Navigating the Landscape of Credit Card Debt in Canada

Credit card debt is a prevalent financial concern for countless individuals and families. More Canadians than ever are relying on credit cards as the allure of making purchases with borrowed money is compelling. Understanding the gravity of credit card debt in Canada is crucial in today’s economic landscape.

This article explores the implications of this debt crisis, examining its current state and its impact on Canadians’ financial well-being. We’ll provide practical strategies to tackle the growing issue of credit card debt in Canada and discuss the potential for debt forgiveness through consumer proposals and bankruptcy.

Join us as we navigate Canada’s credit card debt challenge and chart a path to financial freedom. By the end, you’ll have a comprehensive toolkit to begin your journey toward financial security.

The State of Credit Card Debt in Canada

Economic uncertainties, unexpected expenses, and the high cost of living in certain regions contribute to rising credit card debt in Canada. These factors make it challenging for many individuals to manage their finances effectively.

According to the latest statistics, the average credit card debt in Canada continues to rise, reflecting a significant financial challenge for many households and individuals. As of the second quarter of 2023, the average credit card debt in Canada for a typical consumer increased 9 percent from the prior year to just over $4,000 in card balances1.

How Expensive is Credit Card Debt in Canada?

Credit card debt in Canada can be alarmingly costly due to high-interest rates. These rates typically range from 19 to 25 percent, with certain cards carrying even higher rates. Credit card interest compounds daily, leading to a snowball effect where debt grows exponentially as you pay interest on the principal and interest already accrued.

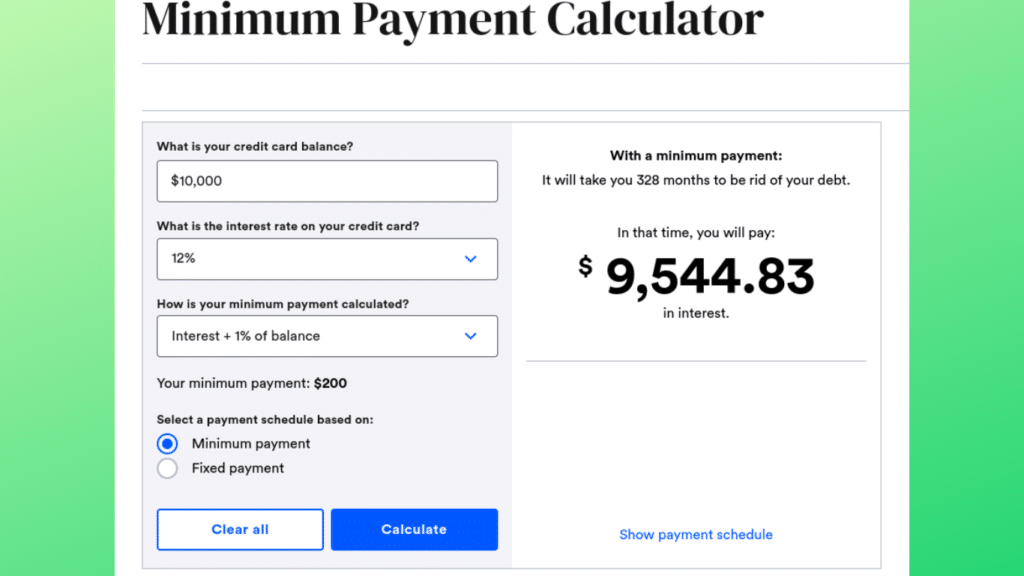

Consider the following example to understand the long-term cost of credit card debt in Canada:

Suppose you have a $10,000 credit card debt at a 12 percent annual interest rate. If you only make the minimum monthly payments, paying off the debt could take you nearly 30 years and cost you almost $10,000 in interest alone.

This example reveals how deceptively expensive credit card debt in Canada can be, highlighting the disparity between the initial debt and the total amount repaid. Understanding the severe impact of high interest rates is vital for Canadians who want to be proactive and reduce their credit card debt.

Credit Card Debt in Canada: The Impact on Credit Scores

Credit card debt can have a profound impact on your credit scores. Credit scores are a numerical representation of your creditworthiness. A lower score can limit credit access and increase interest rates.

The following factors can either boost or lower your credit score:

- Payment History

- Credit Utilization

- Credit History Length

- Credit Types

- Credit Inquiries

Credit card debt affects credit utilization since carrying high balances increases your credit utilization ratio. Aim to keep this ratio below 30 percent of your available credit. Late or missed payments also negatively impact your payment history.

Recognizing how credit card debt affects credit scores is essential for effective debt management. In the next section, we’ll explore actionable strategies for managing credit card debt in Canada and regaining control of your financial well-being.

8 Strategies for Tackling Credit Card Debt In Canada

When conquering credit card debt in Canada, having a well-thought-out plan is vital. Here, we’ll introduce eight effective strategies to help you start chipping away at that debt.

#1 Set a Budget

Creating and adhering to a budget is a pivotal step in effectively managing your credit card debt. Budgeting is essential for increasing awareness of where your money is going, prioritizing expenses, and planning for debt repayment and emergencies.

The following steps will help you create a budget:

- Calculate Income

- List Expenses

- Differentiate Needs and Wants

- Allocate Debt Repayment

- Track Spending

- Review and Make Adjustments

Budgeting is a flexible tool for managing credit card debt in Canada, allowing you to adapt to your evolving financial circumstances. It empowers you to gain insight into your income and spending patterns, ensuring your money goes towards essential needs and debt reduction.

#2 Limit New Credit Card Purchases

Credit card debt can be a slippery slope, and acknowledging the temptation of its convenience is essential for avoiding its potential consequences. Creating a budget is the first defence against excessive credit card purchases. Sticking to it helps you avoid impulse purchases.

One of the driving forces behind credit card spending on unplanned expenses is the lack of an emergency fund. Building an emergency fund that covers at least three to six months’ worth of living expenses can significantly reduce your reliance on credit cards.

While credit cards offer convenience and rewards, they also carry a risk. Setting clear spending boundaries and having a financial safety net can help you avoid accumulating debt.

#3 Pay More Than the Minimum

Paying more than the minimum is crucial, from faster debt repayment and saving on interest to improving your credit score.

Consider the following debt relief strategies:

- Debt Snowball and Debt Avalanche – Prioritize paying off smaller balances or higher interest rates first.

- Increase Monthly Payments – Gradually increase the amount paid each month, even if it’s just a little more than the minimum.

- Windfalls and Bonuses – Allocate some unexpected funds to credit card debt.

Paying only the minimum prolongs your debt and results in substantial interest payments. By committing to paying more than the minimum, you’ll be on the fast track to credit card debt relief in Canada.

#4 Transfer Balances from High Interest to Low/No Interest Cards

An effective strategy for managing credit card debt in Canada is utilizing balance transfers. This practical financial approach involves moving high-interest balances to a card with a low or no-interest introductory period.

Balance transfers offer a window of opportunity, usually six months to a year or more, where you can focus on paying the principal without accruing interest. Carefully evaluate the transfer fees, duration of the introductory period, and subsequent regular interest rate to find the right card.

Individuals juggling debts from multiple cards can consolidate credit card debt onto one card, simplifying repayment. Ensure the terms and conditions align with your circumstances and objectives to make the most of this strategy.

It goes without saying that balance transfers are a double-edged sword. While they can help reduce interest costs and monthly payments, if not carefully managed they can lead to increased debt loads.

#5 Debt Consolidation Loans

Debt consolidation loans offer a practical solution for Canadians struggling with multiple high-interest credit card debts, simplifying monthly payments and reducing interest charges. Credit card debt consolidation streamlines your financial obligations by combining various balances into a single, more manageable loan, often at a lower interest rate.

After you apply and get approved for a consolidation loan from a lender or financial institution, the loan amount pays off your balances, leaving you with a single monthly payment. Once you consolidate your credit card debt, your interest costs and the risk of missed payments decrease significantly.

#6 Seek Credit Counseling from an LIT

Turning to financial experts can be pivotal when attempting to conquer credit card debt in Canada. Among these professionals are Licensed Insolvency Trustees (LITs), skilled in navigating the complex terrain of debt management.

Although LITs typically don’t directly offer traditional debt management programs, their debt resolution expertise is invaluable. Licensed Insolvency Trustees are skilled in evaluating your financial situation, presenting effective debt relief options, guiding you through the process, and protecting you from creditors.

Their primary role as government-licensed experts is administering insolvency proceedings like consumer proposals and bankruptcies. In the subsequent sections, we’ll delve into consumer proposals and bankruptcy as two compelling approaches to credit card debt forgiveness in Canada.

#7 Consumer Proposal

A consumer proposal is an arrangement between you and your creditors, overseen by a Licensed Insolvency Trustee (LIT). This strategy offers a way to manage significant credit card debt without declaring personal bankruptcy.

Consumer proposals have several advantages:

- debt reduction,

- extended payment terms,

- legal protection from creditors,

- milder credit score impact than personal bankruptcy, and

- asset retention.

The steps of a consumer proposal process include consulting with a LIT, creating a formal proposal outlining debt repayment terms, and submitting it to creditors. While this information provides an overview, working closely with an LIT ensures your submission is realistic, sustainable, and based on your financial situation.

#8 Bankruptcy

Personal bankruptcy is a legal process that helps Canadians burdened by unmanageable credit card debt find a path to financial recovery. This strategy involves consulting a Licensed Insolvency Trustee to determine your eligibility and guide you through the process.

Bankruptcy offers debt relief but comes with consequences. On the positive side, bankruptcy provides immediate protection from creditors, halts wage garnishments, and stops legal actions.

On the other hand, a first-time bankruptcy significantly impacts your credit report, affecting future credit prospects for six to seven years. Additionally, subsequent bankruptcies can linger for up to 14 years, and certain assets, like registered savings plans, may be liquidated to repay creditors.

Careful consideration and consulting a LIT is essential before proceeding.

How Long Should It Take to Pay Off Credit Card Debt?

Paying off credit card debt requires time, patience, and commitment. Understanding the repayment timeline allows you to set realistic goals and stay motivated on your path to financial freedom.

Factors that influence the timeline are as follows:

- Amount owed

- Interest rates

- Payment size

Budgeting, setting clear goals, managing credit responsibly, and negotiating lower rates can speed up repayment and provide substantial savings in the long run. Consider all these factors to determine your unique timeline for paying off credit card debt.

Charting Your Path to Freedom from Credit Card Debt in Canada

If you’re facing seemingly insurmountable credit card debt, remember that financial security is within reach. It may take time, but with determination, discipline, and the right strategies, you can chart your path toward financial freedom from credit card debt in Canada.

While the strategies presented here are valuable, credit card debt situations can vary and require specialized solutions. Don’t hesitate to contact the experienced professionals at Powell Associates Ltd., especially if your debt situation is complex.

As Licensed Insolvency Trustees, we offer a free initial consultation to discuss your overwhelming credit card debt in all cities in the Maritimes, including Saint John, New Brunswick; Fredericton, New Brunswick; Dartmouth, Nova Scotia; Halifax, Nova Scotia; and Charlottetown, Prince Edward Island.