Posts Tagged ‘credit’

Guaranteed, Co-Signed and Joint Loans

Generally, a co-signor is usually jointly and severally liable for 100% of the debt. This means that, if there is a default, the lender will pursue the primary debtor and the co-signer at the same time and will be happy to collect their entire debt out of whomever they can recover from first.

Read MoreWhy Would My Trustee Oppose My Bankruptcy Discharge

Your Trustee is required to oppose your discharge if you do not complete specific duties or tasks: complete both mandatory counselling sessions, report you monthly income to the Trustee, sessions, make all agreed upon payments, including voluntary, surplus income, and equity payments. These are only some of the duties that you must complete.

Read MoreHow to Avoid Bankruptcy

You can’t go bankrupt if you have no debt! Bankruptcy is a relief valve for people and companies who find themselves unable to cope with overwhelming debts. Bankruptcy is not necessarily the only option for resolving debts, but the availability of other options depends on individual circumstances. The sooner you identify and get assistance with your debts, the more options you have.

Read MoreAdvantages of Filing a Consumer Proposal vs. a Bankruptcy

A consumer proposal can be creative and involve the sale, over time, of assets and payment of all or a portion of the equity in those assets to your creditors. This would allow you to settle your debts through a lump-sum payment instead of having to make monthly payments.

Read MoreHow Will A Consumer Proposal or Bankruptcy Affect My Credit Rating?

The proposal stays on your credit file for 3 years from the date of completion. A first bankruptcy will stay on your credit report for a period of 6-7 years (depending on which Province you live in) from the date of discharge. A second bankruptcy will be reflected on the debtor’s credit report for a period of 14 years from the date of discharge.

Read MoreWhat Happens if I Default on My Consumer Proposal

If a debtor is 3 months in arrears of monthly consumer proposal payments the consumer proposal is deemed annulled, which means that creditors can resume collection actions. There is no automatic bankruptcy if a debtor defaults on a consumer proposal.

that fails to make more than 2 payments cumulative during the Proposal will have their Proposal annulled and creditors can resume collecting their balances plus interest less any payments made. While a default on a Consumer Proposal will not automatically result in a Bankruptcy, however, the debtor cannot file another Proposal.

Read MorePersonal Bankruptcy in 12 Steps

Recognize the Problem, often the most challenging step as it requires that you admit that you are having financial troubles beyond your control and need help. Contact a Licensed Insolvency Trustee, the Trustee will provide a free confidential consultation and review your financial situation and discuss your options.

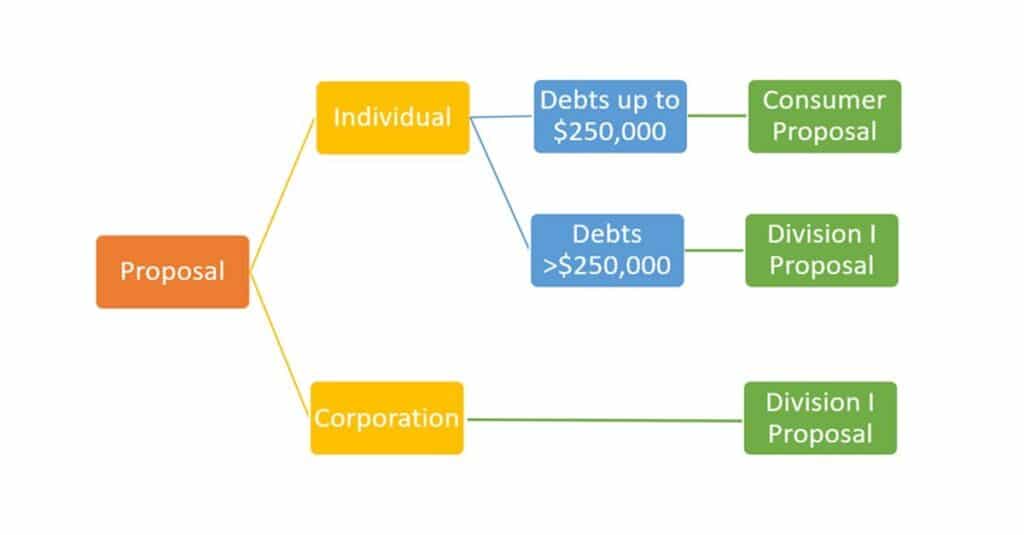

Read MoreDealing With Debt – Understanding the Two Types of Proposals

Division 1 Proposal Is when a consumer debtor owes more than $250,000 in debts, excluding the mortgage on their principal residence. If creditors don’t accept this proposal there is a deemed personal bankruptcy.

A consumer proposal is when a consumer debtor owes less than $250,000 in debts, excluding the mortgage on their principal residence. There is no deemed personal bankruptcy if the creditors reject the consumer proposal.

Read MoreFiling Your Income Tax Return After Bankruptcy

As part of the bankruptcy process, your Licensed Insolvency Trustee is required to file your income tax return for the year of bankruptcy and any returns that came due during the calendar year prior to bankruptcy. Any tax refunds for either of these periods will come directly to your bankruptcy estate for the benefit of the unsecured creditors.

Read MoreDealing With Increasing Insolvency Rates

There are lots of factors but, I think the greatest single contributor is the proliferation of easy credit combined with low levels of financial literacy. High debt levels limit financial flexibility and the ability to weather and recover from financial setbacks resulting from job loss, reduced income, illness, separation/divorce, and other life events.

Read More