July 2019 – Personal Bankruptcy & Consumer Proposal Statistics

July 2019 – Personal Bankruptcy & Consumer Proposal Statistics

On September 4, 2019, the Office of the Superintendent of Bankruptcy released its most current statistics on personal bankruptcy and consumer proposal filings for Canadian debtors.

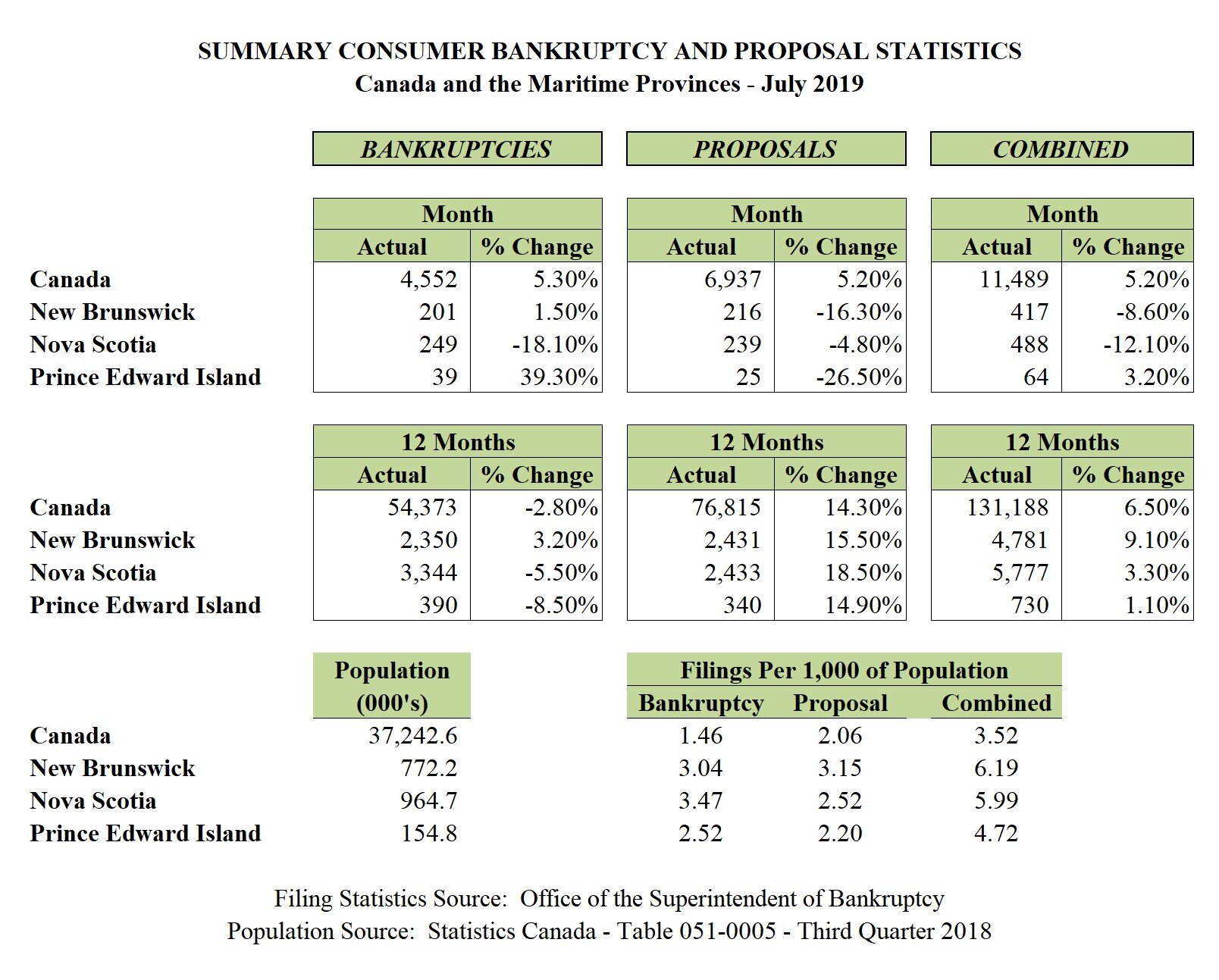

Canada – there were 54,373 personal bankruptcies and 76,815 consumer proposals filed in the 12-months ended July 31, 2019. Personal bankruptcies were down 2.8% and consumer proposal filings were up 14.3% as compared to the 12-months ended July 31, 2018. There were 4,552 personal bankruptcies and 6,937 consumer proposals filed in Canada in the month of July 2019.

New Brunswick – there were 2,350 personal bankruptcies and 2,431 consumer proposals filed in the 12-months ended July 31, 2019. Personal bankruptcies were up 3.2% and consumer proposal filings were up 15.5% as compared to the 12-months ended July 31, 2018. There were 201 personal bankruptcies and 216 consumer proposals filed in New Brunswick in the month of July 31 2019.

Nova Scotia – there were 3,344 personal bankruptcies and 2,433 consumer proposals filed in the 12-months ended July 31, 2019. Personal bankruptcies were down 5.5% and consumer proposal filings were up 18.5% as compared to the 12-months ended July 31, 2018. There were 249 personal bankruptcies and 239 consumer proposals filed in Nova Scotia in the month of July 2019.

Prince Edward Island – there were 390 personal bankruptcies and 340 consumer proposals filed in the 12-months ended July 31, 2019. Personal bankruptcies were down 8.5% and consumer proposal filings were up 14.9% as compared to the 12-months ended July 31, 2018. There were 39 personal bankruptcies and 25 consumer proposals filed in Canada in the month of July 2019.

July 2019 – Personal Bankruptcy & Consumer Proposal Statistics

Powell Associates Ltd. is a Licensed Insolvency Trustee. We are experienced, hands-on insolvency practitioners who understand the personal impacts of major financial stress;

-

You won’t be stuck in an assembly line process.

-

You will expect and receive prompt responses and resolution of issues from our supportive and experienced team.

-

We will review your debt solution options, including filing a consumer proposal or personal bankruptcy.

-

We help Canadians with overwhelming debt get fresh financial starts.

Once you file a consumer proposal or personal bankruptcy, we deal directly with your creditors on your behalf. Your unsecured creditors are required to stop contacting you or continuing legal proceedings against you. Contact us for a free consultation.

We offer free consultations to review your financial situation and practical debt resolution options. Contact us to discuss your situation over the phone, a video chat, or in-person in Saint John, Moncton, Fredericton, Charlottetown, Dartmouth, or Miramichi.