Posts Tagged ‘Credit Score’

Credit Rebuilding Basics, Part 5 — Fine-tuning and Monitoring

If you have already taken the appropriate action steps to rebuild your credit, you should be well on your way to a higher credit score. Now it’s time to fine-tune and build on what you have already accomplished.

Read MoreCredit Rebuilding Basics, Part 3 — Reviewing and Repairing Your Credit Report

To repair your credit, you must first find out what your credit report is saying—that’s the starting point.

Read MoreCredit Rebuilding Basics, Part 2 — How Is Your Credit Score Calculated?

Once you know how the Credit Score system works, the steps required to repair and rebuild your credit will make more sense.

Read MoreCredit Rebuilding Basics, Part 1 — What is Your Credit Score and Why is it so Important?

Your credit score—only three digits long, but those three digits have a significant impact on how the rest of the world looks at you. They can dictate your eligibility for loans and other credit, the accommodations you can rent, and it can even affect your employment opportunities.

Read MoreA Gentler Method: Why a Negotiated Consumer Proposal Can Be A More Fair and Reasonable Debt Solution

If you have debt problems you also have options. A Consumer Proposal can be a much better and more manageable solution than bankruptcy to resolve your debts.

Read MoreWhat Is a Consumer Proposal?

Most consumer proposals are structured as monthly payments overtime at less than the full payout.

Read MoreBudgeting 101 – Part 4 of 5

Lumpy expenses, as I call them, are expenses that we know (or should know) are coming down the track and will have to be incurred but only happen once in a lifetime or only once every couple, few, 5, 10 or 15 years (or so). Lumpy expenses can cause significant stress if you have not prepared for them.

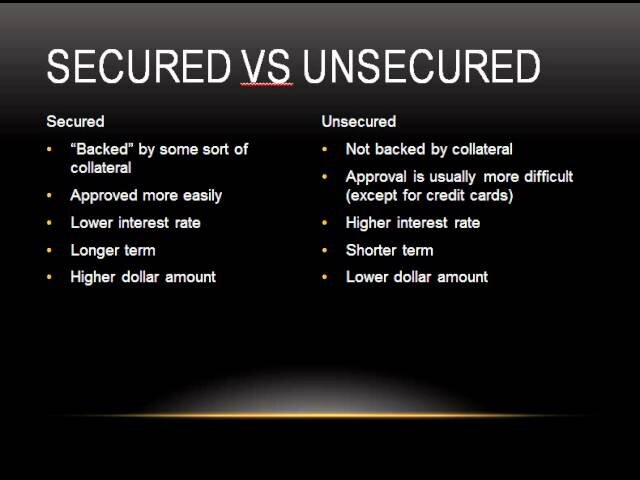

Read MoreSecured vs Unsecured Loan, Debt, Credit Cards & Line of Credit

Secured debts include mortgages, vehicle or investment loans. The borrower gives the lender a lien or mortgage against assets such as property, vehicles or investments in exchange for the loan. Unsecured debts typically include personal loans, lines of credit, credit cards, overdraft on bank accounts, and personal income taxes.

Read MoreDealing With Debts in Collection

Besides all of the harassing phone calls and intimidating letters, these collection accounts have a negative impact on your credit score and your ability to access credit or to own a home.

Read MoreHow to Correct Errors on Your Credit Report

Maintaining a good credit score is vital, as it directly impacts your ability to borrow money or finance purchases. It also affects things such as the cost of insurance and specific employment opportunities. For these and many other reasons, it is essential to identify and correct any errors on your credit report as soon as possible.

Read More