Posts Tagged ‘secured creditor’

Bankruptcy And Sponsoring a Relative’s Application For Immigration

According to Immigration Canada, you can sponsor a relative’s immigration application as long as you are a citizen or permanent resident of Canada and are 18 years of age or older. There are however some restrictions, one of which states that you can not be an undischarged bankrupt.

Read MoreDo I Have To Continue Paying Student Loans During My Bankruptcy or Consumer Proposal?

Even though your student loan debt may not be discharged as part of your personal bankruptcy or consumer proposal, the creditor is still prohibited from normal collection activities during your personal bankruptcy or consumer proposal. We recommend paying the interest portion of the payment during your personal bankruptcy or consumer proposal.

Read MoreCan I Apply For Credit While Bankrupt?

Filing for personal bankruptcy does not prevent you from applying for credit however as a bankrupt person you have a duty not to engage in any business transactions, or obtain credit of more than $1,000, without disclosing to the lender that you are an undischarged bankrupt.

Read MoreCan I Declare Bankruptcy If I Live Outside of The Country?

Generally speaking, under the Bankruptcy & Insolvency Act, if you reside outside of the country you can still declare bankruptcy as long as you meet certain criteria. If you are a previous Canadian resident and are have debt issues you should contact Powell Associates Ltd. to determine if you meet the criteria to file personal bankruptcy or a consumer proposal in Canada.

Read MoreMy Bank Account Is Always In Overdraft

Banks charge interest on overdraft account as high as 20%; this can be a costly form of credit. If you find that you are carrying an overdraft balance and running out of money between pay periods, this can be an early warning sign of future financial difficulties.

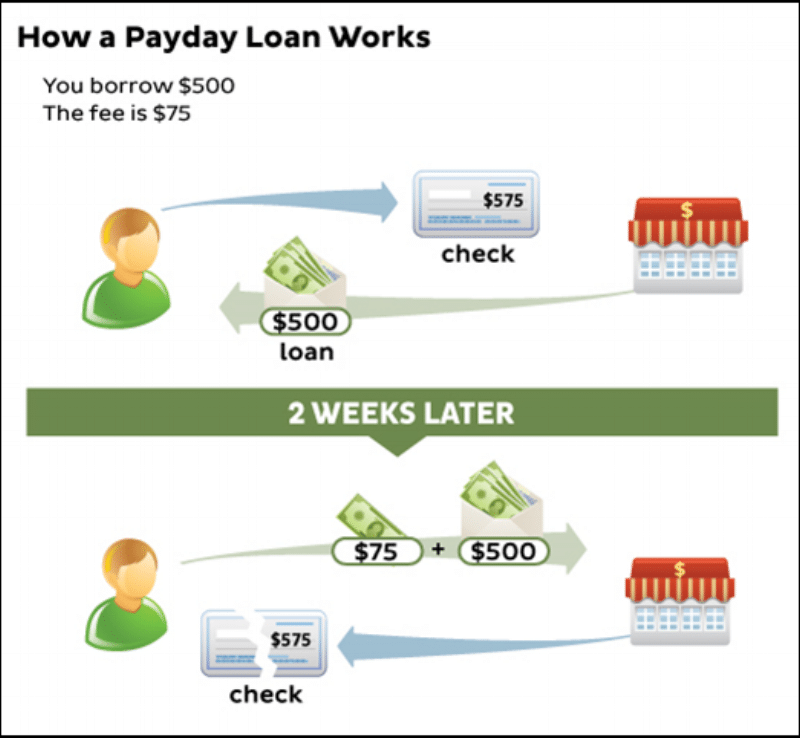

Read MoreCaught in the Pay Day Loan Cycle?

The problem with this type of borrowing is that it is very expensive and can often leave the borrower, who is already in a tight financial position, unable to repay the loan. So they end up re-borrowing or getting a “roll-over” loan by paying off the current loan and immediately getting another one from the payday lender.

Read MoreHow Long Will I be Bankrupt?

If you are a first-time bankrupt, you are eligible for an automatic discharge from bankruptcy after 9 months if you have no obligation to make Surplus Income payments and after 21 months if you have to make Surplus Income payments.

Read MoreDo I Qualify For Bankruptcy?

Basically, if you owe at least $1,000, are unable to keep up with your monthly debt payments and do not have assets such as vehicles, house, or investments that you can sell to pay your debts in full, then you can choose to file personal bankruptcy. It is your choice whether or not to voluntarily put yourself into bankruptcy and no one can stop you.

Read MoreThe Difference Between Prepaid and Secured Credit Cards

Two credit card products that often get confused are secured and prepaid credit cards. Let’s take a closer look at the characteristics of each one and some of the things you should be aware of before choosing either of these products. Choosing the product that is best for you will depend on your circumstances. Either way, we encourage you to do your research and to read the cardholder agreement or terms and conditions prior to opening one of these products.

Read MoreThe Cost of Credit Card Debt

If you are struggling to keep up with credit card debt and don’t see your balances decreasing this is a sign to seek professional help. A Licensed Insolvency Trustee can review your financial situation and help you find the best strategy to deal with your credit card debt.

Read More