Posts Tagged ‘secured creditor’

Financial Deep Cleaning Series – Part 1

Part 1 – Get Rid of the Junk. “Individually, these small things likely don’t disrupt your day-to-day financial well-being.”

Read More3 Questions Every Creditor Will Ask Themselves

If one or more of these scenarios apply, you may need to offer your creditors more than normal in order to convince them to say “yes”.

Read MoreWhat Happens To Life Insurance When I Declare Bankruptcy?

In evaluating your assets in a bankruptcy situation the Licensed Insolvency Trustee is determining if there is any equity or value in the asset that is potentially available to your creditors, subject to any exemptions under Provincial or Federal legislation for that type of asset.

Read MoreNovember is Financial Literacy Month

Financial Consumer Agency of Canada (“FCAC”), FLM is a coordinated effort “to strengthen the financial literacy of Canadians and empower them to manage money and debt wisely, save for the future and understand their financial rights and responsibilities”.

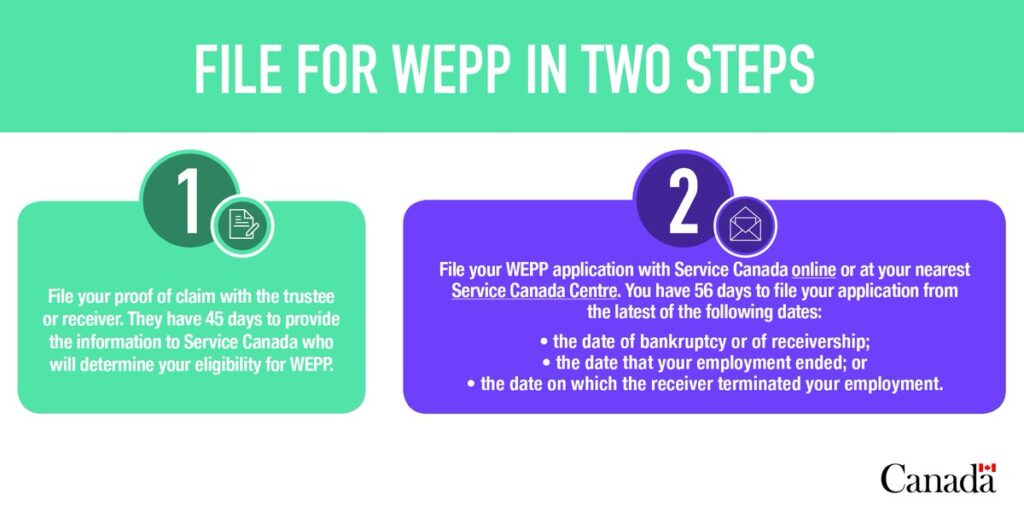

Read MoreWhat Is the Canadian Wage Earner Protection Program (WEPP)

Workers of companies that have gone bankrupt or under receivership may qualify to receive unpaid wages, vacation pay, and termination/severance pay. WEPP is a program that was established by the Federal Government in July 2008. WEPP provides employees of bankrupt employers, or employers subject to a receivership, with the ability to recover up to approximately…

Read MoreWhat is Receivership and How Can It Be Delayed?

Receivership is usually focused on creditors enforcing their rights through the appointment of a receiver to seize and sell assets. A business can seek protection to delay receivership while trying to negotiate a restructuring. These matters are very time sensitive. Don’t wait…we can help! Receivership happens when a Receiver is appointed by creditors or the…

Read MoreWhat Does It Mean to Voluntarily File for Corporate Bankruptcy?

If your debt problems seem insurmountable – we can help. We service the Maritime Provinces. A company can face Corporate Bankruptcy either voluntarily or involuntarily. In order to become bankrupt voluntarily, the board of directors passes a resolution authorizing the company to file for Bankruptcy. Any company that owes at least $1,000 and is unable…

Read MoreWhat Does It Mean to ‘Restructure’ or File a Corporate Proposal?

When their is a viable business with too much debt to handle, a Corporate Proposal can be used to restructure the Company so it can continue in business. We can help guide the business through a restructuring. A corporate proposal is filed with the intent of restructuring the debt of a company and allowing the…

Read MoreThe Up-Sell

You can’t make it through a drive-through without “do you want to upsize that?”, “can we add a muffin?”, “do you want to make a donation to….”; no, thank you, I just want the coffee I ordered!

Read MoreBudgeting 101 – Part 3 of 5

Like monthly expenses, most annual expenses are predictable; at least to the extent that you know they are going to happen. Sometimes the amount is uncertain or the amount is discretionary (you set it – requires some internal fortitude to manage).

Read More