of use and think ahead to consolidate trips, skip the trip, or car pool with friends and co-workers. The cost of vehicle ownership also needs to be considered when you choose where you live. While the cost of housing may be cheaper here in rural New Brunswick, the cost of the travel can offset the housing cost savings.

Read MoreCan A Person Have Savings During Bankruptcy?

Yes, you can accumulate savings during a personal bankruptcy or consumer proposal. During a personal bankruptcy provided you are paying your required surplus income payment, if applicable. You can save as much as your budget allows.

Read MoreWhat Assets Can New Brunswick Residents Keep In Bankruptcy?

What asset can I keep? A Licensed Insolvency Trustee can help you identify which assets you can keep. There is a specific list of assets that you are allowed to keep when you file personal bankruptcy or consumer proposal. This list of assets is specific to the province in which you live.

Read MorePlanning a Debt Free Summer Vacation

If you did not start saving soon enough and don’t have enough money, then you may want to consider delaying your trip to the following year. Your vacation will be much more enjoyable if you know that it is paid for in advance.

Read MoreUsing RRSPs to Pay Down Debt

If you are unable to keep up with your debt payments you should consult a Licensed Insolvency Trustee to discuss your options before cashing-in any of your investments. Your investment savings may be exempt from seizure so you may be able to keep them if you file for personal bankruptcy or settle your debts through a consumer proposal.

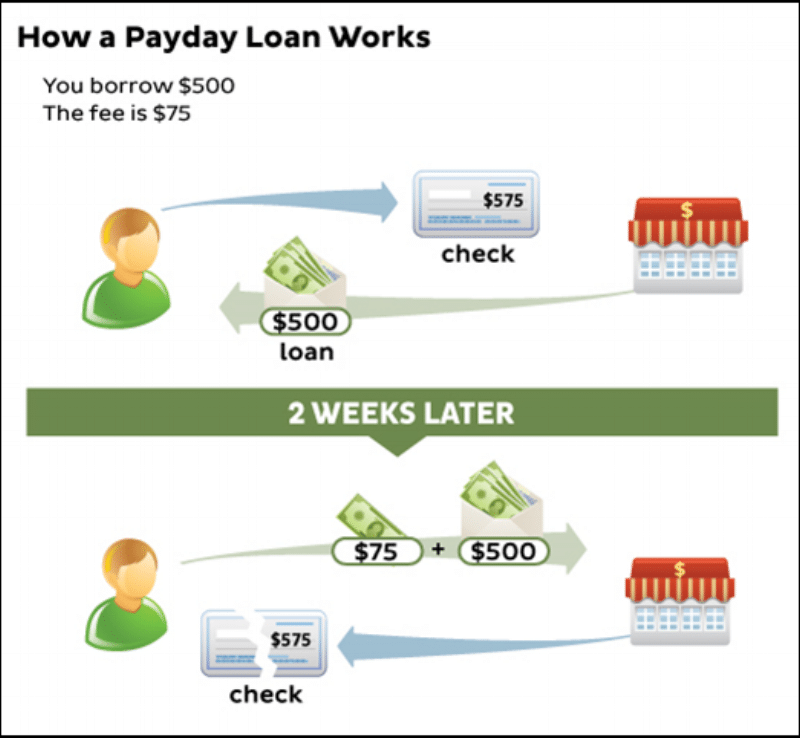

Read MoreCaught in the Pay Day Loan Cycle?

The problem with this type of borrowing is that it is very expensive and can often leave the borrower, who is already in a tight financial position, unable to repay the loan. So they end up re-borrowing or getting a “roll-over” loan by paying off the current loan and immediately getting another one from the payday lender.

Read MoreWhat Happens to my Investments in Bankruptcy

Your RRSP is exempt from seizure except for your contributions in the 12 months before filing personal bankruptcy or a consumer proposal.

Read More