2016 Surplus Income Standards

2016 Surplus Income Standards

On February 23, 2016 the Superintendent of Bankruptcy recently released the new standards for the calculation of surplus income for bankrupt individuals via Directive No.11R2-2016. 2016 Standards

2016 Standards

Directive No.11R2-2016

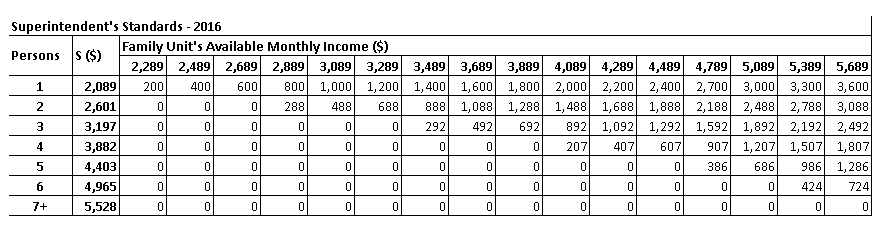

The Government of Canada has set net monthly income thresholds for a person or family to maintain a minimal standard of living in Canada. Every dollar that a bankrupt family makes above this level is subject to a surplus income payment of 50% while a person remains bankrupt.

Under the surplus income rules, the monthly surplus income payment is calculated using the following formula:

Net Income ( – ) government established threshold ( = ) surplus ( ÷ ) 2 ( = ) surplus income payment

For example, John Dough lives alone and his take-home pay is $2,484 per month. Using the above formula, the monthly surplus income payment that he is required to make would be:

$2,485 – $2,089 (threshold for single person) = $396 ÷ 2 = $198

In this example, John Dough is required to pay $198 in surplus income payments for each month that he is bankrupt. He will submit monthly income and expense reports to his bankruptcy trustee and they will calculate his surplus income payment. If John’s pay increases, he will pay more, and if his pay decreases, he will pay less.

If surplus income each month is greater than $200 (meaning that you are paying more than $100 each month in surplus income payments), a first-time bankruptcy is automatically extended to 21 months. A second bankruptcy is extended to 36 months.

If this was John’s first bankruptcy he would be required to pay $198 for a period of 21 months. If John had been bankrupt before then he would have to make 36 payments of $198.

Powell Associates Ltd. is a Licensed Insolvency Trustee, a small firm of experienced, hands-on insolvency practitioners; you won’t get stuck in an assembly line process. You will expect and receive prompt responses and resolutions of issues from our supportive and experienced team.

We will review your debt solutions options, including filing a consumer proposal or personal bankruptcy. We help Canadians with overwhelming debt get fresh financial starts.

Once you file a consumer proposal or personal bankruptcy, we deal directly with your creditors on your behalf and unsecured creditors are prohibited from contacting you or continuing legal proceedings against you. Contact us for a free, no-obligation consultation.

Powell Associates Ltd. is a Licensed Insolvency Trustee. We are experienced, hands-on insolvency practitioners who understand the personal impacts of significant financial stress;

-

You won’t be stuck in an assembly line process.

-

You will expect and receive prompt responses and resolution of issues from our supportive and experienced team.

-

We will review your debt solution options, including filing a consumer proposal or personal bankruptcy.

-

We help Canadians with overwhelming debt get fresh financial starts.

Once you file a consumer proposal or personal bankruptcy, we deal directly with your creditors on your behalf. Your unsecured creditors are required to stop contacting you or continuing legal proceedings against you. Contact us for a free consultation.

We offer free consultations to review your financial situation and practical debt resolution options. Contact us to discuss your situation over the phone, a video chat, or in-person in Saint John, Moncton, Fredericton, Charlottetown, Dartmouth, or Miramichi.