Posts Tagged ‘assets’

What Is a Consumer Proposal?

Most consumer proposals are structured as monthly payments overtime at less than the full payout.

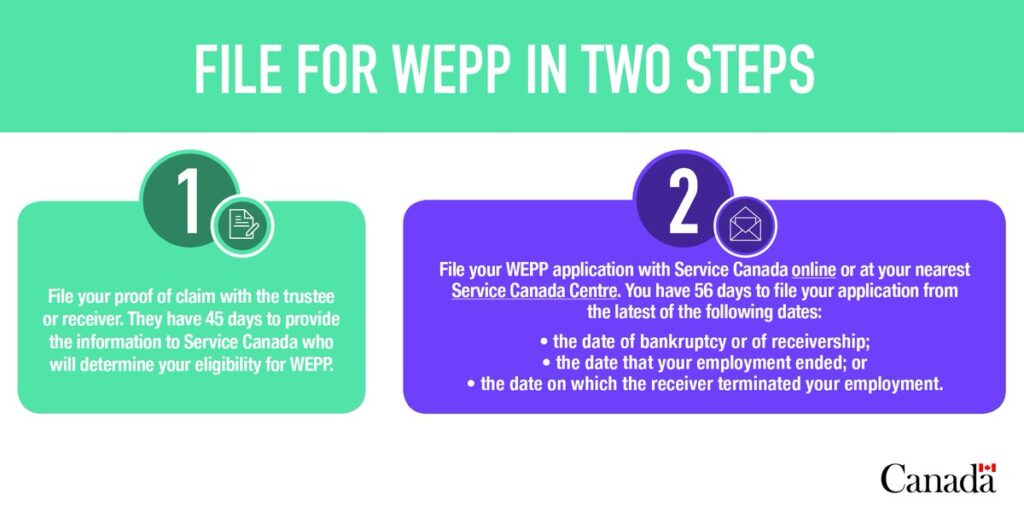

Read MoreWhat Is the Canadian Wage Earner Protection Program (WEPP)

Workers of companies that have gone bankrupt or under receivership may qualify to receive unpaid wages, vacation pay, and termination/severance pay. WEPP is a program that was established by the Federal Government in July 2008. WEPP provides employees of bankrupt employers, or employers subject to a receivership, with the ability to recover up to approximately…

Read MoreWhat is Receivership and How Can It Be Delayed?

Receivership is usually focused on creditors enforcing their rights through the appointment of a receiver to seize and sell assets. A business can seek protection to delay receivership while trying to negotiate a restructuring. These matters are very time sensitive. Don’t wait…we can help! Receivership happens when a Receiver is appointed by creditors or the…

Read MoreWhat Does It Mean to Voluntarily File for Corporate Bankruptcy?

If your debt problems seem insurmountable – we can help. We service the Maritime Provinces. A company can face Corporate Bankruptcy either voluntarily or involuntarily. In order to become bankrupt voluntarily, the board of directors passes a resolution authorizing the company to file for Bankruptcy. Any company that owes at least $1,000 and is unable…

Read MoreWhat Does It Mean to ‘Restructure’ or File a Corporate Proposal?

When their is a viable business with too much debt to handle, a Corporate Proposal can be used to restructure the Company so it can continue in business. We can help guide the business through a restructuring. A corporate proposal is filed with the intent of restructuring the debt of a company and allowing the…

Read MoreWhat Does It Mean to File For Personal Bankruptcy in Canada?

Personal bankruptcy provides a financial fresh start when other options are not practical. Even if you don’t want to use bankruptcy to resolve your situation, you should still understand how it works and don’t ignore the option just because of the “B” word.

Read MoreThe New Debtor Prison

We have found that a new form of debtor prison exists and this is due to excessive phone calls, emails, text messages and mail from creditors and collection agencies. These tactics can leave a person feeling afraid to answer their own phone and for some, it can cause undue stress and anxiety which can negatively affect their everyday life and ability to function at work.

Read MoreWhy People Delay Getting Help With Their Debt

The longer an individual waits to get help with their finances, the harder it is to help as the number of options is greatly reduced. By the time most consumers come to us the only choices left are to file personal bankruptcy or consumer proposal. If you are starting to struggle financially reach out for professional assistance before things get beyond your control.

Read MoreWhat is a Deemed Trust?

In a bankruptcy, amounts owing for GST/HST and the employer portion of CPP and EI, and penalties and interest on these amounts are unsecured claims, ranking the same as all other general creditors of a debtor. However, before bankruptcy occurs, CRA may obtain a lien or charge (be filing a memorial judgment) against the real or personal property of a debtor, CRA will be a secured creditor.

Read MoreBankruptcy: My Name is Still On My Ex-Spouse’s Home

To get your name off of the mortgage, your ex-spouse will have to qualify for the mortgage, on his or her own name, when the mortgage comes up for renewal. Whether or not they qualify is up to their financial institution.

Read More