Understanding Your Credit Score in Canada

Will My Bankruptcy Affect My Spouse

Understanding Your Credit Score in Canada

We all know maintaining a good credit score is important, but what impacts your score?

A credit score is a number attached to your credit report, that represents your credit-worthiness and indicates how likely or unlikely you are to pay your debts. Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to you. The higher the score, the more likely you are to be approved for credit; a lower score decreases your chances of being approved.

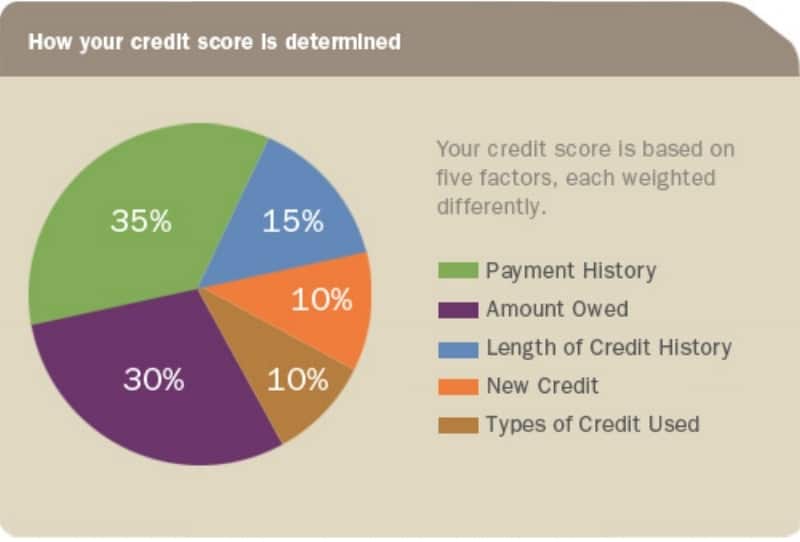

The credit score is a complicated formula that is influenced by the information in your credit report:

Inquiries

Each time a lender checks your credit, an inquiry is recorded. Too many inquiries could be an indication of heavy reliance on credit and can reduce your credit score.

Types of Credit

The most common types of debts are credit cards, lines of credit, loans and mortgages. Some other examples include store credit cards, finance company loans, student loans and cell phone contracts. Borrowing from riskier types of lenders such as finance companies can reduce your credit score.

Balance/Credit Limit

If your credit cards or lines of credit are always “maxed out”, this will reduce your credit score. If possible, always pay your credit cards in full each month. Don’t use more than fifty percent of your available credit limit.

Payment History

Each loan or credit card shows your payment history for the last five years. A loan is typically reported as “I” meaning instalment loan, and credit cards as “R” meaning revolving charge accounts. If you have a record of consistently late payments, it will lower your credit score and lenders will see you as a high risk. A history of late payments will lower your credit score, but you can fix this over time by making your payments on time.

Public Records

The following are examples of information that are contained in public records:

Consumer Proposals or Credit Counselling

Indicates when a third party has intervened on your behalf and has offered your creditors a payment plan to help you reduce your debt obligations. The rating for debts included in these programs is “R-7”. Once paid in full, it will take three years for these ratings to clear off your credit report.

Repossessions

When a secured loan such as a vehicle loan goes unpaid, the lender has the right to take back their security, sell it and apply the proceeds to pay down the loan. Repossessions, whether you give up the vehicle voluntarily or not, are rated as “I-8”.

Bankruptcy

When a person can no longer pay their debts, personal bankruptcy is often necessary. The rating for debts included in bankruptcy is “R-9”, and the bankruptcy will be on your credit report for seven years (14 years for a 2nd time bankrupt) after you complete your bankruptcy.

Collections

Loans or credit cards that go several months past due are often assigned to a third-party collection agency. PS – if you are dealing with collection calls, we can help you stop them.

Court Actions

When a creditor takes action to get a court judgment against you and your assets, the information will be on your credit report. A judgment can prevent you from purchasing or refinancing a home until the debt is paid.

Here are a few tips for maintaining a good credit score:

-

Avoid frequent credit applications and only apply for credit when necessary

-

Make your monthly payments on or before the due date

-

Pay your credit card balances in full each month

-

Avoid using credit for everyday expenses and keep your balances to a minimum

-

Try to avoid carrying multiple credit cards. One card with a reasonable limit should be sufficient with possibly one more in case the first card is compromised. Just remember that a credit card must be used periodically to remain active.

Powell Associates Ltd. is a Licensed Insolvency Trustee. We are experienced, hands-on insolvency practitioners who understand the personal impacts of major financial stress;

-

You won’t be stuck in an assembly line process.

-

You will expect and receive prompt responses and resolution of issues from our supportive and experienced team.

-

We will review your debt solution options, including filing a consumer proposal or personal bankruptcy and how they impact your credit score.

-

We help Canadians with overwhelming debt get fresh financial starts.

Once you file a consumer proposal or personal bankruptcy, we deal directly with your creditors on your behalf. Your unsecured creditors are required to stop contacting you or continuing legal proceedings against you. Contact us for a free consultation.

We offer free consultations to review your financial situation and practical debt resolution options. Contact us to discuss your situation over the phone, a video chat, or in-person in Saint John, Moncton, Fredericton, Charlottetown, Dartmouth, or Miramichi.