What is a Good Debt to Asset Ratio for a Family

Families across Canada face a common challenge on the path to financial prosperity – balancing their economic equation. Prudently managing assets and debts forms the cornerstone of stable finances. The debt to asset ratio is a crucial metric that can be invaluable for families to gauge their financial health.

The concept of financial health isn’t limited to businesses or individuals; it also significantly affects families. Understanding your debt to asset ratio is pivotal, whether you’re contemplating a major purchase or aiming to secure your family’s future.

This comprehensive guide delves into the intricacies of the family debt to asset ratio, demystifying its significance and offering insights into how this ratio can influence your financial standing. From understanding the ratio to improving it, we’ll help you as you strive to attain your family’s monetary objectives.

Join us as we unravel the implications and unveil strategies to optimize your financial health.

What is a Debt to Asset Ratio?

The debt to asset ratio is a compass for families, guiding them toward a stable and secure economic future. At its core, this ratio is a financial indicator that quantifies the proportion of debt relative to assets held by an individual or family. The debt to asset ratio vividly depicts a family’s financial health.

A lower ratio indicates a healthier financial position, with more assets than liabilities. Conversely, a higher ratio suggests a potential imbalance, with debts outweighing assets. As a litmus test for fiscal stability, the debt to asset ratio is pivotal in assessing the ability to weather financial storms and achieve long-term financial goals.

Personal assets, such as investments, savings, real estate, and valuable possessions, significantly shape the debt to asset ratio. Economic or external factors, such as inflation, interest rates, and market volatility, can also influence this ratio. Changes in debt levels or fluctuations in asset values make it a dynamic indicator that requires attention.

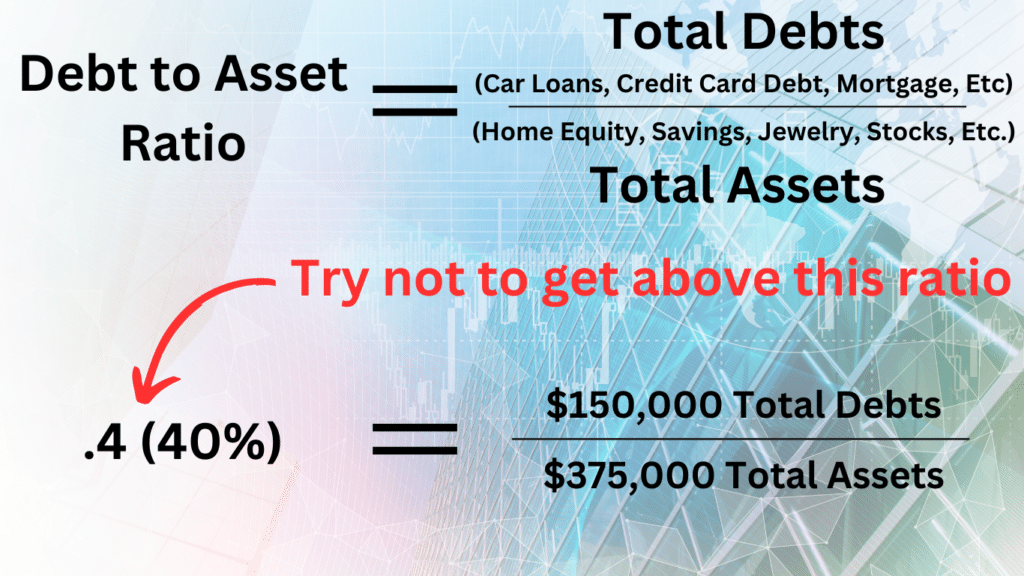

How to Calculate a Debt to Asset Ratio

Calculating your debt to asset ratio is a straightforward process.

Start by tallying your total debts, including outstanding loans, credit card balances, and other financial obligations.

Next, sum up the value of your assets. These should encompass savings, real estate, investments, and valuable possessions.

Finally, divide your total debts by your total assets. The resulting figure is your debt to asset ratio.

Regularly recalculating this ratio empowers you to monitor your family’s financial position and make informed decisions about your fiscal future.

What’s the Difference Between Debt to Asset Ratio and Debt to Income Ratio?

Debt to asset and debt to income ratios are essential tools for families interested in maintaining or achieving financial stability. Let’s break down the similarities, differences, and primary uses.

As discussed earlier, the debt to asset ratio provides insight into a family’s total debt relative to their total assets. The primary focus of this ratio is to assess overall financial health and determine if there’s a potential imbalance.

In contrast, the debt to income ratio gauges a family’s ability to manage their debt payments relative to the household income. The key focus is evaluating a family’s debt burden and capacity to meet current financial obligations.

To put it plainly, debt to asset ratio evaluates the balance between assets and debts, aiding in long-term planning and asset management. Conversely, debt to income ratio assesses the affordability of debt payments relative to income, helping families avoid overextension and maintain short-term stability.

Why Knowing Your Debt to Asset Ratio is Important for Financial Health

Few things are as vital to personal finance as the debt to asset ratio. Understanding and managing this ratio empowers families to make informed decisions about their financial future.

Maintaining a healthy debt to asset ratio is comparable to building a sturdy financial foundation. Here are a few reasons why this ratio is central to managing the financial health of a family:

- Setting financial goals

- Balancing financial ledger

- Debt management

- Long-term financial planning

- Risk evaluation and mitigation

- Emergency fund evaluation

- Making investment and financial decisions

The following are some benefits of maintaining a healthy debt to asset ratio:

- Lower financial risk

- Increased financial stability and flexibility

- Improved ability to weather economic downturns

- Higher borrowing capacity and access to credit

- Reduced financial stress

- The ability to borrow at a lower interest rate

The debt to asset ratio offers a comprehensive view of your financial position, ensuring that your assets work for you and that obligations don’t negatively impact your economic well-being.

Stay with us as we navigate the nuances of this vital metric and discuss the ideal debt to asset ratio for your family.

What is a Good Debt to Asset Ratio?

The debt to asset ratio for families is dynamic and nuanced. There is no one-size-fits-all, as many factors influence the ratio. Individual circumstances such as age, life stage, financial goals, and family risk tolerance can all affect the ideal ratio. Additionally, regional and economic variations like cost of living and employment prospects can alter the perception of an ideal ratio.

While there isn’t a universal ideal ratio to strive for, a standard benchmark suggests that a debt to asset ratio below 0.4 (40%) indicates financial health. Remember, families in their early stages may have a higher ratio as they invest in housing, assets, and education, while later in life, a lower ratio may become more likely.

All factors aside, a lower debt to asset ratio is generally considered more favorable because it signifies that a family’s assets are robust enough to cover their debts. This lower ratio reduces the vulnerability to unforeseen financial challenges, promoting peace of mind.

A lower ratio further indicates a family doesn’t rely on debt financing as much as equity, improving their ability to navigate life’s uncertainties confidently. Next, we’ll show you how having a high debt to asset ratio can hurt your family’s financial health.

What Are Some Risks of a High Debt to Asset Ratio?

Striving for financial growth as a family is commendable, but many perils are associated with a high debt to asset ratio.

Here are the potential pitfalls of a high debt to asset ratio that can expose a family to a range of risks:

- Potential impact on borrowing costs, favorable interest rates, and loan qualification

- Limiting investment opportunities

- Delaying or jeopardizing retirement

- Reducing financial flexibility to cover unforeseen emergencies

- Increasing financial stress

- Hindering progress toward financial goals (homeownership, education, etc.)

- Larger interest payments

- Asset vulnerability to financial creditors during economic downturn

- Potential increased strain on relationships

- Increased potential for bankruptcy

Understanding these challenges empowers you to avoid the potential risks of a high debt to asset ratio. Next, let’s explore actionable steps to improve and maintain a healthier financial position for your family.

How to Improve Your Debt to Asset Ratio

A healthy debt to asset ratio is essential for ensuring your family’s financial stability and peace of mind as you work towards achieving a more beneficial economic equilibrium. Here are some practical strategies to help you bolster this critical metric by reducing your family’s debt and growing your assets.

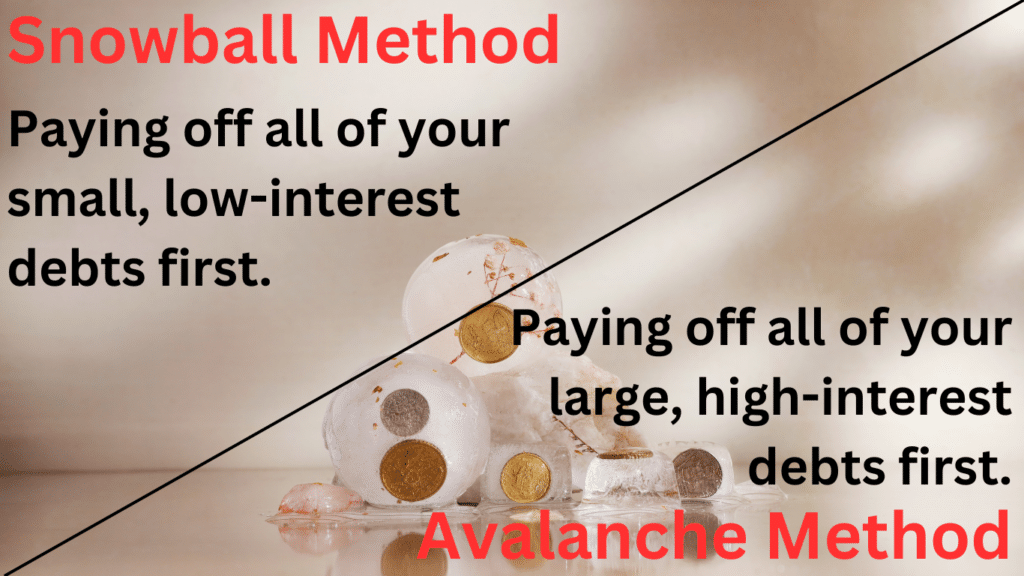

Strategies to Reduce Debt

- Debt Reduction: Prioritize paying down your high-interest debts, beginning with loans and credit cards. Implement a debt paydown strategy such as the snowball or avalanche method1.

- Debt Consolidation: Explore options to consolidate your high-interest debts into lower-rate liabilities.

- Avoid Taking on New Debt: Make informed purchasing decisions and avoid unnecessary credit.

- Review Contracts: Ensure you’re getting the best terms by reviewing existing loan and insurance policy contracts.

Strategies to Grow Assets

- Boost Household Income: Explore opportunities to increase household income through freelancing, gig work, passive income, or part-time work.

- Establish a Budget: Create a detailed budget that tracks income and expenses, allowing for strategic debt reduction.

- Emphasize Savings: To increase your asset base, begin allocating a portion of your income to savings and investments.

- Emergency Fund: Establish an emergency fund to handle unexpected expenses rather than resorting to additional debt.

- Asset Appreciation and Diversification: Pursue opportunities to grow your assets through investments or acquiring real estate or valuable possessions. Diversify existing and new assets across different investment vehicles to spread risk.

Periodically review your financial position by recalculating your debt to asset ratio to track your progress and make necessary adjustments. You can gradually improve your ratio by implementing these strategies and enhance your family’s financial health.

Invest in your financial future and seek advice from a financial professional to create a debt management plan and optimize your financial strategy.

Build a Foundation for Financial Prosperity with a Healthy Debt to Asset Ratio

Your family’s financial stability and prosperity are paramount. More than just a financial strategy, a healthy debt to asset ratio is a guiding light to long-term financial health and success. It’s a commitment to securing your family’s economic well-being, empowering you to seize opportunities that come your way, and shielding you from life’s unexpected setbacks.

Assessing your financial situation is the first step toward economic prosperity. Whether you’re on the road to a balanced ratio or seeking strategies to improve it, don’t hesitate to contact us at Powell Associates Ltd for tailored solutions and expert insights.

We offer a free financial assessment and our Licensed Insolvency Trustee services in Saint John, NB; Fredericton, NB; Moncton, NB; Miramichi, NB; Dartmouth, NS; and Charlottetown, PE.