Posts Tagged ‘PPR’

Credit Rebuilding Basics, Part 5 — Fine-tuning and Monitoring

If you have already taken the appropriate action steps to rebuild your credit, you should be well on your way to a higher credit score. Now it’s time to fine-tune and build on what you have already accomplished.

Read MoreCredit Rebuilding Basics, Part 2 — How Is Your Credit Score Calculated?

Once you know how the Credit Score system works, the steps required to repair and rebuild your credit will make more sense.

Read MoreCredit Rebuilding Basics, Part 1 — What is Your Credit Score and Why is it so Important?

Your credit score—only three digits long, but those three digits have a significant impact on how the rest of the world looks at you. They can dictate your eligibility for loans and other credit, the accommodations you can rent, and it can even affect your employment opportunities.

Read MoreFood Budget Too High? 13 Helpful Tips When Budgeting for Food

As the second or third largest expense in your budget, the money you spend on your groceries is something you have lots of control over. It’s almost always the easiest and most effective way to reduce your cost of living.

Read MoreNew Payday Loans Rules as of January 2018

If your finances are strained, a payday loan may solve an immediate need, but, their cost will take more money out of an already strained situation and, over time, make your situation worse.

Read MoreWeek 2: How To Live In Debt To No One

Calvin Coolidge once said, “There is no dignity quite so impressive, and no independence quite so important, as living within your means.” I like to think what he meant by this is that when you live within your means, you can hold your head high because you are beholden to no one.

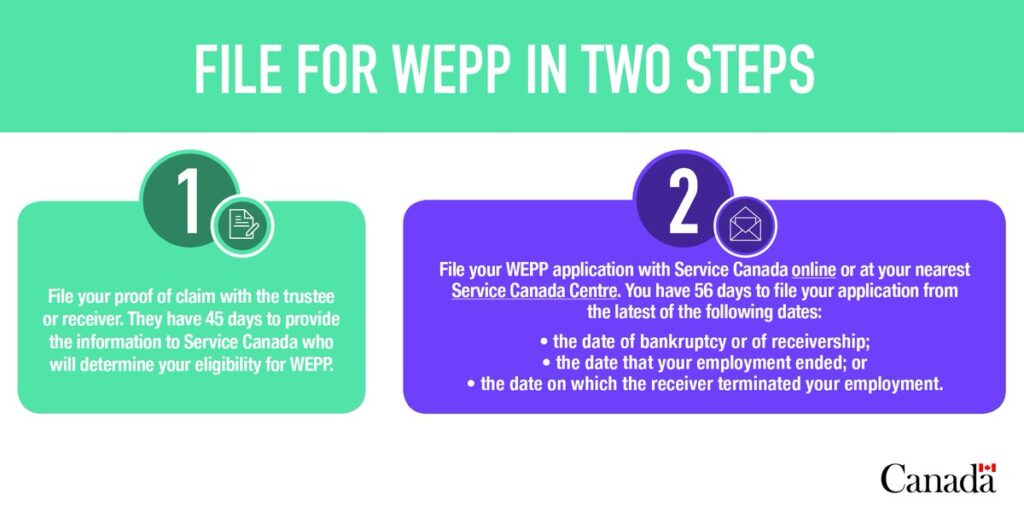

Read MoreWhat Is the Canadian Wage Earner Protection Program (WEPP)

Workers of companies that have gone bankrupt or under receivership may qualify to receive unpaid wages, vacation pay, and termination/severance pay. WEPP is a program that was established by the Federal Government in July 2008. WEPP provides employees of bankrupt employers, or employers subject to a receivership, with the ability to recover up to approximately…

Read MoreWhat Does It Mean to Voluntarily File for Corporate Bankruptcy?

If your debt problems seem insurmountable – we can help. We service the Maritime Provinces. A company can face Corporate Bankruptcy either voluntarily or involuntarily. In order to become bankrupt voluntarily, the board of directors passes a resolution authorizing the company to file for Bankruptcy. Any company that owes at least $1,000 and is unable…

Read MoreThe Up-Sell

You can’t make it through a drive-through without “do you want to upsize that?”, “can we add a muffin?”, “do you want to make a donation to….”; no, thank you, I just want the coffee I ordered!

Read MoreWhat Happens if I Default on My Consumer Proposal

If a debtor is 3 months in arrears of monthly consumer proposal payments the consumer proposal is deemed annulled, which means that creditors can resume collection actions. There is no automatic bankruptcy if a debtor defaults on a consumer proposal.

that fails to make more than 2 payments cumulative during the Proposal will have their Proposal annulled and creditors can resume collecting their balances plus interest less any payments made. While a default on a Consumer Proposal will not automatically result in a Bankruptcy, however, the debtor cannot file another Proposal.

Read More