Dealing With Debt – Understanding the Two Types of Proposals

Dealing With Debt – Understanding the Two Types of Proposals

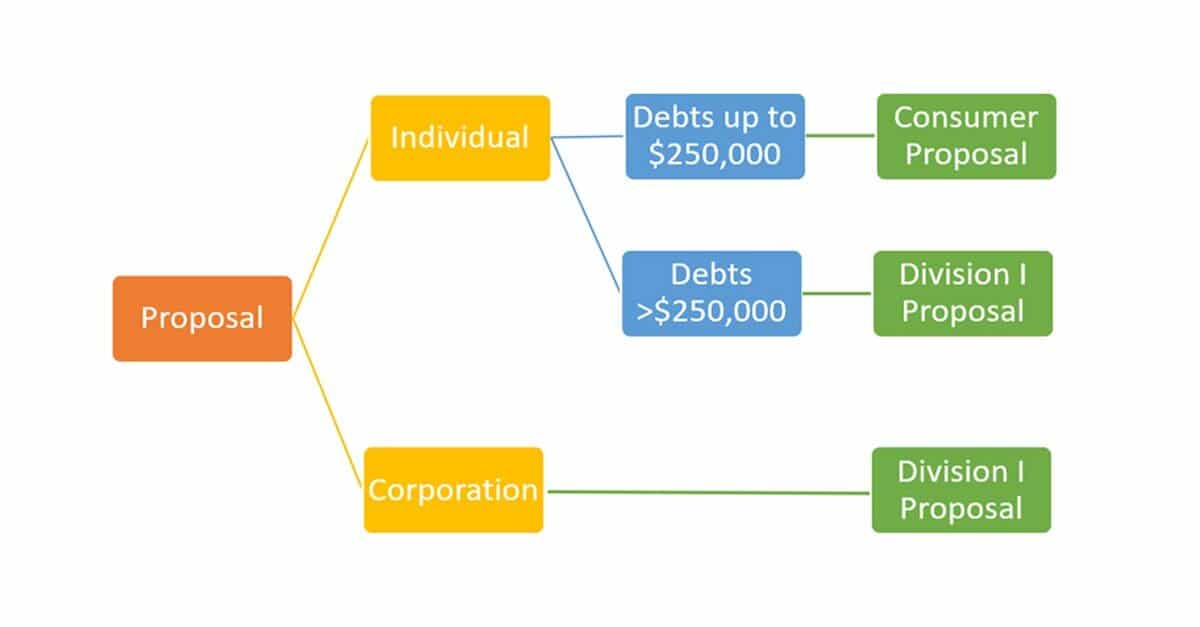

Just like there are different types of bankruptcies in Canada, there are different types of proposals.

DIVISION I or “ORDINARY” PROPOSALS

Consumer debtors with debt over $250,000, excluding the mortgage on their principal residence, must file a Division I Proposal.

There are two methods of filing a Division I Proposal:

-

File a Notice of Intention to Make a Proposal (the “NOI”) followed by the filing of the actual Proposal, or

-

File the actual Proposal without having first filed an NOI.

Notice of Intention to Make a Proposal

Typically, you would file an NOI when it is necessary to stop or “stay” creditor actions, to allow you time to review your situation with a Trustee in Bankruptcy and prepare a Proposal.

Once you file the NOI, there is an initial 30-day stay of proceedings that stops all unsecured creditors from any further collection activities. The NOI can also stop Secured creditor enforcement actions, as long as the secured creditor has not previously issued a 10-day Notice of Intention to Enforce Security (“NITES”), and the 10-day notice period has not expired before filing the NOI.

When you file an NOI, you have 30 days to file the Proposal or make a Court application for an extension of up to 45 days. You can make multiple Court applications for extensions; the total of all extensions, including the initial 30-day stay, cannot exceed 6 months from the date of the initial NOI filing.

You must file the Proposal within 30 days of filing the NOI or make a Court application for an extension; if neither of these is completed, you are deemed to have filed an assignment in bankruptcy. An NOI cannot be withdrawn once it has been filed.

Division I Proposal

The terms of a Proposal can be creative or straightforward as the circumstances require, bearing in mind that the objective is to get the creditors to accept it. Most Proposals filed by individuals are generally fixed monthly payments for up to 5 years. All Proposal payments must be paid to the Trustee, and the Trustee will issue periodical distributions to your creditors.

A Proposal for a consumer debtor typically deals with the debtor’s unsecured creditors. Secured creditors are only dealt with to the extent that the debtor wishes to retain the collateral (a house or car) held by the secured creditor. If you keep the collateral, then you will have to continue paying the secured creditor. If you surrender the collateral, the secured creditor can then seize and sell it and then file an unsecured claim in the Proposal for any deficiency.

A Proposal should provide a recovery to the unsecured creditors better than what the unsecured creditors would receive in bankruptcy. There would be no incentive for them to vote in favour of the Proposal.

For the Proposal to be approved, it is necessary for more than 50% (voting by dollar-value of claims) and more than two-thirds (by head-count, one vote for each creditor) to vote for the acceptance of the Proposal.

It is not unusual for creditors to object to the Proposal’s terms and put forth counter-proposals. These situations are unique to each Proposal and need to be evaluated and dealt with. Sometimes it may be necessary to amend the Proposal’s terms to get it accepted, but such amendments are only done with your consent. An adjournment of the meeting may be necessary to understand the objecting creditor’s concerns and attempt to negotiate an acceptable amended Proposal.

If the Proposal, or an amended Proposal, is not approved, you are deemed to have filed an assignment in bankruptcy.

An accepted Proposal must then be sent to the Court for final approval. A Court-approved Proposal, or amended Proposal, is binding on all creditors affected by the Proposal, including creditors that voted against the Proposal and creditors that did not file a claim before the creditors’ meeting to consider the Proposal.

After the Proposal is approved, the Trustee will monitor its performance and whether any default has occurred. Default terms are usually described in the actual Proposal, and there are limited provisions for curing defaults. If the default is not fixed, the Trustee must notify the creditors of the default and then proceed to get discharged as Trustee. Once the Trustee is discharged, the creditors’ rights to pursue the debtor would be revived.

If all of the terms of the approved Proposal are completed, the Trustee will issue a Certificate of Full Performance, and the debts in the Proposal will then be considered to have been settled.

DIVISION II or “CONSUMER PROPOSAL”

A Consumer Proposal is a proposal to settle debts than can only be filed by a consumer (individual person) who owes less than $250,000, excluding the mortgage on the debtor’s principal residence. Business debts for a sole proprietor or business debts related to guarantees of corporate business debts and director liabilities can also be included as long as the total is less than the $250,000 threshold.

The Consumer Proposal process is more streamlined than the process for a Division I Proposal. No Notice of Intention (NOI) can be filed in this process, and it is started with the filing of the Consumer Proposal and related documentation.

The Consumer Proposal needs to offer something better to the creditors than they would receive in bankruptcy. Our comments above regarding the inclusion or exclusion of secured creditors are equally applicable in a Consumer Proposal.

There is no mandatory meeting of creditors in a Consumer Proposal.

-

The Consumer Proposal is filed, and, if no meeting of creditors is requested within 45-days after filing (by at least 25% of creditors with filed claims), then the Consumer Proposal is approved.

-

If a meeting is requested, it will typically be held within 21-days after the expiry of the initial 45-day period. At that meeting, the Consumer Proposal will be approved if more than 50% (voting by dollar-value of filed claims only) of the unsecured creditors vote in favour of its acceptance.

-

As with a Division I Proposal, there could be a negotiation with one or more creditors to amend the terms of the Consumer Proposal before it is voted on. This negotiation may, or may not, require an adjournment of the meeting.

If the Consumer Proposal is not approved, unlike a rejected Division I Proposal, the debtor does not automatically become bankrupt. A Consumer Proposal cannot exceed five years in term, while a Division I Proposal can exceed five years. In a Consumer Proposal, the debtor must attend two mandatory counselling sessions. If you file a Division I Proposal, the counselling sessions are not required.

Once approved, the debtor needs to fulfill the terms of the Consumer Proposal. The debts are not settled until the terms of the Consumer Proposal, and the counselling sessions are fully completed. The Trustee will typically make distributions to the creditors annually during the term of the Consumer Proposal and then will issue a Certificate of Full Completion at the end of the process.

The issuance of this certificate causes the debts to be settled subject to some exceptions that, if applicable, will be discussed with the Trustee prior to the actual filing of the Consumer Proposal. Read more about which debts will be released here.

A default will occur under the terms of the Consumer Proposal if a total of more than three monthly payments are in arrears or if any payment due less frequently than monthly is more than three months past due.

There is a limited ability to revive a Consumer Proposal that has gone into default. If it is not revived, the Trustee will distribute the funds on-hand and apply for its discharge from the file. Once the Trustee is discharged from the administration of a defaulted Consumer Proposal, creditors’ rights to pursue the debtor will be revived.

Wondering if a consumer proposal is worth it? – click here.

CREDIT REPORT IMPLICATIONS

Both types of the Proposal will be recorded on your credit report for for a maximum of 6 years (including the time during your consumer proposal). That means a 5-year consumer proposal will stay on your credit report for 1 additional year after you have completed all of the terms of your Proposal. Equifax Canada – How Long Does Information Stay on My Equifax Credit Report?

Proposals that are based on fixed monthly payments that can be paid early; this will shorten the total number of years the Proposal is reported on your credit report.

If you pay off a five-year proposal in two years, the Proposal will be completed, and that will start the three-year clock ticking for when the Proposal falls off your credit report.

By comparison, if you went bankrupt for the first time, the bankruptcy will be recorded on your credit report for seven years after discharge from bankruptcy, which typically occurs between 9 and 21 months after filing for bankruptcy.

For a second time bankrupt, the bankruptcy will be recorded for fourteen years after discharge, typically between twenty-four and thirty-six months after filing for bankruptcy.

For a second time bankrupt, a proposal can make sense just from a credit report perspective as it will only stay on your credit report for three years after completion regardless of whether or not you have been previously bankrupt.

Powell Associates Ltd. is a Licensed Insolvency Trustee. We are experienced, hands-on insolvency practitioners who understand the personal impacts of significant financial stress;

-

You won’t be stuck in an assembly line process.

-

You will expect and receive prompt responses and resolution of issues from our supportive and experienced team.

-

We will review your debt solution options, including filing a consumer proposal or personal bankruptcy.

-

We help Canadians with overwhelming debt get fresh financial starts.

Once you file a consumer proposal or personal bankruptcy, we deal directly with your creditors on your behalf. Your unsecured creditors are required to stop contacting you or continuing legal proceedings against you. Contact us for a free consultation.

We offer free consultations to review your financial situation and practical debt resolution options. Contact us to discuss your situation over the phone, a video chat, or in-person in Saint John, Moncton, Fredericton, Charlottetown, Dartmouth, or Miramichi.