Uncategorized

Personal Bankruptcy in Canada – Top 20 FAQs to Consider

If you’re struggling to pay your bills every month, you may be thinking about bankruptcy to help you relieve these financial pressures. Filing for personal bankruptcy can be a viable option if you have unsecured debt you can’t pay and you’re worried about legal actions your creditors may initiate. As with any life decision this…

Read MoreIs CRA Debt Forgiveness Possible?

Regarding personal finances, few things can be as stressful as accumulating debt, especially when that debt involves an overwhelming entity like the Canada Revenue Agency (CRA). The prospect of owing money to the CRA can lead to mounting anxiety and sleepless nights for many Canadians. When faced with CRA debt, it’s crucial to understand the…

Read MorePowell Associates Welcomes Angela Rodgers & David Moffatt As Partners

Robert Powell is pleased to announce that Angela Rodgers and David Moffatt have become part owners of Powell Associates Ltd. Together, Angela, David and Robert now own the firm and will manage it together. Angela is now the President of the firm and David and Robert are Vice Presidents. Robert founded Powell Associates in 2010…

Read MoreCanada Student Loans Forgiveness: What You Need to Know

If you are a Canadian with outstanding student loan debt, you may be eligible for student loan forgiveness. There are many repayment assistance programs that exist both federally and provincially, but most of these programs focus on reducing your student loan debt payments which still leaves you with an outstanding balance on your student debt.…

Read MoreWhat Is a Consumer Proposal?

Most consumer proposals are structured as monthly payments overtime at less than the full payout.

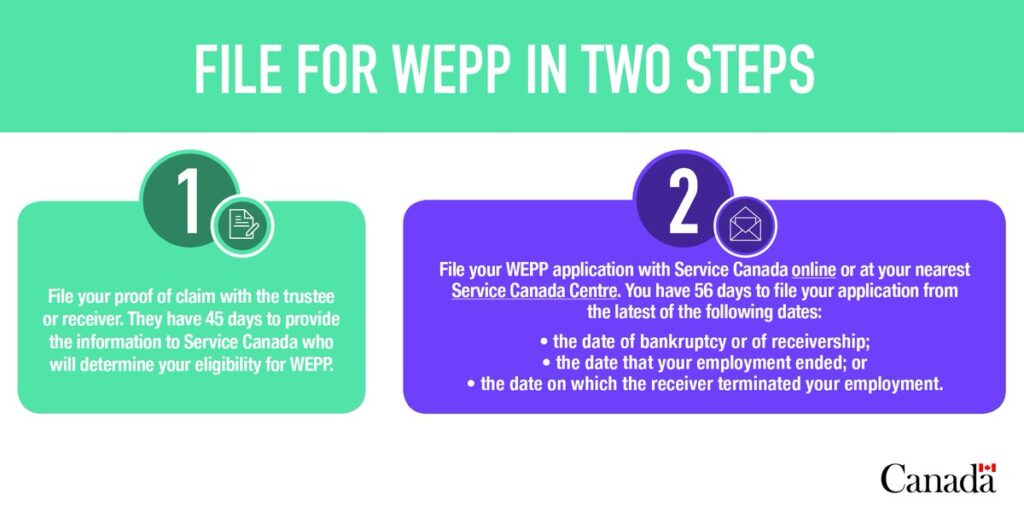

Read MoreWhat Is the Canadian Wage Earner Protection Program (WEPP)

Workers of companies that have gone bankrupt or under receivership may qualify to receive unpaid wages, vacation pay, and termination/severance pay. WEPP is a program that was established by the Federal Government in July 2008. WEPP provides employees of bankrupt employers, or employers subject to a receivership, with the ability to recover up to approximately…

Read MoreWhat is Receivership and How Can It Be Delayed?

Receivership is usually focused on creditors enforcing their rights through the appointment of a receiver to seize and sell assets. A business can seek protection to delay receivership while trying to negotiate a restructuring. These matters are very time sensitive. Don’t wait…we can help! Receivership happens when a Receiver is appointed by creditors or the…

Read MoreWhat Does It Mean to Voluntarily File for Corporate Bankruptcy?

If your debt problems seem insurmountable – we can help. We service the Maritime Provinces. A company can face Corporate Bankruptcy either voluntarily or involuntarily. In order to become bankrupt voluntarily, the board of directors passes a resolution authorizing the company to file for Bankruptcy. Any company that owes at least $1,000 and is unable…

Read MoreWhat Does It Mean to ‘Restructure’ or File a Corporate Proposal?

When their is a viable business with too much debt to handle, a Corporate Proposal can be used to restructure the Company so it can continue in business. We can help guide the business through a restructuring. A corporate proposal is filed with the intent of restructuring the debt of a company and allowing the…

Read MoreWhat Does It Mean to File For Personal Bankruptcy in Canada?

Personal bankruptcy provides a financial fresh start when other options are not practical. Even if you don’t want to use bankruptcy to resolve your situation, you should still understand how it works and don’t ignore the option just because of the “B” word.

Read More