COVID- 19 Canadian Emergency Wage Subsidy (CEWS)

Canadian Emergency Wage Subsidy (CEWS)

Canada Revenue Agency has rolled out the anticipated Canadian Emergency Wage Subsidy (CEWS) and eligible businesses can now begin making their applications online through their ‘My Business Account’ or ‘Represent a Client’, or with a Web Forms application using a web access code.

The CEWS will pay an eligible employer a wage subsidy of up to 75% of eligible remuneration (to a maximum of $847 per employee per week) and paid to eligible employees, for up to 12 weeks, retroactive to March 15, 2020. CEWS will enable employers to re-hire workers previously laid off, to help prevent further job losses, and to better position businesses to resume normal operations following the COVID-19 crisis.

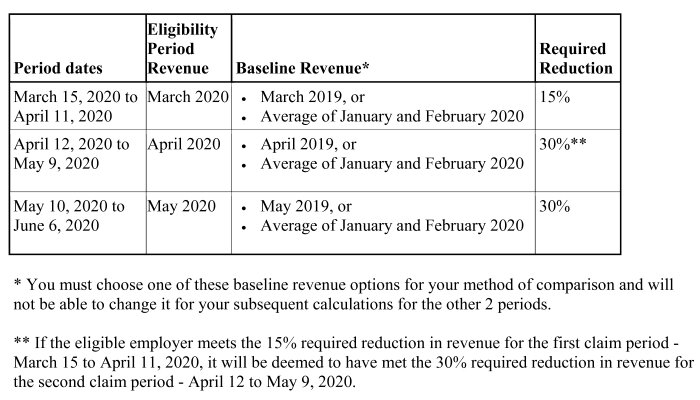

Eligible employers include sole proprietorships, taxable corporations, and registered charities to name a few. In order to qualify for the CEWS, your business must have experienced an Eligible Revenue Reduction. We have reproduced the Federal Government’s table below which shows the remuneration claiming periods, the required reduction in revenue for that period, and the reference period for determining whether the revenue test is met:

Canadian Emergency Wage Subsidy (CEWS)

CRA has an online calculator that will help with an employer’s application.

Eligible employees are individuals employed in Canada by an eligible employer during the claim period, except if there was a period of 14 or more consecutive days in that period in respect of which they were not paid eligible remuneration.

Employees who had been previously laid off or furloughed can become eligible retroactively, as long as they are rehired and their retroactive pay and status meet the eligibility criteria for the claim period.

Eligible remuneration includes salary, wages, and other taxable benefits, fees, and commissions. Severance pay, stock options benefits, or the personal use of a corporate vehicle are not part of eligible remuneration. Baseline remuneration is the average weekly remuneration paid to an employee from January 1, 2020, to March 15, 2020.

Eligible applicants should expect payment within 10 business days if they are registered for direct deposit on their payroll account. In some cases, if additional review is required it may delay payment.

The CEWS is taxable and must include the amount received on annual Income Tax returns when calculating taxable income.

This has been a brief overview of the CEWS program. For more in-depth information, visit CRA’s website.

Powell Associates Ltd. is a Licensed Insolvency Trustee. We are experienced, hands-on insolvency practitioners who understand the personal impacts of major financial stress;

-

You won’t be stuck in an assembly line process.

-

You will expect and receive prompt responses and resolution of issues from our supportive and experienced team.

-

We will review your debt solution options, including filing a consumer proposal or personal bankruptcy.

-

We help Canadians with overwhelming debt get fresh financial starts.

Once you file a consumer proposal or personal bankruptcy, we deal directly with your creditors on your behalf. Your unsecured creditors are required to stop contacting you or continuing legal proceedings against you. Contact us for a free consultation.

We offer free consultations to review your financial situation and practical debt resolution options. Contact us to discuss your situation over the phone, a video chat, or in-person in Saint John, Moncton, Fredericton, Charlottetown, Dartmouth, or Miramichi.