The Real Cost of Not Dealing with Your Debt

There are debt solutions available that will save significant sums of money for you.

Your debt is getting you down, and for good reason. You know it’s a problem, but you’ve been putting it off for months, and maybe even years. Will Rogers, the cowboy philosopher, said: “If you’ve dug yourself into a hole, the first thing to do is stop shovelling!”

“If you’ve dug yourself a hole, the first thing to do is stop shovelling.”

— Will Rogers

So it is with debt problems. You need to stop digging and start looking around to see how deep the hole is and your options for getting out of the hole. In such cases, you should learn more about bankruptcy rules and engage the services of a bankruptcy trustee to help you in these situations.

Introducing Nathan & Amanda

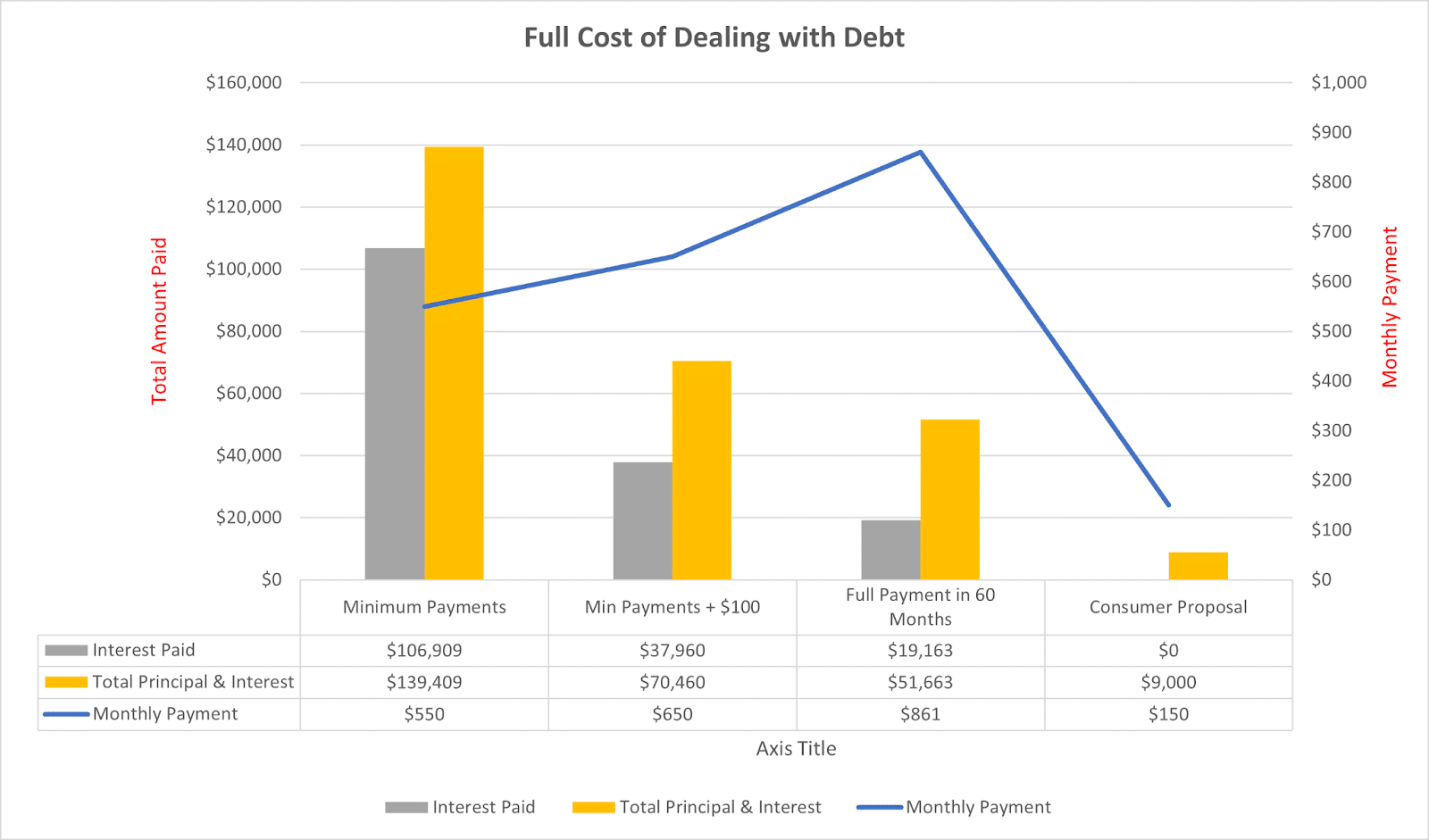

Let’s look at an example to see the total cost of debt. Nathan and Amanda have accumulated $32,500 in credit card debt at an average interest rate of about 20%; this doesn’t include their car loan. They have two kids and monthly combined take-home pay of $4,500.

They have kept current with their debts, and they are renters, hoping that someday, they will have saved enough for a downpayment on their own home. They’ve been able to stay current on their credit card debt, so their minimum monthly payments on the cards are only $550. This amount allows them some flexibility in their budget to deal with expenses outside their regular spending.

However, look at the table below to see what happens if they keep on this path.

Yikes!! If Nathan & Amanda continue to pay the minimum payments on their debts each month, the $32,500 in total debt they owe today will cost them $139,409 when they finish paying it off.

Minimum payments will seem like forever

Making only the minimum payments, it will take 251 months to finish paying the debt, or 20 years and 11 months! Clearly, not a good plan!

Minimum payments take a long time to pay off a debt

Let’s imagine that Nathan and Amanda decide to grind their budget a little harder and pay an additional $100 per month toward their debt. They will pay a total of $70,460 to pay off the $32,500 in debt, and it will take them over nine years. The extra payment makes a HUGE difference, as you can see in the table.

This plan is much better, but it’s still a lot of extra money going to interest payments, as it more than doubles the original debt. What if Nathan and Amanda pay the debt off in just 60 months or five years?

Payments too big can break the budget

This accelerated payment plan reduces their interest payments even more. Instead of paying over $37,000 in interest, they are now paying just over $19,000 in interest. However, it has one major drawback: the monthly payment amount. Can Nathan and Amanda adjust their budget sufficiently to make a payment of $861 per month, month after month, for five years? They might be able to pay this much for a little while, but it will be challenging to keep it up over five years.

To understand why let’s take a little closer look at their budget. With their $4,500 in monthly take-home pay, they spend nearly $4,000 on basic expenses. Rent, groceries, a small car payment, utilities, telecommunications and activities for their kids cost them $3,950 per month. By paring back on the groceries, the kids’ activities and changing their cell phone plans, they can just make the $861 payment per month work.

But this budget makes no allowance for significant car repairs or out-of-pocket health expenses. Nor is there an allowance for any emergency saving if something unforeseen happens, such as a job layoff.

It’s precisely this predicament that leads thousands of Canadians each year to explore alternative ways of dealing with their debts. The most obvious choice that most Canadians know about is bankruptcy. But bankruptcy isn’t necessary in most cases, and it has the harshest possible credit rating impact.

A negotiated step short of bankruptcy

“A consumer proposal is a deal you make with the creditors. You usually pay back much less than 100% of the debt, and there is no interest.”

Another option for dealing with debt very aggressively which does not have such a negative credit rating impact is a consumer proposal.

A consumer proposal is a deal you make with the creditors to pay back some of your debt over a fixed period, generally five years. The creditors usually agree to proposals because they are getting more back than they would in bankruptcy. In a typical proposal, however, much less than 100% of the debt is paid back. Furthermore, the payment plan in a proposal carries no interest. Let’s return to Nathan and Amanda’s situation.

For comparison’s sake, let’s say they filed a consumer proposal to pay back $9,000 of their $32,500 of consumer debt. They are offering to pay the creditors a little more than a quarter of the debt. Their monthly payments in this example are $150 per month.

The table above illustrates how much better this is than the other three options—it’s a huge improvement in the total amount paid back and in the monthly outflow to service the debt. Nathan and Amanda save more than $700 per month to service their debt than paying it off in full over five years.

“Once the creditors agree to the proposal, you are free to begin rebuilding your credit.”

The biggest drawback to a consumer proposal is the adverse effect on your credit rating. However, compared to bankruptcy, once the creditors have agreed to the consumer proposal (usually 60 days after its filing), you are free to begin rebuilding your credit.

Determining if a consumer proposal is worth it in your situation depends on many factors so speaking with a professional is a must.

One crucial aspect to filing a consumer proposal: you can’t do it on your own! You must work with a Licensed Insolvency Trustee (LIT)—they are the only professionals in Canada licensed to help individuals file a consumer proposal or personal bankruptcy.

The opportunity cost

Now that you know there are debt solutions available that will save significant sums of money for you, there is another consideration. It’s referred to as the opportunity cost of money. What are we talking about here?

If the proposal allows you to save dollars that you would have otherwise spent to pay the debt, what else could you do with that money? It’s not hard to come up with a list:

-

Save for your retirement

-

Save for a child’s education

-

Save for a downpayment to buy your own home or renovations to your existing home

-

Save for your dream vacation

-

And on, and on

Let’s look in more detail at the first item on this list, so you can see the full impact of not dealing very aggressively with debt. What if you took the funds saved from filing the consumer proposal and invested them in your retirement?

“Maybe it’s time to stop shovelling and look at all of the options for dealing with your debt.”

The proposal saves $700 per month in cash compared to paying the debt in full over five years. Over five years, that is a savings of $42,000. If those funds are invested and receive an average return of 4% per year, the investment will double every eighteen years. If Nathan and Amanda are 37 when they file their proposal, by the time they are 64, that investment could be worth $103,518. Nice!

The question you have to ask yourself then relative to your debt is: “Is it worth it to keep shovelling??” Maybe it’s time to look at all of the choices for dealing with your debt and do something different than what you’ve been doing so far.

Matt Munro has been a Licensed Insolvency Trustee (LIT) since 2003 and a Chartered Professional Accountant (CPA) since 2008. This article was written by him when he was employed at Powell Associates Ltd.