Posts Tagged ‘unsecured debt’

Will a consumer proposal or personal bankruptcy release me from all types and forms of debts

When it comes to unmanageable debt, there are a few different debt relief options available to you: consumer proposal and bankruptcy. Each option has its own benefits and drawbacks, so it’s important to understand what each one entails before making a decision. In this article, we will focus on the question of whether or not…

Read MoreDebts Owing to the Canada Revenue Agency

Many people believe that debts owing to CRA will never go away. That is not necessarily the case, particularly when an individual goes bankrupt or files a proposal under the provisions of the Bankruptcy and Insolvency Act (“BIA”). However, prior to file personal bankruptcy or a consumer proposal, CRA has some significant legislated powers to collect debts.; including garnishing paycheques, seizing bank accounts.

Read MoreWhat Is The New Brunswick Personal Property Security Act (PPSA)?

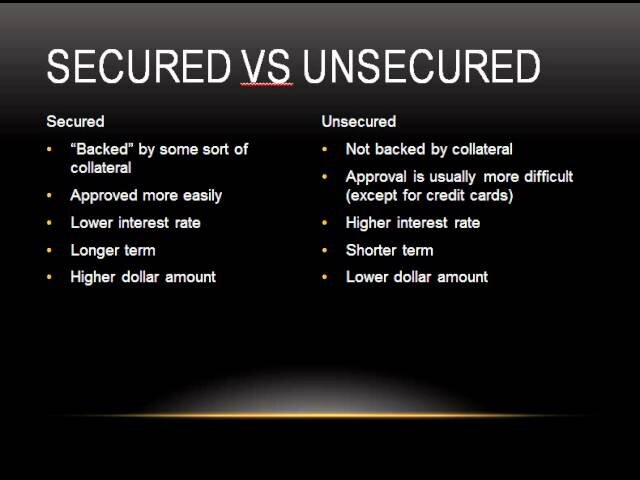

PPSA legislation provides a central registry for filing notices of security interests in personal property, allows both individuals and institutions to record their financial interest in personal property (cars, boats, appliances, etc.). Bankruptcy eliminates all of your unsecured debt such as credit cards, bank loans, tax debts, unpaid bills and payday loans. However, secured debts such as vehicle loans, mortgages and home equity lines of credit are typically not included in a bankruptcy.

Read MoreSecured vs Unsecured Loan, Debt, Credit Cards & Line of Credit

Secured debts include mortgages, vehicle or investment loans. The borrower gives the lender a lien or mortgage against assets such as property, vehicles or investments in exchange for the loan. Unsecured debts typically include personal loans, lines of credit, credit cards, overdraft on bank accounts, and personal income taxes.

Read MoreHow Are Secured Debts Treated In Personal Bankruptcy or a Consumer Proposal?

When an individual files personal bankruptcy or a consumer proposal these loans are not always impacted and the assets can usually be kept as long as the loan payments are current and continue to be made in accordance with the credit agreement.

Read MoreWill Bankruptcy Take Care of Judgments?

Yes, judgments from creditors do get released when you file a personal bankruptcy or complete a consumer proposal. However, judgments registered against your assets by Canada Revenue Agency do not get released when you file a personal bankruptcy or complete a consumer proposal.

Read MorePersonal Bankruptcy and Income Taxes – What You Need to Know

When filing a personal bankruptcy income tax debts are discharged the same as any other unsecured debt, such as credit cards and personal loans. If you are struggling with income tax debt or have had your wages garnished then you should seek the assistance of a professional.

Read More