What Is the Canadian Wage Earner Protection Program (WEPP)

Workers of companies that have gone bankrupt or under receivership may qualify to receive unpaid wages, vacation pay, and termination/severance pay.

WEPP is a program that was established by the Federal Government in July 2008. WEPP provides employees of bankrupt employers, or employers subject to a receivership, with the ability to recover up to approximately $7,578 (2021) for unpaid wages, vacation pay, pay-in-lieu of notice, termination pay, and severance pay.

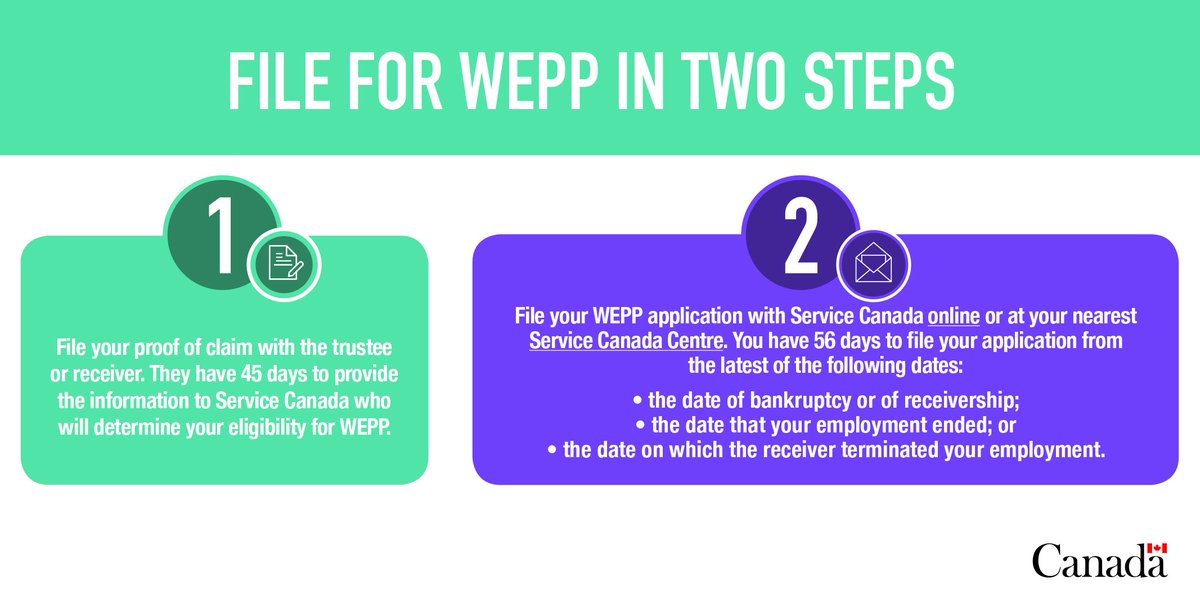

It is the Trustee’s or Receiver’s obligation to advise the employees of their rights under WEPP and to make the calculations of the amounts due to employees. The Trustee or Receiver reports these figures to Service Canada and the employees file their claims with Service Canada who makes the necessary payments directly to the employees. Service Canada may be able to recover some of the funds paid to employees from the assets of the company that is bankrupt or subject to a receivership.

The claims of employees for unpaid compensation and vacation pay earned in the six months preceding bankruptcy or the appointment of a receiver form a secured against Cash, Accounts Receivable, and Inventory of the company, in priority to the interests of secured creditors.