Credit rating; credit score; Equifax Credit Report; Trans Union Credit Report…

What is the Average Credit Score in Canada by Age?

Unfortunately, your credit score can influence many decisions you make in life. Where you’ll live, what jobs you may qualify for, and even how you get to work can all be influenced by your credit score. Knowing the average credit score in Canada by age can help you determine if you’re moving in the right…

Read MoreCredit Rebuilding Basics, Part 5 — Fine-tuning and Monitoring

If you have already taken the appropriate action steps to rebuild your credit, you should be well on your way to a higher credit score. Now it’s time to fine-tune and build on what you have already accomplished.

Read MoreCredit Rebuilding Basics, Part 4 — Rebuilding Your Credit

We’ve also provided a blueprint for how you can repair your credit before rebuilding your credit. Now for the exciting stuff—rebuilding your credit score!

Read MoreCredit Rebuilding Basics, Part 3 — Reviewing and Repairing Your Credit Report

To repair your credit, you must first find out what your credit report is saying—that’s the starting point.

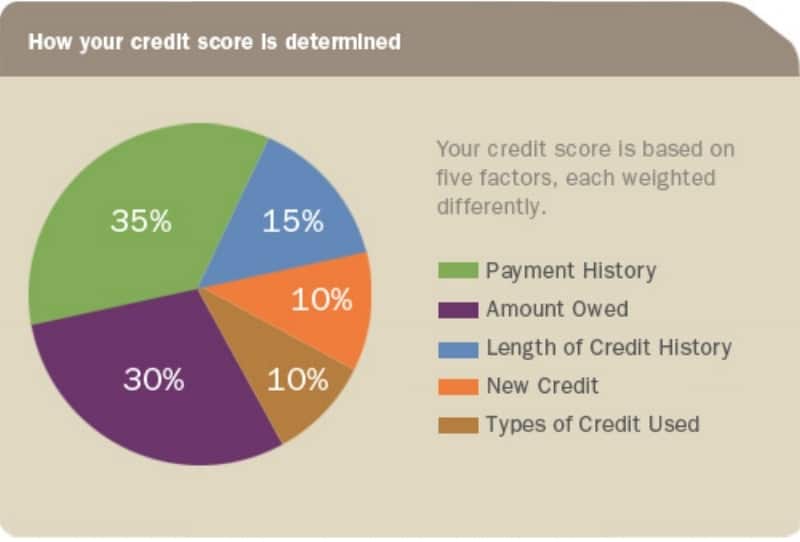

Read MoreCredit Rebuilding Basics, Part 2 — How Is Your Credit Score Calculated?

Once you know how the Credit Score system works, the steps required to repair and rebuild your credit will make more sense.

Read MoreUnderstanding Your Credit Score in Canada

A credit score is a number, attached to your credit report, that represents your credit-worthiness and indicates how likely or unlikely you are to pay your debts. Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to you. The higher the score the more likely you are to be approved for credit; a lower score decreases your chances of obtaining credit.

Read More