Caught in the Pay Day Loan Cycle?

In an emergency, people who don’t have savings or access to credit may turn to a payday loan company for short-term emergency cash needs.

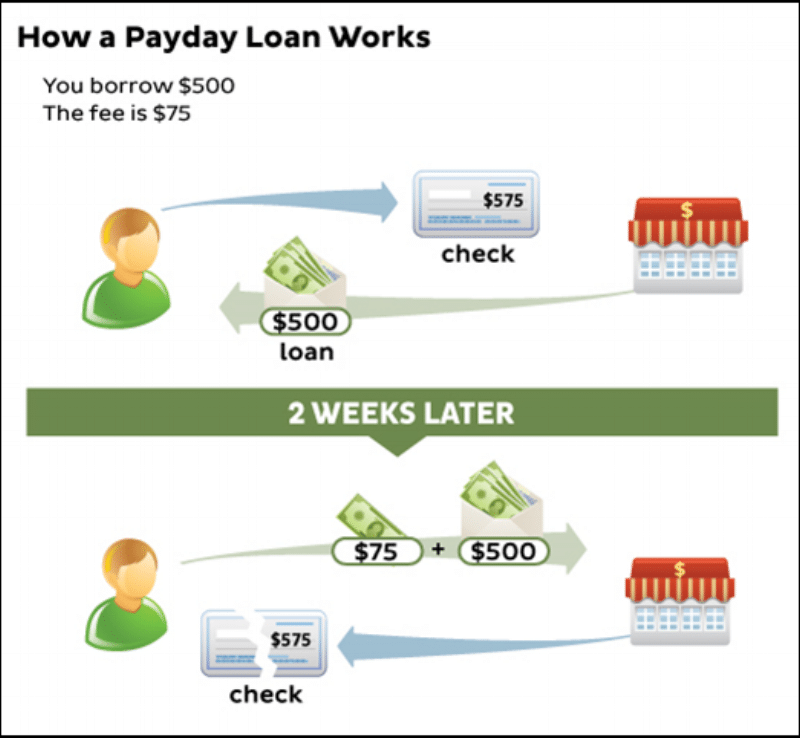

How do payday loans work? The payday lender agrees to lend you money equal to a percentage of your paycheck, which must be paid in full plus interest and fees on your next payday.

There are no credit checks, and all you need to qualify is a dependable source of income (yes, some lenders count pension and social assistance benefits). The payday lender typically requires confirmation of your income and a post-dated or void cheque so they can debit your bank account when the loan is due.

The loan plus interest and fees will be due in full on your next pay period. If you cannot repay the loan in full, you will be charged more penalties and interest.

The problem with this type of borrowing is that it is very expensive and can often leave the borrower, who is already in a tight financial position, unable to repay the loan. So they end up re-borrowing or getting a “roll-over” loan by paying off the current loan and immediately getting another one from the payday lender.

Some will even get several payday loans from several providers – using one loan to pay off another. When this happens, interest and late fees accumulate quickly until the debts spiral out of control. This cycle is known as the “payday loan cycle” and it is nearly impossible to get out without some intervention.

Using payday loans is one of the most common warning signs of financial trouble. The only way to get out of this cycle is to pay what you owe in full and stop re-borrowing. The payday loan cycle is often impossible, so you will likely need a Licensed Insolvency Trustee to help you break the payday loan cycle and find solutions to address your financial concerns. Thankfully both a consumer proposal and bankruptcy can be used to discharge a payday loan debt.

A Licensed Insolvency Trustee can provide you with a free consultation and explain how personal bankruptcy or a consumer proposal can help you break the payday loan cycle and regain control of your finances.

Powell Associates Ltd. is a Licensed Insolvency Trustee. We are experienced, hands-on insolvency practitioners who understand the personal impacts of major financial stress;

-

You won’t be stuck in an assembly line process.

-

You will expect and receive prompt responses and resolution of issues from our supportive and experienced team.

-

We will review your debt solution options, including filing a consumer proposal or personal bankruptcy.

-

We help Canadians with overwhelming debt get fresh financial starts.

Once you file a consumer proposal or personal bankruptcy, we deal directly with your creditors on your behalf. Your unsecured creditors are required to stop contacting you or continuing legal proceedings against you. Contact us for a free consultation.

We offer free consultations to review your financial situation and practical debt resolution options. Contact us to discuss your situation over the phone, a video chat, or in-person in Saint John, Moncton, Fredericton, Charlottetown, Dartmouth, or Miramichi.