Posts Tagged ‘income tax’

Debts Owing to the Canada Revenue Agency

Many people believe that debts owing to CRA will never go away. That is not necessarily the case, particularly when an individual goes bankrupt or files a proposal under the provisions of the Bankruptcy and Insolvency Act (“BIA”). However, prior to file personal bankruptcy or a consumer proposal, CRA has some significant legislated powers to collect debts.; including garnishing paycheques, seizing bank accounts.

Read MoreWhy Would My Trustee Oppose My Bankruptcy Discharge

Your Trustee is required to oppose your discharge if you do not complete specific duties or tasks: complete both mandatory counselling sessions, report you monthly income to the Trustee, sessions, make all agreed upon payments, including voluntary, surplus income, and equity payments. These are only some of the duties that you must complete.

Read MoreAdvantages of Filing a Consumer Proposal vs. a Bankruptcy

A consumer proposal can be creative and involve the sale, over time, of assets and payment of all or a portion of the equity in those assets to your creditors. This would allow you to settle your debts through a lump-sum payment instead of having to make monthly payments.

Read MoreFiling Your Income Tax Return After Bankruptcy

As part of the bankruptcy process, your Licensed Insolvency Trustee is required to file your income tax return for the year of bankruptcy and any returns that came due during the calendar year prior to bankruptcy. Any tax refunds for either of these periods will come directly to your bankruptcy estate for the benefit of the unsecured creditors.

Read MoreCan A Person Have Savings During Bankruptcy?

Yes, you can accumulate savings during a personal bankruptcy or consumer proposal. During a personal bankruptcy provided you are paying your required surplus income payment, if applicable. You can save as much as your budget allows.

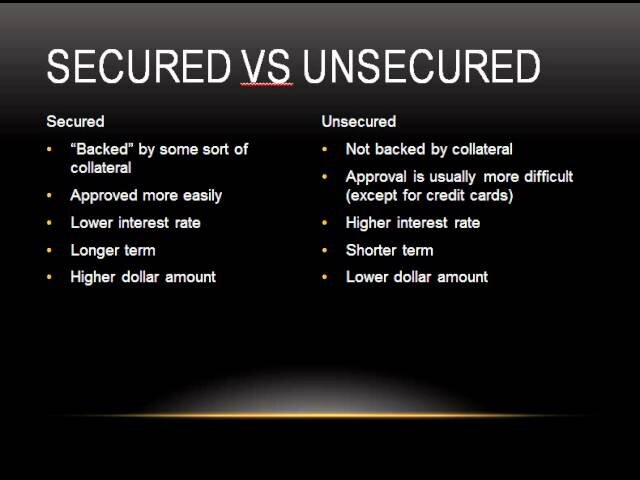

Read MoreSecured vs Unsecured Loan, Debt, Credit Cards & Line of Credit

Secured debts include mortgages, vehicle or investment loans. The borrower gives the lender a lien or mortgage against assets such as property, vehicles or investments in exchange for the loan. Unsecured debts typically include personal loans, lines of credit, credit cards, overdraft on bank accounts, and personal income taxes.

Read More2016 New Brunswick Home Energy Assistance Program (HEAP)

The New Brunswick government is offering a one-time benefit of $100 to help low-income families with their home energy bills. The government has had similar programs in the past to help families offset some of the cost of heating their residence.

Read MoreWill Bankruptcy Take Care of Judgments?

Yes, judgments from creditors do get released when you file a personal bankruptcy or complete a consumer proposal. However, judgments registered against your assets by Canada Revenue Agency do not get released when you file a personal bankruptcy or complete a consumer proposal.

Read MoreUsing RRSPs to Pay Down Debt

If you are unable to keep up with your debt payments you should consult a Licensed Insolvency Trustee to discuss your options before cashing-in any of your investments. Your investment savings may be exempt from seizure so you may be able to keep them if you file for personal bankruptcy or settle your debts through a consumer proposal.

Read MoreIs Bankruptcy My Only Option?

Bankruptcy is not the only debt solution option available to resolve overwhelming debt. Your Trustee (Licensed Insolvency Trustee) can also put together a consumer proposal to your creditors. Where you pay a portion of the debt, you owe your creditors, and the creditors write off the remaining balance of the debt.

Read More