Posts Tagged ‘mortgage’

Credit Rebuilding Basics, Part 2 — How Is Your Credit Score Calculated?

Once you know how the Credit Score system works, the steps required to repair and rebuild your credit will make more sense.

Read MoreCredit Rebuilding Basics, Part 1 — What is Your Credit Score and Why is it so Important?

Your credit score—only three digits long, but those three digits have a significant impact on how the rest of the world looks at you. They can dictate your eligibility for loans and other credit, the accommodations you can rent, and it can even affect your employment opportunities.

Read MoreFinancial Deep Cleaning Series – Part 3

It is important to stay on top of your finances and keep a finger on the pulse of your household budget.

Read MoreFinancial Deep Cleaning Series – Part 2

Deep cleaning your financial rooms can save you a lot of money, significantly reduce your monthly “burn rate” and significantly reduce your stress.

Read MoreWhen Small Business Owners Run Into Financial Trouble, What They Need is Help

We believe that entrepreneurs should be encouraged and supported, particularly when they run into financial difficulty.

Read MoreBudgeting 101 – Part 1 of 5

If you want to make a budget, you need to understand your expenses, short-term, medium-term and long-term. Monthly expenses can be fixed or variable. Annual expenses can be fixed and some variable.

Read MoreFinancial Math – The 5% House Down-Payment

The reality is that owning a home can be the root of a myriad of problems, one of which is tied to the 5% down-payment. With mortgage insurance, you can buy a house with only a 5% down-payment. Mortgage insurance is actually required whenever your down-payment is 20% or less of the purchase price.

Read MoreWhat Happens if I Default on My Consumer Proposal

If a debtor is 3 months in arrears of monthly consumer proposal payments the consumer proposal is deemed annulled, which means that creditors can resume collection actions. There is no automatic bankruptcy if a debtor defaults on a consumer proposal.

that fails to make more than 2 payments cumulative during the Proposal will have their Proposal annulled and creditors can resume collecting their balances plus interest less any payments made. While a default on a Consumer Proposal will not automatically result in a Bankruptcy, however, the debtor cannot file another Proposal.

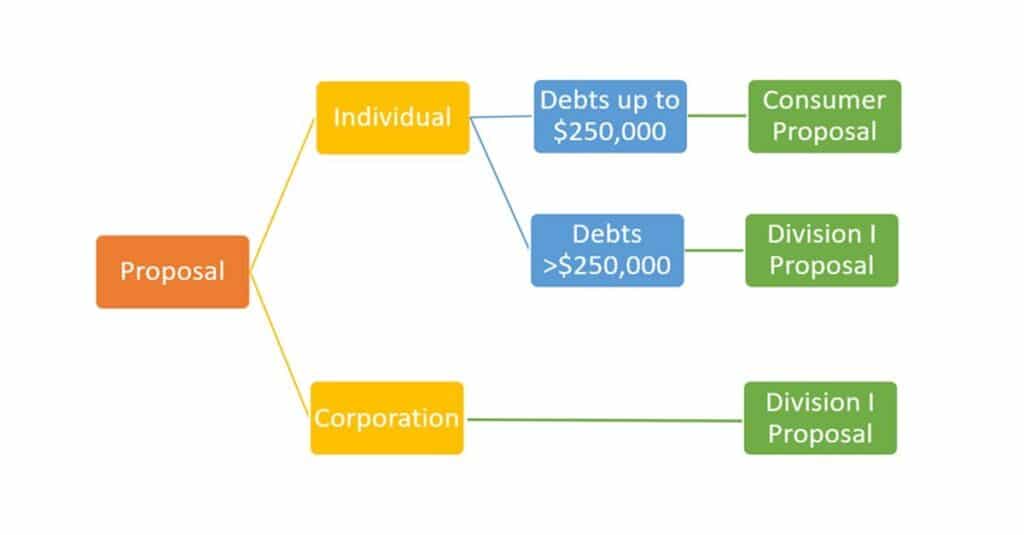

Read MoreDealing With Debt – Understanding the Two Types of Proposals

Division 1 Proposal Is when a consumer debtor owes more than $250,000 in debts, excluding the mortgage on their principal residence. If creditors don’t accept this proposal there is a deemed personal bankruptcy.

A consumer proposal is when a consumer debtor owes less than $250,000 in debts, excluding the mortgage on their principal residence. There is no deemed personal bankruptcy if the creditors reject the consumer proposal.

Read MoreCan I Apply For Credit While Bankrupt?

Filing for personal bankruptcy does not prevent you from applying for credit however as a bankrupt person you have a duty not to engage in any business transactions, or obtain credit of more than $1,000, without disclosing to the lender that you are an undischarged bankrupt.

Read More