What Is the Bankruptcy and Insolvency Act (“BIA)

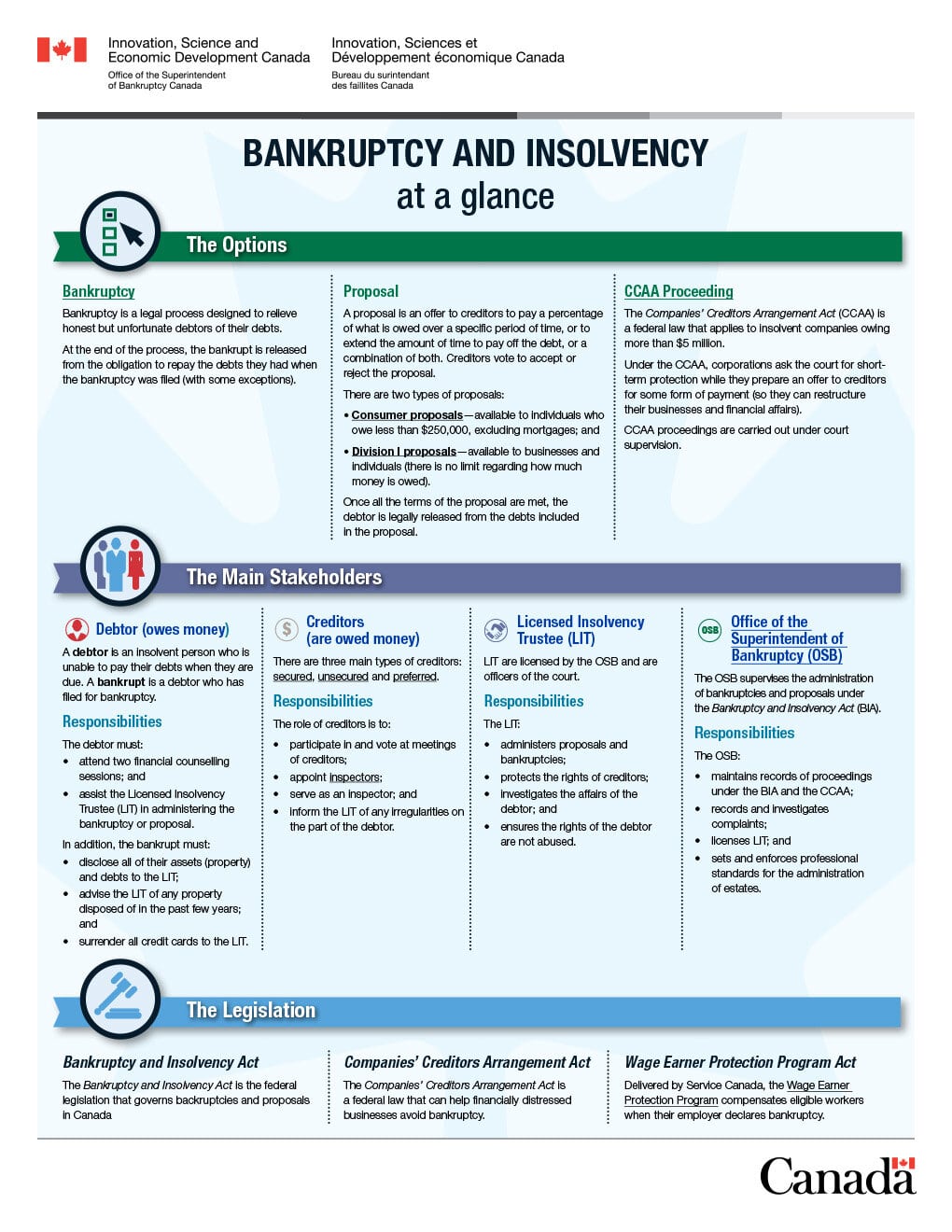

Generally speaking, the BIA is a federal statute that governs bankruptcy, proposal and receiverships in Canada. It provides relief to the honest, but unfortunate debtor from the crushing burden of debt so they can get a fresh start.

Bankruptcy provides a mechanism for the orderly liquidation of a bankrupt’s estate and the distribution of the values of assets in the estate for the benefit of creditors.

Consumer Proposal allows for the negotiation of reduced balances or amended payment terms. For individual debtors a consumer proposal allows for the repayment of a portion of the debt and allows the debtor to avoid bankruptcy. For businesses, a proposal allows the company to reorganize their debts and devise a business plan that is acceptable to creditors. For some businesses it allows them to restructure debt in an orderly and equitable fashion. It also allows the business to make plans for the continuation of that business.

The BIA also provides for:

-

Investigation into the affairs of the bankrupt.

-

The setting aside of preferences and fraudulent transactions.

-

Rehabilitation of the bankrupt through mandatory counselling.

-

The submission of creditors’ claims and the prioritization of those claims.

-

The equitable distribution to creditors of funds realized through the liquidation of the bankrupt’s assets, subject to the rights of preferred and secured creditors.

The Act also sets out the powers, duties and responsibilities of all parties involved in the process, with oversight of the Courts.

Powell Associates Ltd. is a Licensed Insolvency Trustee. We are experienced, hands-on insolvency practitioners who understand the personal impacts of significant financial stress;

-

You won’t be stuck in an assembly line process.

-

You will expect and receive prompt responses and resolution of issues from our supportive and experienced team.

-

We will review your debt solution options, including filing a consumer proposal or personal bankruptcy.

-

We help Canadians with overwhelming debt get fresh financial starts.

Once you file a consumer proposal or personal bankruptcy, we deal directly with your creditors on your behalf. Your unsecured creditors are required to stop contacting you or continuing legal proceedings against you. Contact us for a free consultation.

We offer free consultations to review your financial situation and practical debt resolution options. Contact us to discuss your situation over the phone, a video chat, or in-person in Saint John, Moncton, Fredericton, Charlottetown, Dartmouth, or Miramichi.