Credit Rebuilding Basics, Part 2 — How Is Your Credit Score Calculated?

In the first article in this series on credit rebuilding, we looked at why your credit score is important, who uses this information, and we started to look at how the scoring system works. This post will go a bit deeper into the calculations that lead to your credit score.

Once you know how the system works, the steps required to repair and rebuild your credit will make more sense.

Credit Rebuilding Series:

Part 1 – What is Your Credit Score and Why is it so Important?

Part 2 – How Is Your Credit Score Calculated?

Part 3 – Reviewing and Repairing Your Credit Report

Part 4 – Rebuilding Your Credit

Part 5 – Fine-tuning and Monitoring

How is Your Credit Score Calculated?

How is Your Credit Score Calculated

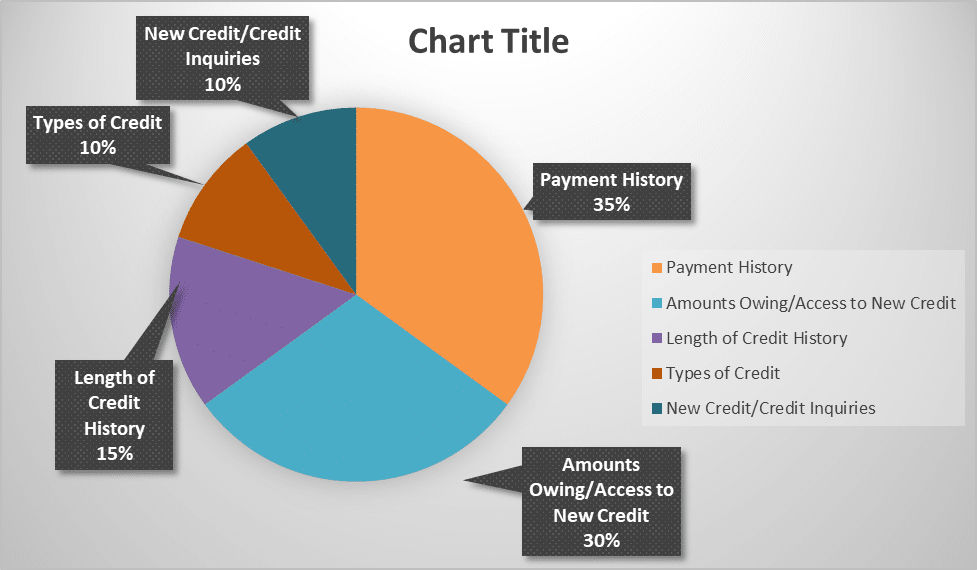

The basis for your credit score is a very complicated system of formulas. Let’s simplify these formulas and look at the most critical factors. From this, you can see what you need to do if your score has been damaged by filing a bankruptcy, a consumer proposal, missing payments, or other factors.

Payment History

Your payment history establishes 35% of your credit score. Missing payments will tank your credit score faster than anything else you do, apart from filing a bankruptcy or a proposal.

Inside this category, multiple items are being measured, including your payment history on many types of accounts, records of any missed payments or delinquencies, and any negative public records or collection items.

Amounts Owing/Access to Credit

“Keep your credit utilization ratio below 30%, ideally between 10 and 20%.”

This category is the second largest factor influencing your credit score, accounting for 30% of it. It can also be a bit confusing. The bureaus and the lenders are assessing, in another way, how good a job you are doing in managing the debt you already have. They want to know how much credit you already have access to and how many lenders have extended credit to you.

A critical sub-category is your credit utilization ratio. This ratio measures how much credit you are using compared to what you have as available credit. Let’s say you have a line of credit and a couple of credit cards, and the limits on all 3 of these total $20,000. If your balances owing on all 3 of these pieces of credit are $10,000, then your credit utilization ratio is 50%. The general guideline is to keep your credit utilization ratio below 30%, ideally between 10 and 20%.

Length of Credit History

While this category is only worth 15% in the credit scoring formula, it is still essential. Lenders like to see a long history of making payments—this tells them you are an acceptable risk for new credit. The bureaus look at all of your credit accounts in total and calculate an ‘average age of credit’. The longer this age is the better as far as they and the lenders are concerned.

Types of Credit

“Remember that when you are actively rebuilding your credit, it’s crucial to take advantage of every avenue open to you.”

Although this category is only worth 10% of your credit score, it’s crucial to take advantage of every avenue open to you when you are beginning to rebuild. Lenders and the credit bureaus like to see you using several types of credit.

There are two general types of credit: installment and revolving. Installment credit includes loans where you make fixed payments on a regular schedule. Revolving credit refers to credit cards and lines of credit, where you have access to a certain amount of credit—the credit carries over, or ‘revolves’ from month to month by making a payment that will vary from month to month.

New Credit/Credit Inquiries

“Several hard inquiries within a few weeks can knock many points off your credit score very quickly.”

Although this category only accounts for 10% of your credit score, mistakes here can very quickly have a significant negative impact on your score. The credit bureaus and lenders pay attention when requests for your credit report occur. There are two types of inquiries: hard and soft.

A soft inquiry happens when you request your credit report or when a landlord, employer, or someone else looking for your credit score asks. When a bank or another lender asks about existing credit, that is also considered a soft inquiry. Examples of this include asking about refinancing your mortgage or changing the payments on a vehicle loan. Although these inquiries will register with the credit bureaus, they do not affect your score.

“Missing payments will tank your credit score faster than anything else you do”

Hard inquiries affect your credit score, and they occur any time you ask for approval for new credit. One aspect of credit inquiries that the bureaus are particularly interested in is their timing—if three or four hard inquiries occur per year, your score will not generally suffer. However, if you make the same number of inquiries within a couple of weeks, it will suggest to the lenders that you are desperate for credit and can knock many points off your score very quickly.

Now that you understand the basics of the credit scoring system let’s begin to look at how to fix damaged credit, no matter how that damage occurred. The next article in this series will explain how to get your reports, review them and begin the process of repairing your credit.