Avoiding The Debt Consultant Trap

In recent years, the number of debt consultants in Canada has seemingly increased significantly. These businesses claim to offer to help consumers reduce their debt, stop interest, and stop collection calls.

These claims seem great – I mean who wouldn’t want all those benefits? The issue is that all of these claims are misleading at best, and deceptive at worst.

Contents showThe Truth is only Licensed Insolvency Trustees are licensed by the Federal Government to administer debt relief solutions that can reduce debt and debt payments, stop interest, and stop collection calls.

In a nutshell – this means that most debt consultants will charge you a fee and ultimately refer you off to a Licensed Insolvency Trustee to complete the process. The same process could have been achieved for free by contacting a Licensed Insolvency Trustee directly.

Unfortunately, identifying debt consultants can be incredibly difficult. In this article, we will discuss two main methods of determining if you are dealing with an unlicensed debt consultant:

- Asking debt consultants questions and seeing how they answer, and

- Knowing what to look for on their websites.

Method #1: Debt Consultant Q&A

Here are some simple questions you can ask to determine if an individual is a Licensed Insolvency Trustee. We have also included the response you will receive from a Trustee. If you receive any other answers, it is likely because you are not dealing with a licensed debt professional.

Q 1. What license do you hold to offer consumer debt advice?

A LIT will respond: I am/we are licensed by the Federal Government, specifically the Office of the Superintendent of Bankruptcy (‘OSB’).

An unlicensed debt consultant will likely respond: We are accredited by X organization, we have great reviews, and have been around for X years.

Q 2. How can I independently verify that you are licensed to do this work?

A LIT will respond: You can visit the OSB’s website at: https://www.ic.gc.ca/app/scr/tds/web/list-liste where you can browse all active LITs in Canada.

An unlicensed debt consultant will likely respond: You can look us up online or on Google.

Q 3. How are your fees paid?

A LIT will respond: Our fees are regulated by the Federal Government and, for most files, are based upon a Tariff located within the Bankruptcy And Insolvency Act General Rules sections 128 to 129.

An unlicensed debt consultant will likely respond: We base our fee on your debt load and the work involved.

Q 4. Do I have to pay anything before I actually file?

A LIT will respond: No. Your first payment is not due until you actually file.

An unlicensed debt consultant will likely respond: Yes, absolutely. I need to get paid and we need to ensure you can afford the payments you want your proposal to be at.

Q 5. Do I have to swear an oath about the truthfulness and completeness of the information that will be provided?

A LIT will respond: Yes, you need to swear an oath in front of a commissioner of oaths (usually the trustee themselves).

An unlicensed debt consultant will likely respond: You will be required to swear an oath in front of a government officer (sometimes also referred to as a court officer).

Q 6. Can I leave out any assets or debts?

A LIT will respond: No – you must disclose all assets and debts. This includes all of your secured and unsecured loans, lines of credit, payday loans, etc as well as all of your assets such as property, vehicles, cash, investments, etc.

An unlicensed debt consultant will likely respond: Certain debts and assets can be left out.

Don’t be fooled by non-answers.

LITs will almost always answer in a nearly identical manner. This is because of how regulated the insolvency process is.

Consultants, on the other hand, may answer in all kinds of different ways to try and convince you that you require their services.

Method #2: Reviewing Their Websites

Let’s first start with what you should be seeing on a properly regulated firm’s website. Trustee advertising standards come from Directive No. 33 which specifies exactly what is required to advertise insolvency searches as a LIT firm.

One of the first requirements is to identify ourselves as a LIT firm. You can see at the top of this page, and every other page on our website.

Most Trustees also include the LIT designation at the top of the page, but you may also find it in the main section of their website or in the footer.

Furthermore, another requirement of advertising guidelines is that they shall not be untrue, misleading, or deceptive in nature. This is usually where most consultants claiming to offer debt solutions falter.

Example #1

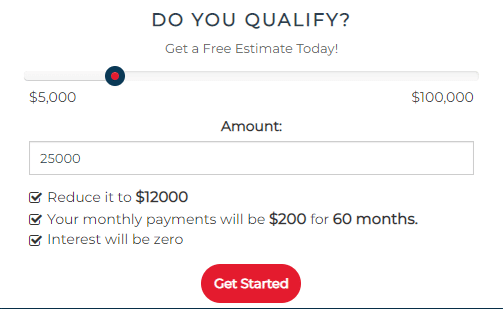

We recently fell across a website that had a calculator on their website. In this example, the calculator defaulted to having $25,000 of debt. The calculator made some fairly incredible claims. Let’s break down the first two claims

- ‘Reduce it to $12,000’ – While this sounds great, it is impossible to know even an estimation of how much debt could be reduced without conducting a full assessment. Furthermore, even after a full assessment, there is still some uncertainty. With consumer proposals, creditors get to vote on your offer. Even a bankruptcy has some uncertainty to it as your payments can vary based upon your income and assets you receive after you file and before you are discharged.

- ‘Your monthly payments will be $200 for 60 months’ – We wanted to highlight the ‘will’ in this sentence. Just as the last claim this calculator made, it is impossible to know even an estimation of what the payments will be for the same reasons as noted above.

Because of the nature of how the insolvency system works there are simply no guarantees, and companies who claim guarantees are simply lying.

Example #2

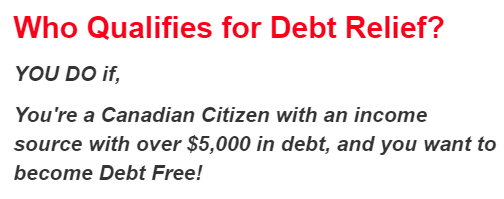

You’ll notice a theme in that the claims made by unlicensed professionals are almost always incredibly certain, for example: You will have a payment of… You do qualify if…

But the truth is significantly more complicated than this. Whenever someone wishes to file a consumer proposal or bankruptcy they must undergo a full financial assessment to understand their assets and liabilities, among other items. This includes understanding the composition of unsecured debt and secured debt, what types of debt are owed (credit card debt, student loan debt, business debt, etc), and many more.

An individual does not simply qualify for ‘debt relief’ just because they are a Canadian Citizen and owe more than $5,000 in debt.

Example #3

This is an ad we have seen around the internet lately. We have removed any identifiable markings.

This one is better than the previous two examples we looked at. Nothing in the ad text itself is incorrect or misleading. One may confuse this ad to be legitimate.

However, as per the requirements imposed by the government on LITs, you can tell immediately that this is not a licensed and regulated trustee firm as nowhere in the ad does it identify itself as being a Licensed Insolvency Trustee.

Need help with your unsecured debts? LITs are the only debt professionals who are legally allowed to administer Consumer Proposals and Bankruptcies

Most debt consulting companies who claim to offer debt relief via ‘government debt relief programs‘, in fact, refer files off to LITs for consumer proposals and bankruptcy. They simply charge a fee, grab information from consumers, and then send them off to a LIT for filing who has to redo the entire assessment process.

Save yourself the headache, and most importantly money, by contacting a trustee directly.

The risks associated with using a debt consultant instead of a licensed insolvency trustee

When an individual or business is struggling with debt, it can be difficult to know where to turn for help. In recent years, the popularity of so-called “debt consultants” has grown, as these individuals claim to be able to provide relief from financial troubles. However, it is important to be aware of the risks associated with using a debt consultant instead of a licensed insolvency trustee.

Debt consultants (sometimes referred to as debt consolidation consultants) are not regulated by any government body that regulates legislated debt relief options (consumer proposals and bankruptcies), which means that they are not held to the same standards as Licensed Insolvency Trustees. As a result, they may not have the knowledge or experience necessary to provide effective assistance.

Additionally, debt consultants usually do not have any formal complaint mechanism, or if they list one on their website is handled entirely via internal processes. While this isn’t always a bad thing, LITs have oversight from two main bodies; the government (the Office of the Superintendent of Bankruptcy) and the Canadian Association of Insolvency and Restructuring Professionals, their professional organization.

For these reasons and many more, it is typically best to work with a licensed insolvency trustee directly when trying to resolve debt problems.

How to find a reputable and qualified debt professional in Canada

If you are facing financial difficulty and are considering filing for insolvency, it is important to choose a reputable and qualified Licensed Insolvency Trustee.

In Canada, there are several professional organizations that oversee the insolvency industry and protect consumers. The main organization is the Canadian Association of Insolvency and Restructuring Professionals (CAIRP).

This organization has strict standards for membership, and its members must adhere to a code of ethics and standards of professional conduct. CAIRP also provides a member directory on its website. We are proud members of CAIRP.

You can also ask friends, family, or your financial advisor for recommendations. Once you have found a few potential trustees, be sure to interview them to ensure that they are a good fit for your needs.

Powell Associates Ltd. – Licensed Insolvency Trustee

Powell Associates Ltd. is a Licensed Insolvency Trustee. We are experienced, hands-on insolvency practitioners who understand the personal impacts of major financial stress;

- You won’t be stuck in an assembly line process.

- You will expect and receive prompt responses and resolution of issues from our supportive and experienced team.

- We will review your debt solution options, including filing a consumer proposal or personal bankruptcy.

- We help Canadians with overwhelming debt get fresh financial starts.

Once you file a consumer proposal or personal bankruptcy, we deal directly with your creditors on your behalf. Your unsecured creditors are required to stop contacting you or continuing legal proceedings against you. Contact us for a free, no-obligation consultation.

We offer free consultations to review your financial situation and practical debt resolution options. Contact us to discuss your situation over the phone, a video chat, or in-person in Saint John, Moncton, Fredericton, Charlottetown, Dartmouth, or Miramichi.

This article was written by Angela Rodgers, CIRP, LIT. She is a Licensed Insolvency Trustee and the President of Powell Associates Ltd. She has worked in the insolvency industry for over 20 years. No matter if you are looking at filing bankruptcy, a consumer proposal, or simply looking for debt management advice, Angela can help.